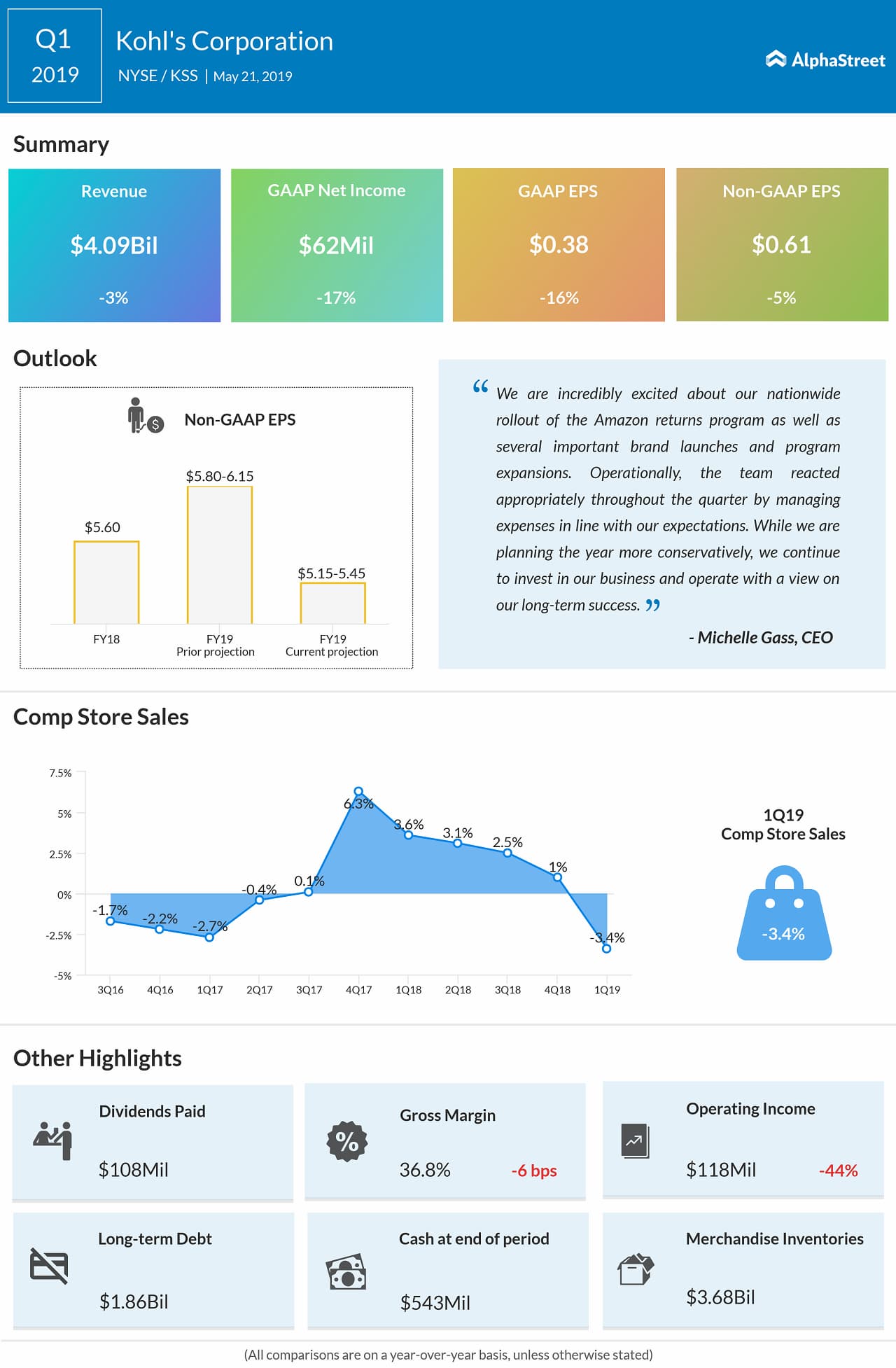

On a reported basis, earnings fell to 38 cents per share from 46 cents per share a year ago.

KSS stock has mostly traded sideways this year, and is currently down 7.4%.

The Menomonee Falls, Wisconsin-based retailer slashed its outlook for annual EPS to a range of $5.15 to $5.45, compared to its prior guidance of $5.80 to $6.15.

READ:

THE QUESTION EVERY POT INVESTOR ASKS HIMSELF – AURORA CANNABIS OR HEXO?

CEO Michelle Gass said, “The year has started off slower than we’d like, with our first quarter sales coming in below our expectation. We are actively addressing the opportunities that impacted our first quarter sales and we have strong initiatives that will enhance our sales performance in the second half.”