Shares of Kellogg Company (NYSE: K) were up 1% on Wednesday. The stock has dropped 6% year-to-date. The cereal giant will report its second quarter 2023 earnings results on Thursday, August 3, before market open. Here’s a look at what to expect from the earnings report:

Revenue

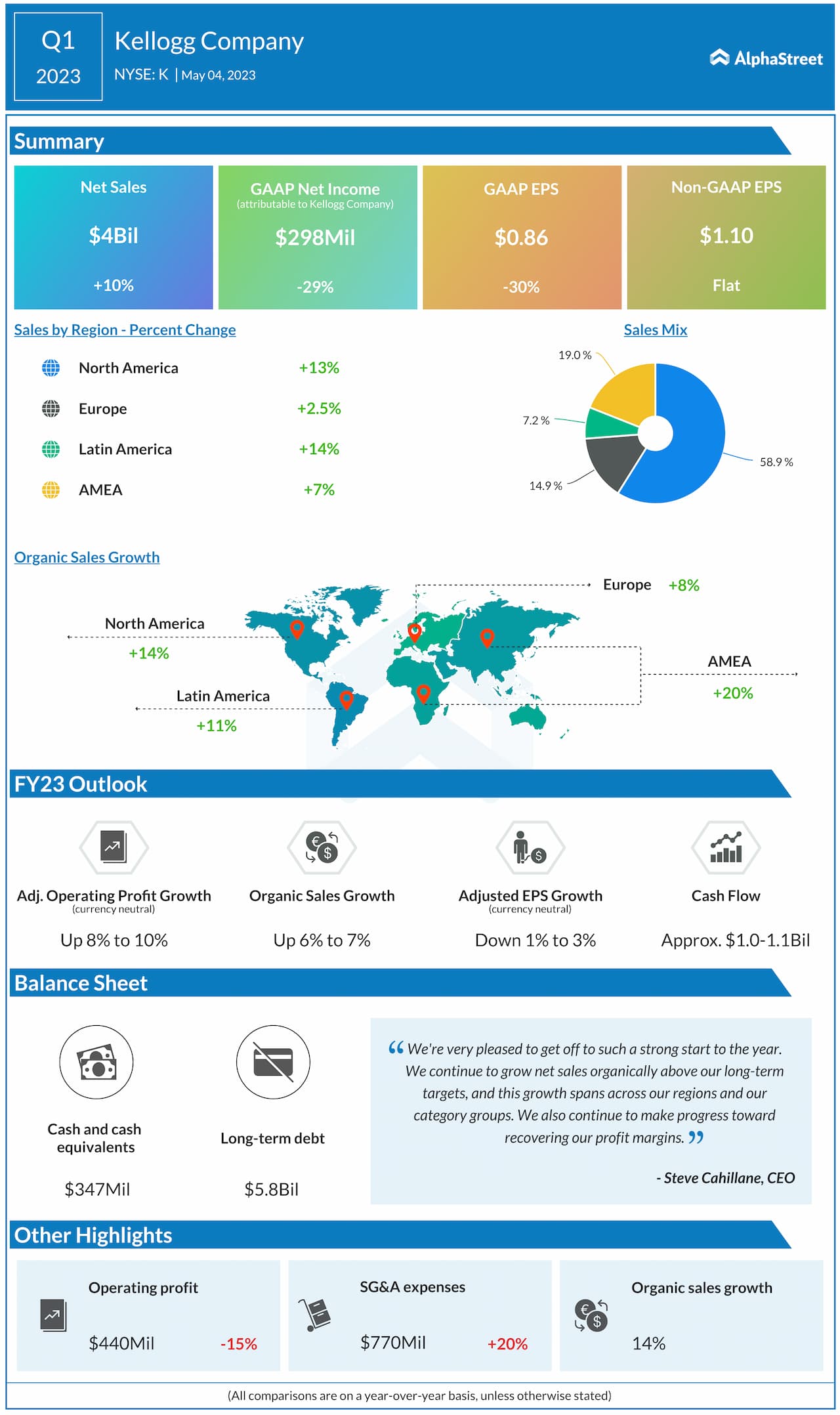

Analysts are projecting revenue of $4.07 billion for the second quarter of 2023, which would reflect a 5% growth from the same period a year ago. In the first quarter of 2023, revenues increased 10% year-over-year to $4.05 billion. Organic net sales were up nearly 14%.

Earnings

The consensus estimate is for EPS of $1.11 which compares to $1.18 in the prior-year period. In Q1, adjusted EPS remained flat YoY at $1.10.

Points to note

Kellogg is expected to benefit from the strength of its brands in the second quarter. In Q1, sales benefited from positive price/mix and momentum in the snacks and noodles categories. The North America cereal business is witnessing a continued rebound which is also a positive. The company posted sales growth across all its four regions.

In Q1, Kellogg saw supply bottlenecks and shortages start to moderate. This, along with productivity initiatives and revenue growth management actions, have helped in making progress towards margin recovery.

Higher costs remain a concern. In Q1, SG&A expenses increased 20% year-over-year. Higher expenses, including costs related to the pending separation, are likely to weigh on the bottom line.