Dividend Power

Meanwhile, the dividend yield is one of the best in the market, which often prompts investors to hold the stock for the long term. The company should be able to continue returning cash to shareholders as its capital allocation plan is focused on continued investments in assets that can generate stable cash flow.

Read management/analysts’ comments on Kinder Morgan’s Q3 results

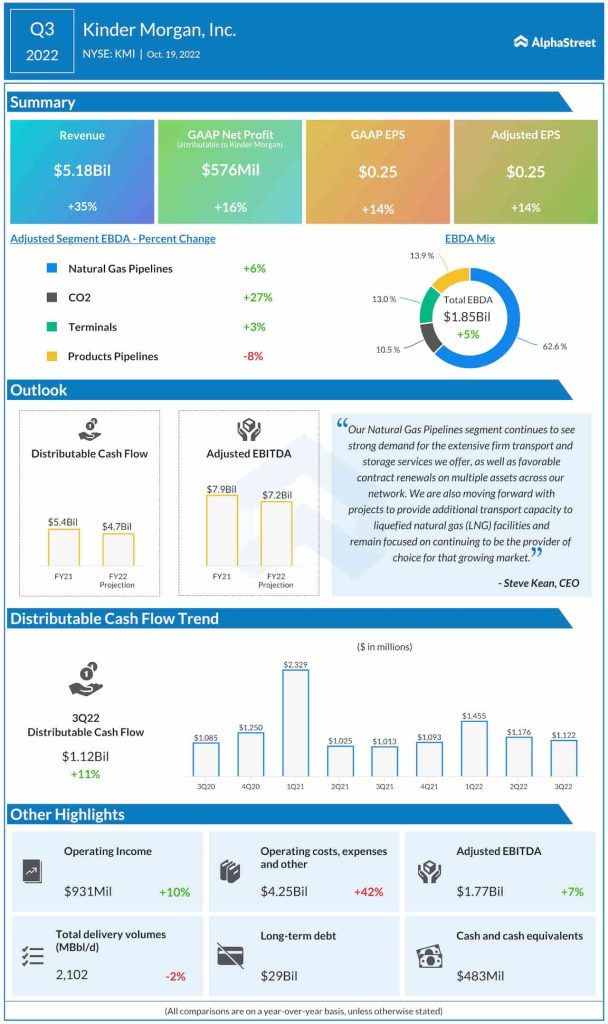

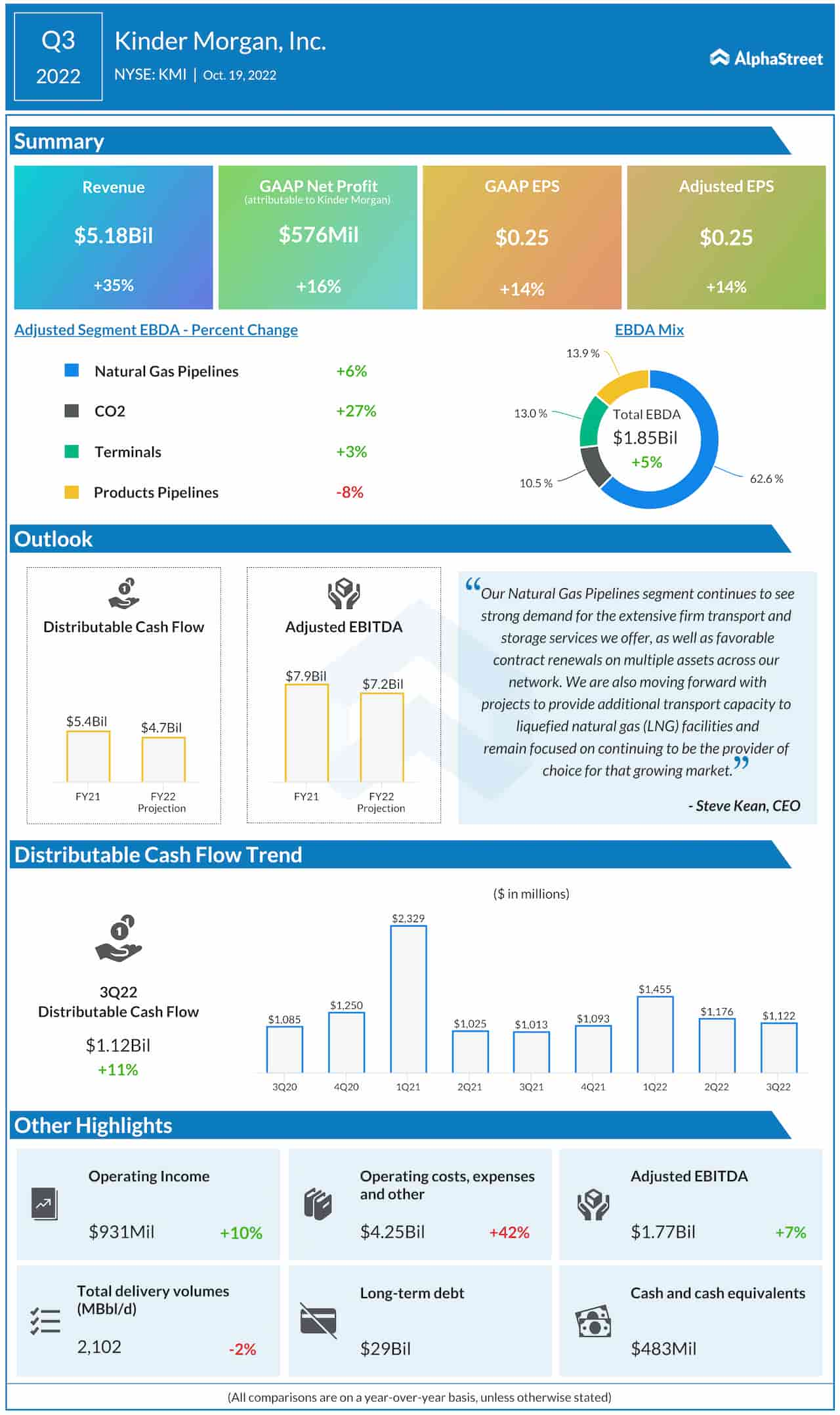

Kinder Morgan bets on the stable demand for natural gas transportation and storage to maintain growth this year. The other factors that could enable the company to beat the effect of high interest rates are investments in its Energy Transition Ventures business and strong demand for refined products. The management forecasts a net income of $1.12, on a per-share basis, for fiscal 2023. Adjusted EBITDA is seen growing 3% year-over-year to $7.7 billion, while distributable cash flow per share is expected to drop to $2.13.

Q4 Report on Tap

Kinder Morgan will be releasing fourth-quarter financial results on January 18 at 4.05 PM ET. Having delivered earnings growth in the past two quarters, the company seems to have maintained that trend in the final three months of fiscal 2022. As per experts’ consensus estimates, adjusted earnings will rise 11% annually to $0.30 per share, on revenues of $4.91 billion.

From Kinder Morgan’s Q3 2022 earnings conference call:

“Our capacity sales and renewals in our gas business are strong. Gathering and processing is also up versus planned and up year-over-year. The existing capacity is growing in value on our natural gas network and we’re seeing it across our network on our major interstate systems and on our Texas intrastate system. And we are seeing it in both storage and transportation service offerings and we’re even seeing it on a previously challenged system, the Midcontinent Express Pipeline.”

Chevron vs. ExxonMobil: Which energy stock is a better buy?

Net profit, on an adjusted basis, rose to $0.25 per share in the September quarter from $0.22 per share a year earlier. All operating segments, except Products Pipelines, registered positive EBDA, and there was a 35% growth in revenues to $5.18 billion. Distributable cash flow per share, an important measure of financial health, grew by 11%.

Kinder Morgan’s stock traded up 1% on Thursday afternoon, after gaining about 14% in the past six months.