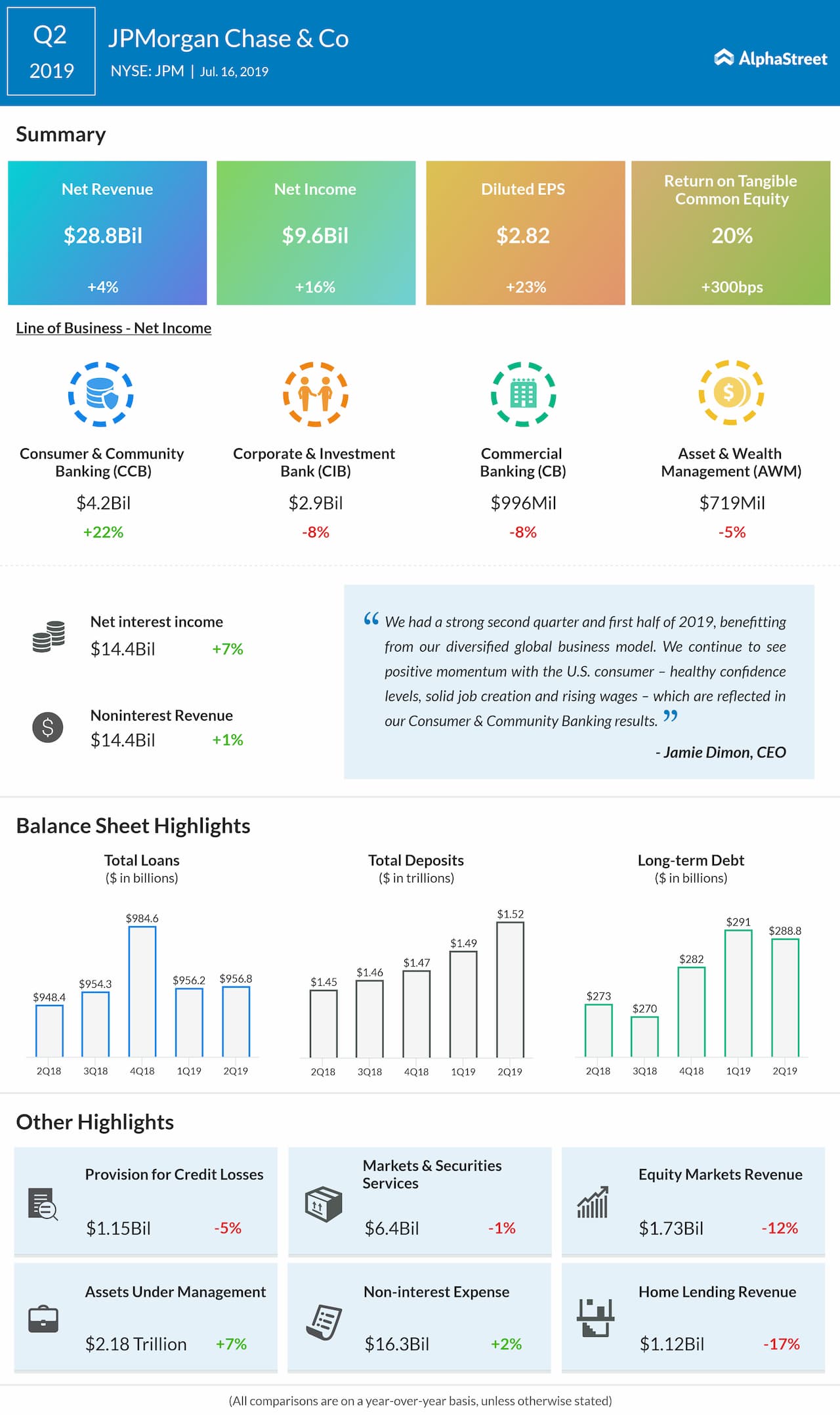

Revenues improved 4% to $29.6 billion, riding on high consumer confidence and strong loan growth. Analysts had projected Q2 revenues of just $28.9 billion.

Helped by the popularity of its Sapphire card among millennials, credit card sales volume increased by 11% in Q2.

CEO Jamie Dimon said, “Double-digit growth in credit card sales and merchant processing volumes reflected healthy consumer spending and drove 8% growth in credit card loans, while mortgage and auto originations showed solid improvement, and we continued to attract new deposits, up 3%.

READ: Earnings preview: Wall St expects a lackluster Q2 from Bank of America

The Consumer and Community Banking business continued its strong run and recorded 11% revenue growth despite weakness in home lending.

Meanwhile, the Corporate and Investment Banking division fell 3% as dismal trading volumes continued, driven by a slowing economy and geopolitical tensions.

Like its rival Citigroup (NYSE: C), JPMorgan benefited from the IPO of Tradeweb, excluding which, markets revenues would have been down 6%. Fixed Income markets revenue was down 3%, while Equity Markets revenue plunged 12% driven by lower client activity.

JPM shares fell 1.4% during pre-market trading on Tuesday. The stock has gained 15.7% in the year-to-date period and 7.4% in the trailing 12 months.

Competitors Wells Fargo (NYSE: WFC) and Goldman Sachs (NYSE: GS) are also reporting financial results today, while Bank of America (NYSE: BAC) will report on Wednesday.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.