Kinder Morgan Inc. (NYSE: KMI) reported a 26% jump in earnings for the fourth quarter of 2019 driven by greater contributions from the Natural Gas Pipelines and Products Pipelines segments and gain associated with the KML/Cochin sale. The bottom line came in line with the analysts’ expectations while the top line missed consensus estimates.

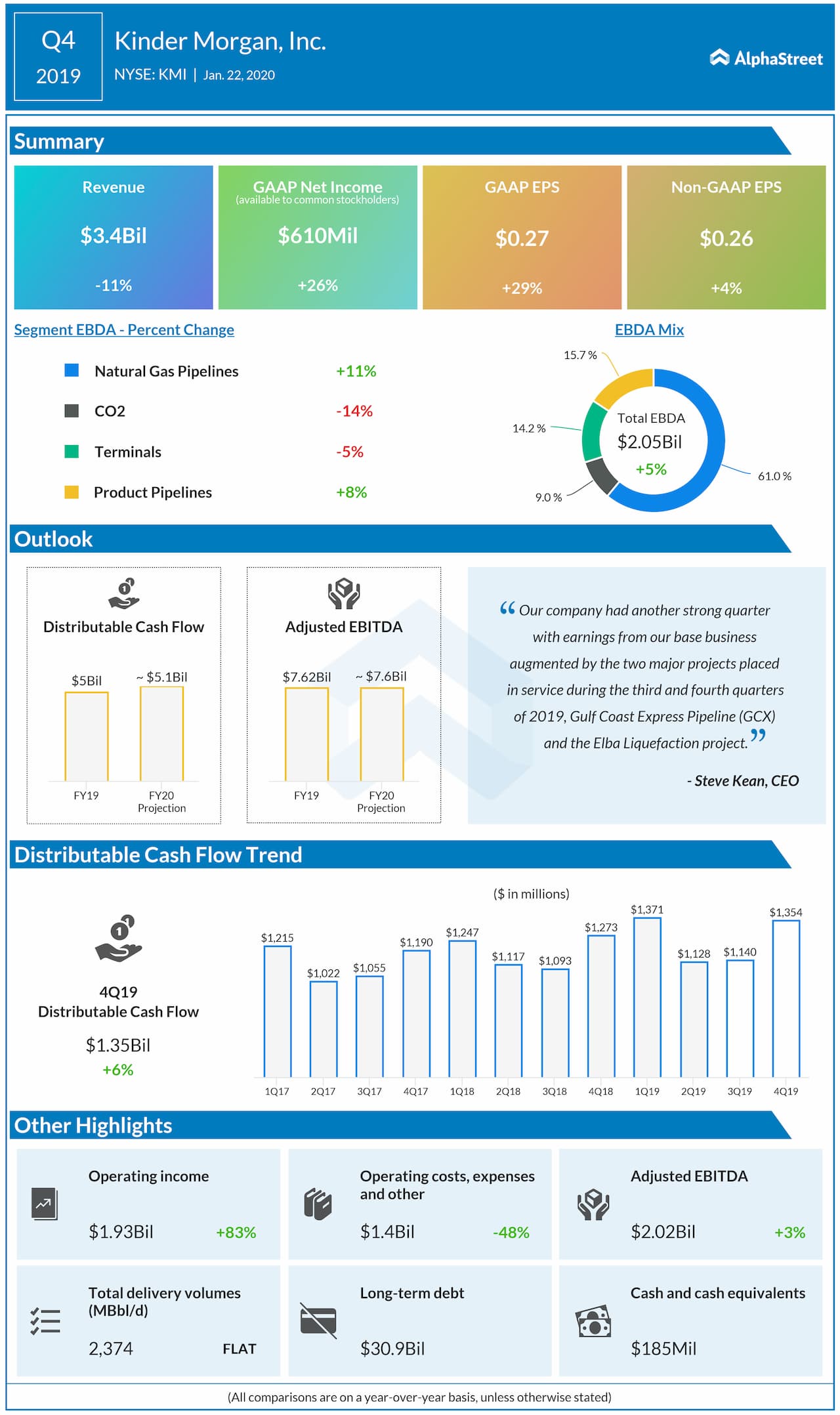

Net income jumped by 26% to $610 million or $0.27 per share. Adjusted earnings increased by 4% to $0.26 per share. However, revenue declined by 11% to $3.35 billion. Analysts had expected EPS of $0.26 on revenue of $3.62 billion for the fourth quarter.

The company’s board of directors approved a cash dividend of $0.25 per share for the fourth quarter ($1.00 annualized). The dividend is payable on February 18, 2020, to common stockholders of record on February 3, 2020. This represents a 25% increase over the fourth quarter 2018 dividend.

Looking ahead into 2020, the company’s budget contemplates declared dividends of $1.25 per common share, a 25% increase from the 2019 declared dividends, a discounted cash flow of about $5.1 billion and adjusted EBITDA of about $7.6 billion. KMI also expects to invest $2.4 billion in expansion projects and contributions to joint ventures during 2020.

The company expects to use internally generated cash flow to fully fund its 2020 dividend payments, as well as almost all of its 2020 discretionary spending, with no need to access equity markets. Kinder Morgan also expects to end 2020 with a net debt-to-adjusted EBITDA ratio of about 4.3 times.

For the fourth quarter, the natural gas pipelines segment saw higher revenue backed by contributions from the Elba Liquefaction and GCX projects and various expansion projects placed in service on Tennessee Gas Pipeline. Natural gas transport volumes were up 14% with the largest gains on El Paso Natural Gas (EPNG), TGP and Colorado Interstate Gas (CIG), followed by Kinder Morgan Louisiana Pipeline (KMLP), GCX and the Texas Intrastates.

The demand for US natural gas is expected to increase from 2019 levels by nearly 30% to more than 120 billion cubic feet per day (Bcf/d) by 2030, according to independent analysts. The future natural gas infrastructure opportunities through 2030 will be driven by LNG exports, continued industrial development, particularly in the petrochemical industry, net exports to Mexico, and greater demand for gas-fired power generation.