Dropbox, Inc. (NASDAQ: DBX) is a leading provider of cloud-based file storage and sharing tools that help office workers carry out their tasks with ease. The company, which offers solutions that allow enterprises to organize, manage and share official documents, is currently busy broadening its portfolio through initiatives like M&A deals.

The San Francisco-headquartered cloud service provider’s stock suffered a major loss last week after it reported mixed results for the fourth quarter — investor sentiment was hit by the muted user and ARPU growth, mainly reflecting the challenging macroeconomic backdrop. The company’s sluggish growth has been a concern for shareholders, characterized by weakness in the stock that traded almost sideways in the past five years.

Buy DBX?

The stock’s best performance ever was a few months after the company went public in 2018, and it experienced continued volatility since then. After the post-earnings rout, it is trading broadly in line with the long-term average. On the positive side, the stock was more stable than most others in the tech space last year when the market was battered by a selloff.

Dropbox Inc Q4 2022 Earnings Call Transcript

Currently, Dropbox is one of the cheapest tech stocks and it looks poised to get stronger this year as operating conditions improve amid the growing demand for record management solutions. But prospective investors will be checking on factors that would rejuvenate this sleepy cloud firm and enable it to create good shareholder value. That said, DBX is unlikely to disappoint long-term investors as stronger customer additions and higher prices would help the company meet its growth goals.

From Dropbox’s Q4 2022 earnings call:

“We’re actively working to strengthen the alignment between our business units and our go-to-market teams and see opportunities to improve renewal activity as we increase customer awareness of the added functionality we’re adding for teams. We’re also continuing to invest in our security roadmap to strengthen our offering for business users. In Q4, we acquired assets from Boxcryptor, a provider of end-to-end zero-knowledge encryption for cloud storage services. And over time, we plan to embed these encryption capabilities natively within Dropbox for our business users…”

Results Beat

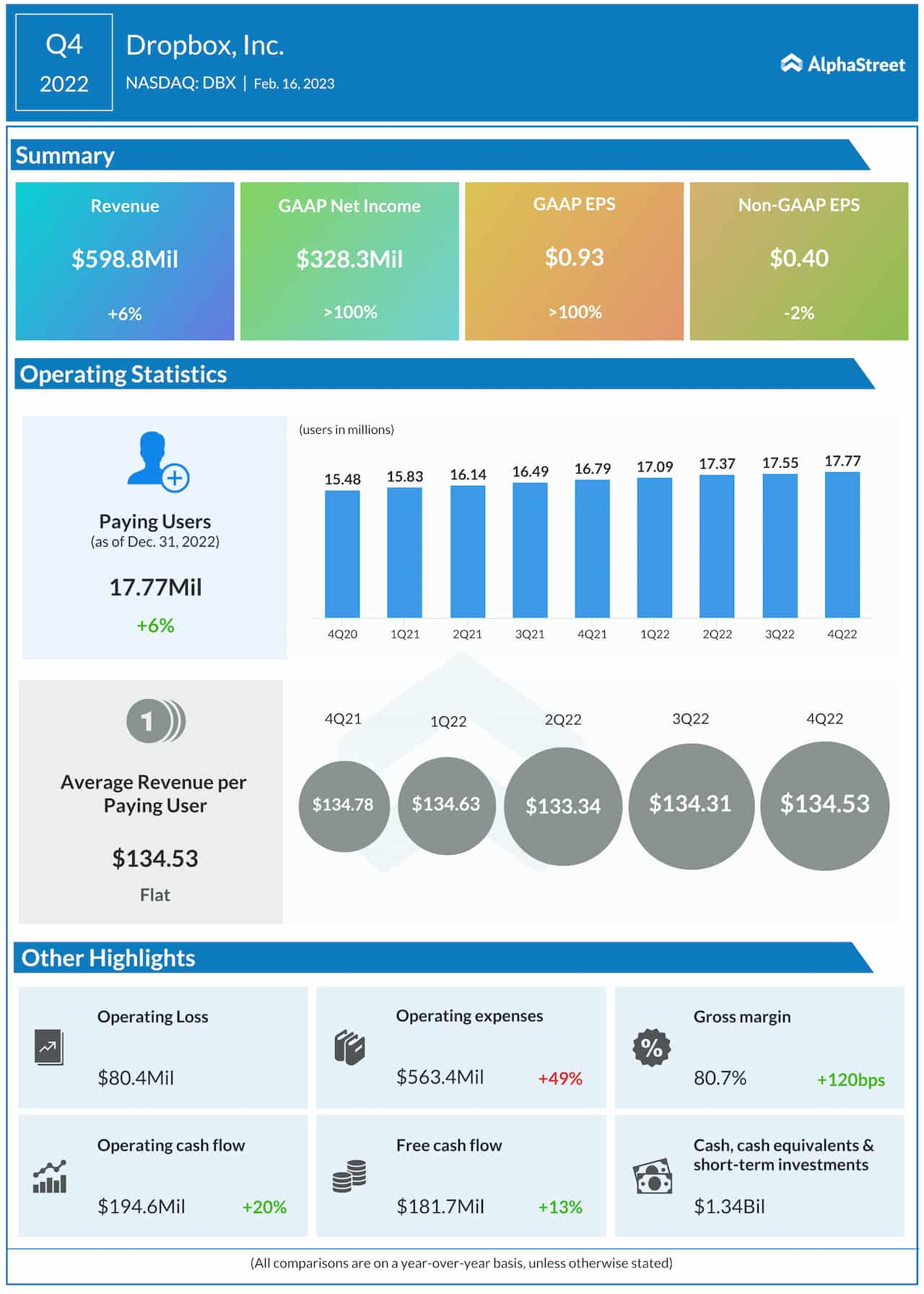

When it comes to beating the market’s quarterly earnings estimates, the company has never disappointed its stakeholders. In the fourth quarter, adjusted net profit dropped modestly to $0.40 per share but topped expectations, as it did in every quarter in the past five years. The bottom line was negatively impacted by a 49% surge in operating expenses. Revenues moved up 6% to $598.8 million and came in above the forecast. As of December 2022, Dropbox had 17.77 million paying users, up 6%.

Earnings Infographic: Oracle Q2 2023 revenue rises 18%

Of late, the company’s capital spending has been focused on research and development, while cutting down general & administrative, and marketing costs. Its document management capabilities got a major boost after the acquisition of FormSwift in December last year, adding a large number of customizable document templates to the existing suite.

After losing more than 10% soon after last week’s earnings release, Dropbox’s shares traded lower on Tuesday afternoon. It has lost about 7% since the beginning of 2023.