In Growth Mode

Reflecting the management’s continued focus on innovation, there has been an uptick in R&D spending lately. In the most recent quarter, Johnson & Johnson expanded its Innovative Medicine portfolio with the acquisition of Ambrx. The company also signed an agreement to acquire Shockwave Medical, which is expected to strengthen its capability to address coronary artery and peripheral artery diseases. The transaction is expected to close by midyear 2024.

The growth initiatives are important because Stelara, one of the company’s top products, will be losing patent protection next year. Going forward, the company’s finances might come under pressure from talc-related lawsuits, which have already cost it billions of dollars.

From Johnson & Johnson’s Q1 2024 earnings call:

“We anticipate Innovative Medicine sales growth to be slightly stronger in the first half of the year compared to the second half given the anticipated entry of Stelara biosimilars in Europe midyear. For MedTech, we expect operational sales growth to be relatively consistent throughout the year. Looking ahead, we have many important catalysts in the pipeline that will drive meaningful near- and long-term growth across both Innovative Medicine and MedTech.”

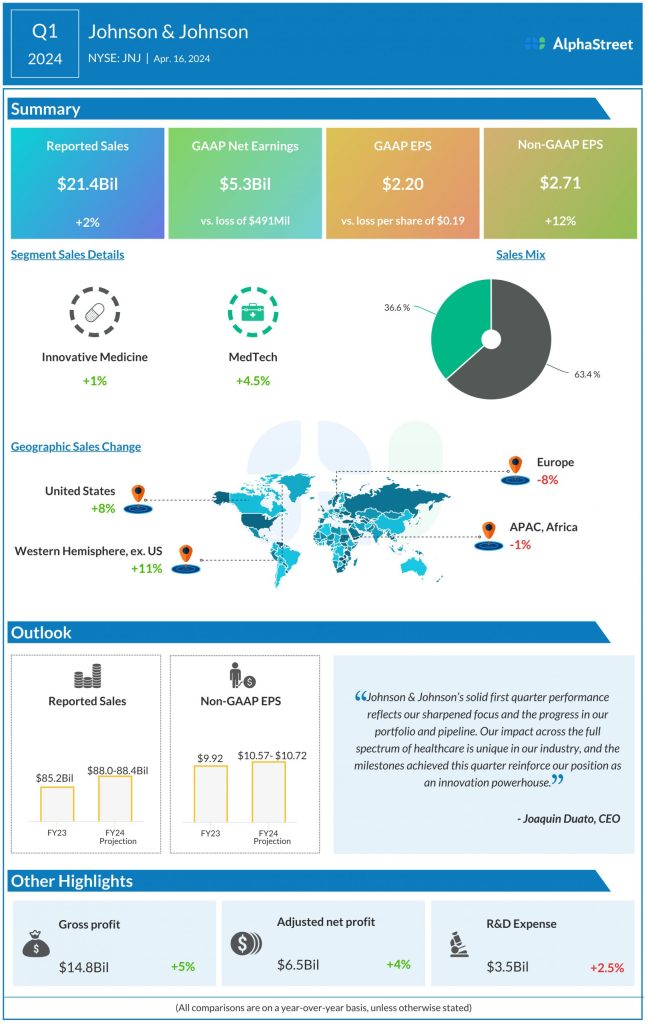

Johnson & Johnson has been delivering stronger-than-expected quarterly earnings consistently for over a decade. In the first three months of fiscal 2024, adjusted profit increased 12% annually to $2.71 per share. Revenues edged up 2% from last year to $21.4 billion in Q1, which is broadly in line with analysts’ estimates. Innovative Medicine revenue, the core business division which accounts for more than 60% of total revenue, rose 1% while MedTech revenue increased 4.5%. R&D expenses rose 2.5%.

Guidance

For fiscal 2024, the management expects ‘reported sales’ to be between $88 billion and $88.4 billion, which marks an increase from the prior year when sales came in at $85.2 billion. The earnings per share guidance, on an adjusted basis, is $10.57-10.72, vs. $9.92 in fiscal 2023.

Shares of Johnson & Johnson, which have stayed below their 52-week average so far this month, traded lower in the early hours of Wednesday’s session.