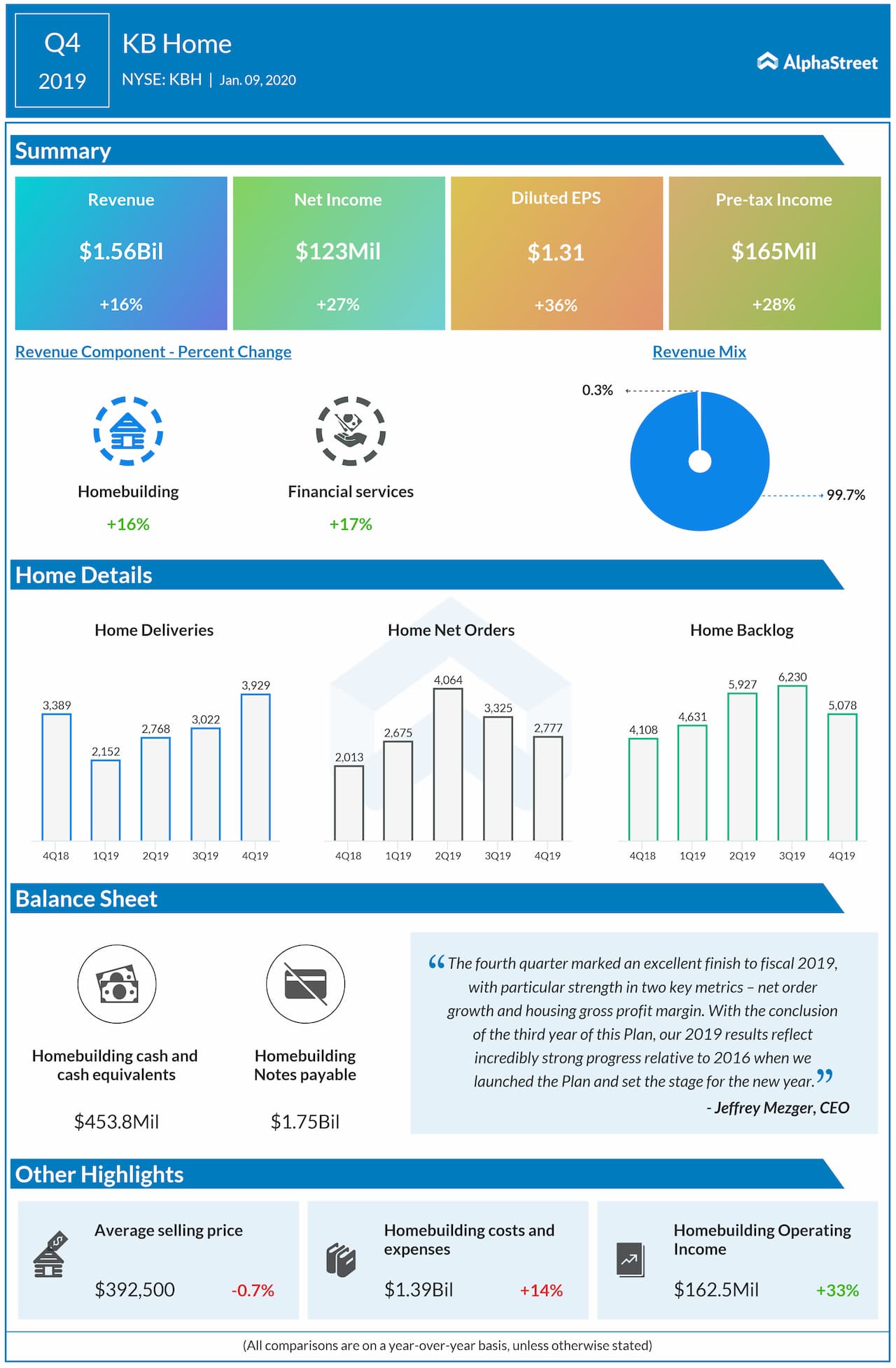

The total pre-tax income grew by 28% to $165 million, which included a charge for the early extinguishment of debt. Excluding this charge, pretax income jumped by 33% to $171.8 million.

Homes delivered increased 16% to 3,929 while the average selling price declined slightly to $392,500. Net orders for the quarter increased 38% to 2,777, with net order value up 43% to $1.06 billion. The strong demand for built-to-order products along with limited inventory in served markets drove net order higher by 38%.

The net orders growth was backed by a rise in community absorption pace to 3.7 net orders per month, its highest fourth-quarter pace in many years, along with a 9% growth in community count.

The average community count for the quarter increased 9% to 253. Ending community count grew 5% to 251. The cancellation rate as a percentage of gross orders improved to 22% for the quarter from 28%.

The company’s ending backlog rose 24% to 5,078 homes. The ending backlog value grew to $1.81 billion, up 26% from $1.43 billion, with increases in all four regions.

As of November 30, 2019, the company had total liquidity of $1.23 billion, while notes payable stood at $1.75 billion. The debt to capital ratio improved by 740 basis points to 42.3% while the net debt to capital ratio is at 35.2%.