Mixed results

Category performance

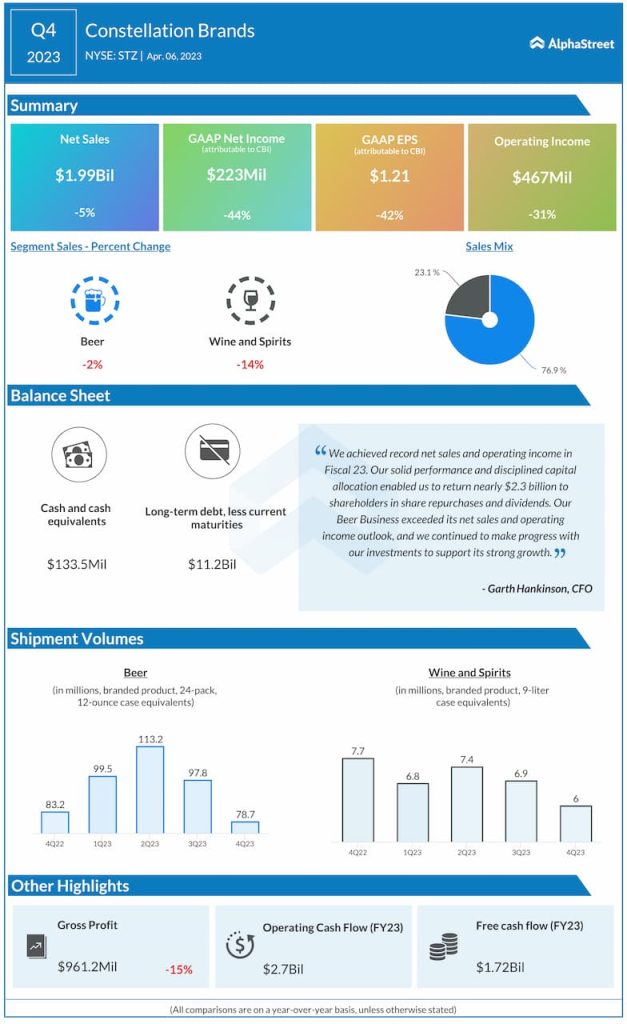

Constellation’s beer business saw sales drop by 2% to $1.53 billion in Q4 with shipments falling by 5.4%. Depletions grew 6.3%, driven by strong performances from Modelo Especial and Corona Extra. Operating margin in this segment decreased by 510 basis points due to higher packaging, raw material, and logistics costs as well as higher SG&A expenses.

Net sales in the wine and spirits division fell 14% YoY to $462.2 million, while organic sales were down 9%. Shipments were down 22% on a reported basis and 19% on an organic basis. Overall depletions were down nearly 5% but the company saw strong gains across some of its higher-end brands such as Kim Crawford, The Prisoner Wine Co. and Casa Noble.

Outlook

For fiscal year 2024, Constellation Brands expects reported EPS to range between $11.60-11.90 while comparable EPS, excluding Canopy, is estimated to be $11.70-12.00. Net sales for the beer business is expected to grow 7-9% for the year while operating income is expected to grow 5-7%. Organic net sales in the wine and spirits division is projected to be down 0.5% to up 0.5% in FY2024 while operating income growth, excluding certain items, is estimated to be 2-4%.

Dividend

Constellation’s board of directors declared a quarterly cash dividend of $0.89 per share of Class A Common Stock, reflecting an increase of 11%, payable on May 18, 2023 to stockholders of record as of May 4.