Q3 performance

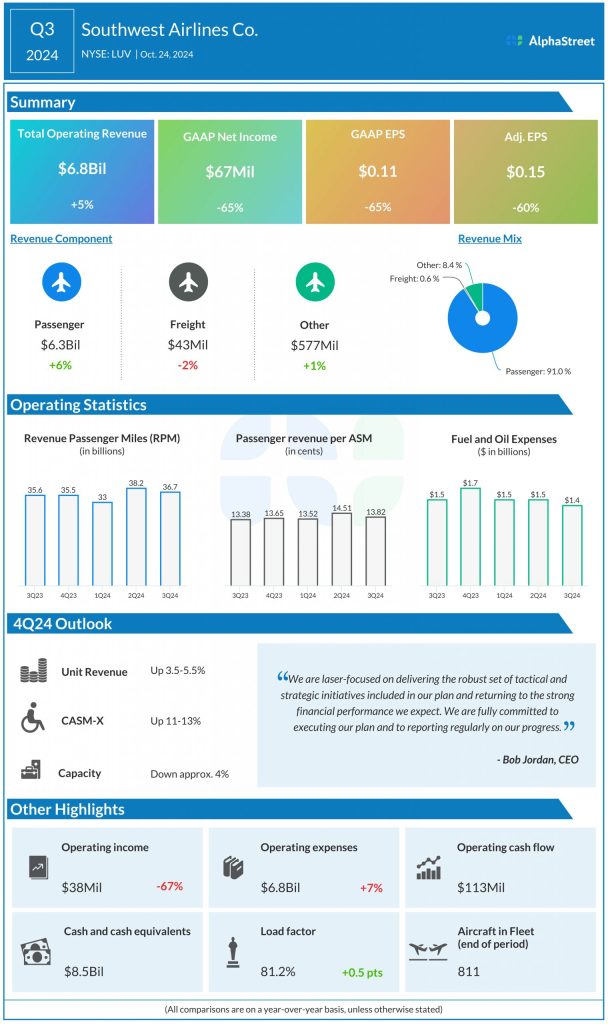

The company’s top line performance was driven by yield improvements from capacity moderation across the industry and progress in managing tactical initiatives. Passenger revenues increased 5.7% while freight revenues dropped 2.3% compared to last year.

Unit revenues increased 2.8% while capacity was up 2.4% YoY. Passenger unit revenues were up 3.3%. Traffic was up 3.1% while load factor stood at 81.2%. Passenger revenue yield per RPM rose 2.5%. Cost per available seat mile, excluding fuel and oil, special items and profit-sharing, or CASM-X, increased 11.6%. Economic fuel costs were $2.55 per gallon.

Outlook

For the fourth quarter of 2024, Southwest expects unit revenues to increase 3.5-5.5%, with capacity down approx. 4% YoY. The outlook anticipates a slight headwind from Hurricane Milton and resulting customer cancellations.

So far the company has been seeing healthy travel demand and strong bookings-to-date for the holiday season, which indicate that leisure travel remains stable. In addition, its focus on network optimization, capacity moderation and revenue management is expected to support unit revenue improvement.

CASM-X for Q4 is expected to increase 11-13% YoY, due to pressures from new labor contracts and capacity reduction as well as unit cost headwinds from flight cancellations related to Hurricane Milton. Economic fuel costs per gallon are expected to range between $2.25-2.35.