JPMorgan Chase (JPM), the biggest U.S. bank by assets, reported record revenue and profits in the first quarter aided by strong stock trading revenues, interest rate hikes and tax reforms. The company’s results beat Street estimates on both top- and bottom-line. All the major banking firm stocks (JPM, WFC, C and PNC) which reported their earnings today traded in the negative territory.

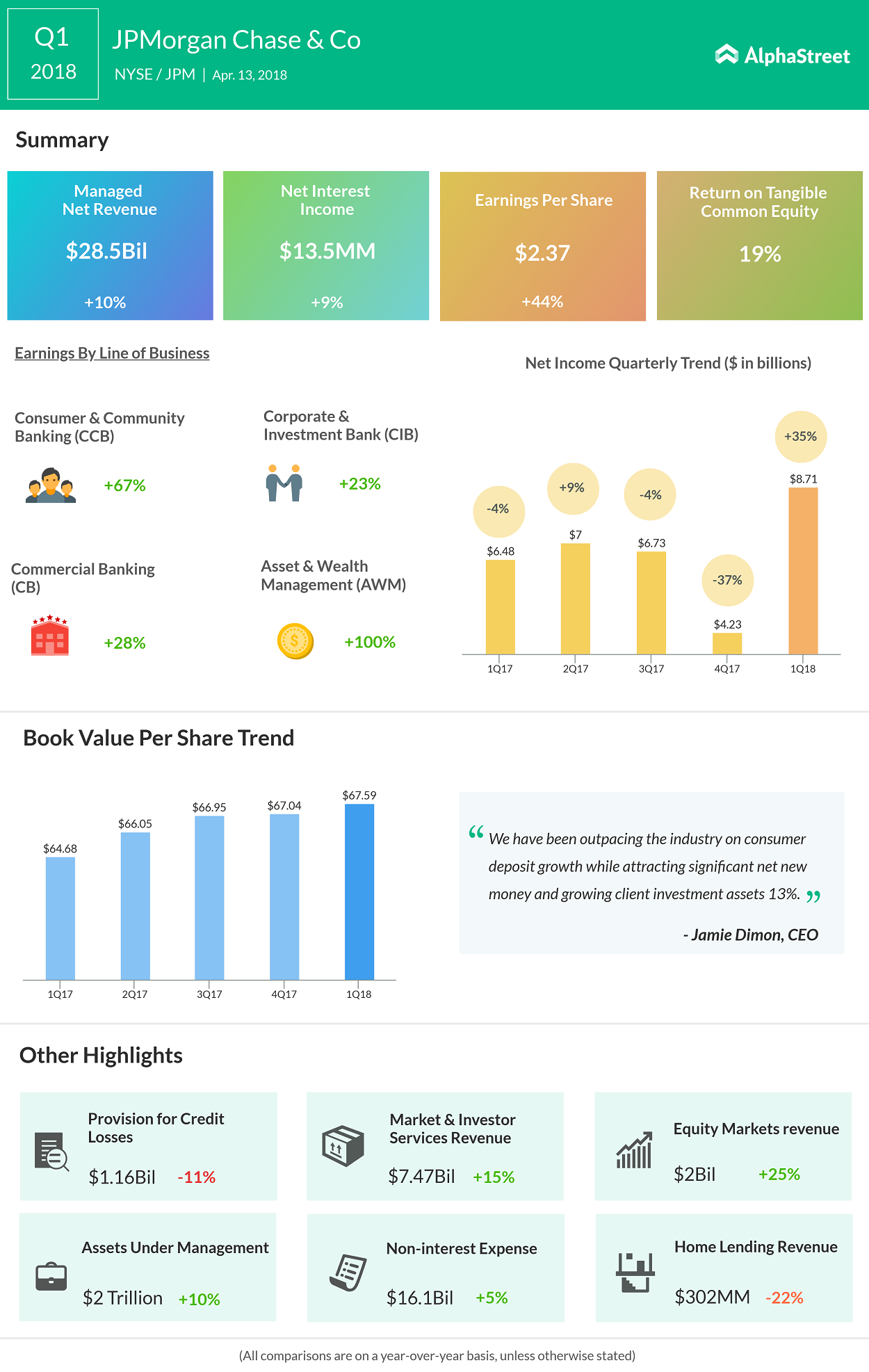

The Jamie Dimon-led firm’s net interest income climbed 9% approaching $13.5 billion. The Fed rate hikes helped the bank to move up the lending rates while keeping deposit interest rates low. Non-interest revenues increased 13% to $14.6 billion driven by solid results across the board, offset by an 8% drop in investment banking fees.

JPMorgan’s trading revenues rose 13% to $6.57 billion, thanks to the increased volatility in stock markets. Fixed Income trading revenue swelled 8% to $4.55 billion, while equity trading revenues came in at $2 billion, up 25% driven by strong growth across all products. On the flip side, revenue from the Investment banking segment slipped 7% due to low underwriting fees. Managed revenues increased 10% to $28.5 billion, while the company saved $240 million due to tax reforms.

Profits rose 35% to $8.71 billion in the quarter. On a per share basis, earnings came in at $2.37 per share compared to $1.65 a year earlier. Expenses increased 5% to $16.1 billion due to increased salary costs and depreciation charges.

Assets under management rose 10% to $2 trillion and total client assets stood at $2.78 trillion. Return on Equity, a key metric to gauge profitability by investors, increased 15%, while return on tangible common equity rose 19%. In the first quarter, JPMorgan bought back stock worth $4.7 billion.

The bank plans to invest in opening 400 branches across the U.S., a brand new headquarters in Manhattan, New York and in technology.

For 2018, the bank expects net interest income to be between $54 billion and $55 billion and non-interest revenue to improve 7%. Due to the recent tax reforms, JPMorgan forecasts its effective tax rate to be 20% for the year.

CEO Jamie Dimon is bullish about the bank’s performance in 2018 amidst brewing trade wars between U.S. and China and volatile markets. He is also quite upbeat about the global economic scenario and positive about the macro factors in the U.S. aided by recent tax reforms.