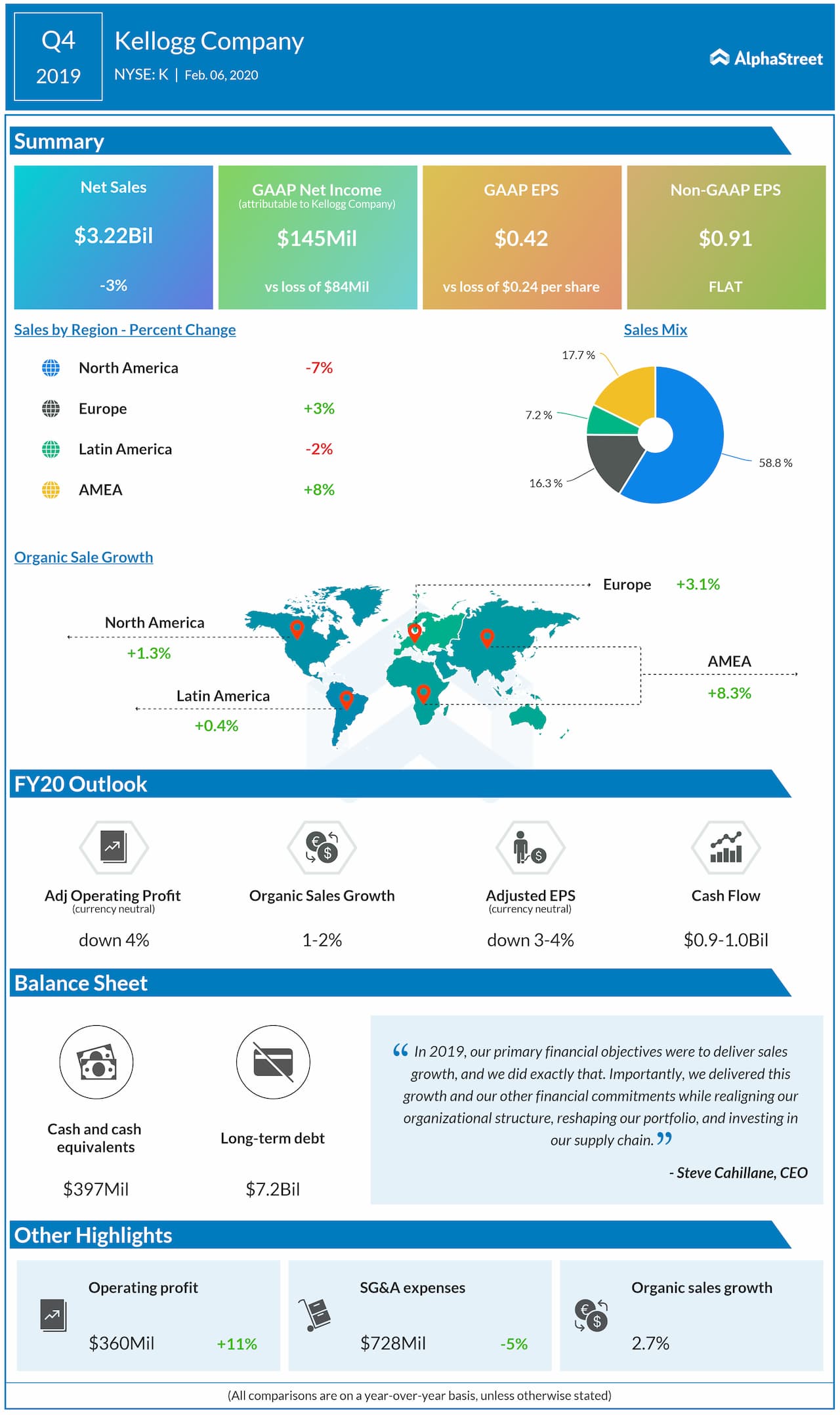

— Kellogg (NYSE: K) reported its fourth-quarter 2019 adjusted earnings of $0.91 per share versus $0.85 per share expected.

— Net sales decreased by 2.8% to $3.22 billion versus $3.18 billion expected. The absence of results from divested businesses lowered net sales by nearly 6%.

— In North America, frozen foods sales and consumption growth continued in the fourth quarter, led by its leading brand of frozen plant-based meat alternatives, MorningStar Farms, which again grew consumption at a double-digit rate while gaining share.

— In North America, cereal sales and consumption declines moderated as its growth and share gains accelerated in the taste-fun segment, led by key brands Frosted Flakes, Froot Loops, Corn Pops, and Krave behind the increased commercial activity.

— In Europe, sales growth was benefited by snacks and particularly the sustained consumption growth momentum for Pringles. Cereal sales continued to stabilize, led by overall consumption growth in the region.

— In Latin America, softened macroeconomic conditions in Puerto Rico, Argentina, and Brazil, along with distributor transitions in Central America hurt the sales. The ramp-up of new production facilities in Brazil for Pringles and cereal created incremental costs in the quarter.

— In Asia Pacific, the Middle East and Africa, sales growth was benefited by the expansion of Pringles and noodles, continued growth by Multipro in West Africa, cereal and snack growth in Asia, and Pringles and cereal consumption growth in Australia.

— Looking ahead into 2020, the company expects organic net sales growth of 1-2%. Adjusted EPS, on a currency-neutral basis, is predicted to decline by 3-4% due to the absence of results from divested businesses.