Revenue

Earnings

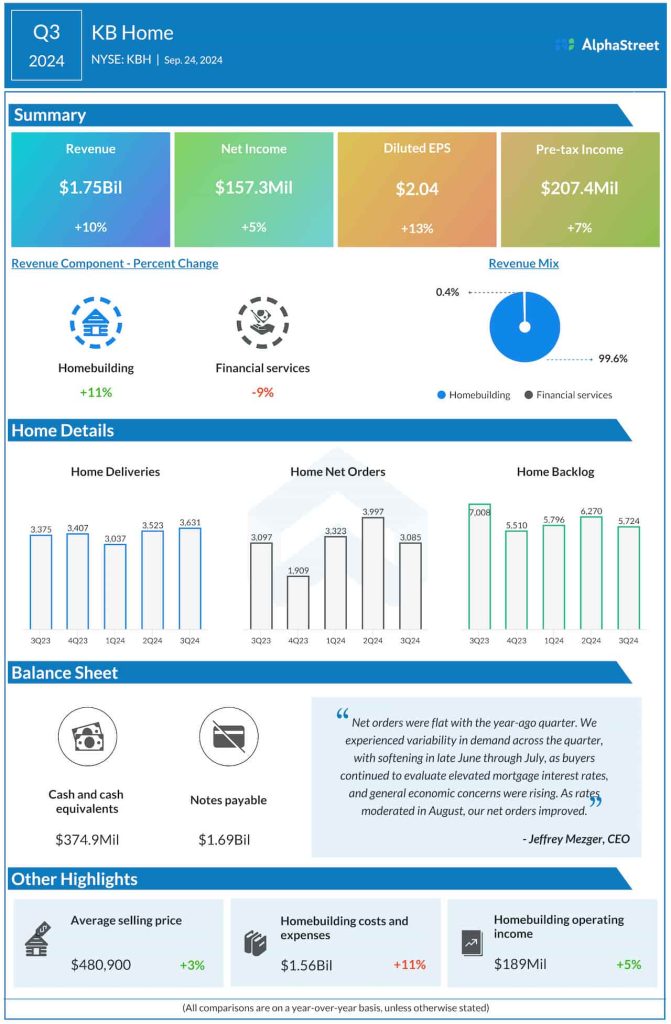

The consensus target for earnings per share for Q4 2024 is $2.46, which compares to $1.85 reported in Q4 2023. In Q3 2024, EPS grew 13% YoY to $2.04.

Points to note

On its Q3 earnings call, KB Home guided for housing revenues of $1.94-2.04 billion in Q4 2024. Its housing revenues in Q3 witnessed growth driven by increases in deliveries and average selling price. Deliveries benefited from improvements in construction cycle time and lower cancellation rates. The company anticipates these factors will benefit its deliveries in Q4 as well.

KBH recorded a 3% increase in its average selling price in Q3, which mainly reflected a mix shift in homes delivered towards its higher-priced West Coast region. The homebuilder has forecast average selling price for the fourth quarter to increase by $23,000 YoY to approx. $510,000, driven by an expected higher proportion of deliveries from the West Coast region.

The company guided for housing gross profit margin to range between 21% to 21.4% and homebuilding operating income margin to range between 11.4% and 11.8% in the fourth quarter. KBH expects operating income margin to benefit from improvements in its housing gross margin and SG&A expense ratio.

KB Home’s built-to-order business model, which offers customers the choice and flexibility to purchase homes suited to their needs and budgets, is an advantage to the company. In addition, its efforts to reduce its direct costs and enhance affordability are expected to yield benefits.

The homebuilding industry is anticipated to benefit from stable employment rates and the new mortgage rate standard, which appear to be encouraging home buyers to move forward with their purchase plans. KBH is expected to have benefited from this trend.