Quarterly numbers

Business performance

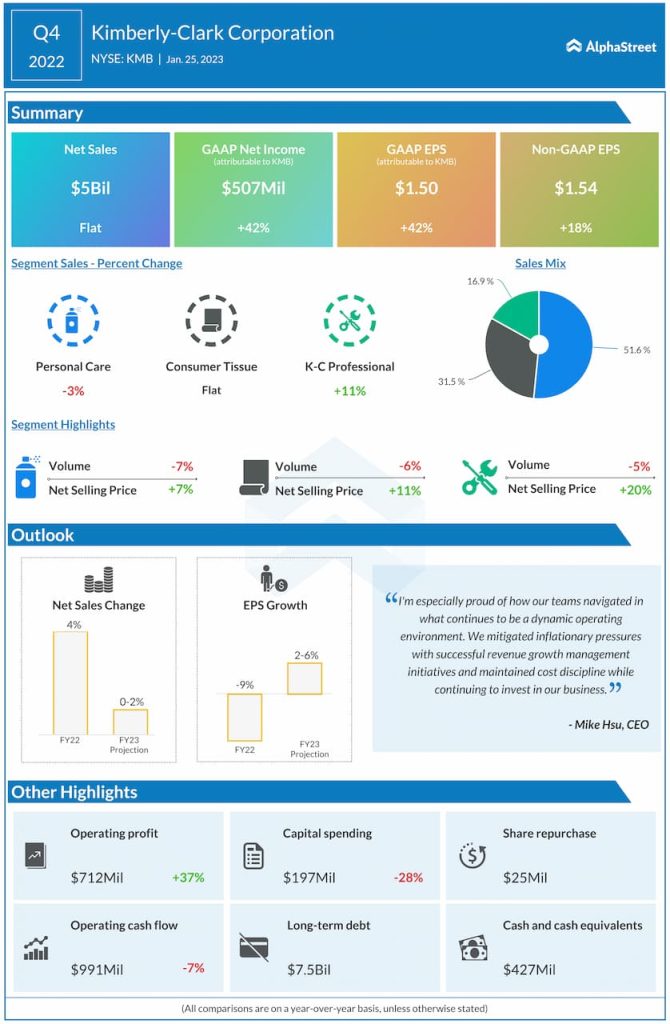

Organic sales for the fourth quarter increased 5% as net selling prices rose approx. 10% and product mix increased sales 1% while volumes declined 7%. In North America, organic sales increased 1% in consumer products and 18% in K-C Professional. Outside North America, developed markets recorded an 11% growth in organic sales while developing and emerging (D&E) markets saw an increase of 3%. The company reported organic sales growth across all its segments during the quarter.

On a reported basis, net sales in the Personal Care segment fell 3% YoY in Q4 2022. Sales in North America were flat while sales in D&E markets fell 6%. Sales in developed markets outside North America were down 4%.

Sales in the Consumer Tissue segment remained flat in Q4 compared to the previous year. Sales in North America increased 2% while sales in D&E markets and developed markets outside North America decreased 1% and 3% respectively.

Sales in the K-C Professional segment increased 11% during the quarter. Sales in North America grew 17% while sales in D&E markets and developed markets outside North America rose 3% and 1% respectively.

During the quarter, Kimberly-Clark’s sales benefited from net selling price increases and product mix improvements but volumes declined across all segments.

Outlook

Looking ahead into 2023, Kimberly-Clark expects inflation to have an impact on its business but it also expects gross margin to recover as it continues to implement revenue growth and cost management measures that will help offset cost headwinds.

Due to tougher top line comparisons, foreign currency headwinds and higher cost headwinds, the company expects top line and earnings performance to be softer in the first half of 2023 with a pickup as the year progresses.

For FY2023, KMB expects net sales growth of 0-2% and organic sales growth of 2-4%. EPS is expected to increase 2-6% versus adjusted EPS in 2022.