Sales Slump

Falling sales and high input costs are the primary headwinds facing the consumer staples company, which had resulted in a hefty noncash impairment charge in 2018. The situation has not changed much since the last report, and it might have a negative impact on the results this time. Meanwhile, the pressure on margins eased in recent quarters, thanks to the company’s aggressive cost-cutting efforts.

Strategic Vision

The stakeholders of the company will be looking for inputs from new CEO Miguel Patricio on his vision for a turnaround. The stock should get a much-needed boost if the management provides an optimistic update with regard to the growth strategy. In the run-up to the earnings announcement, investors will be closely following the stock, considering its relatively low price.

Related: McDonald’s beats Q4 revenue and earnings estimates

ADVERTISEMENT

The efforts to drive growth through an efficient pricing strategy might help the company retain the current sales momentum to some extent. In the long term, the ongoing innovation and revamped product line should help it get back on track. The increased focus on promotional activities will be helpful.

Looking Back

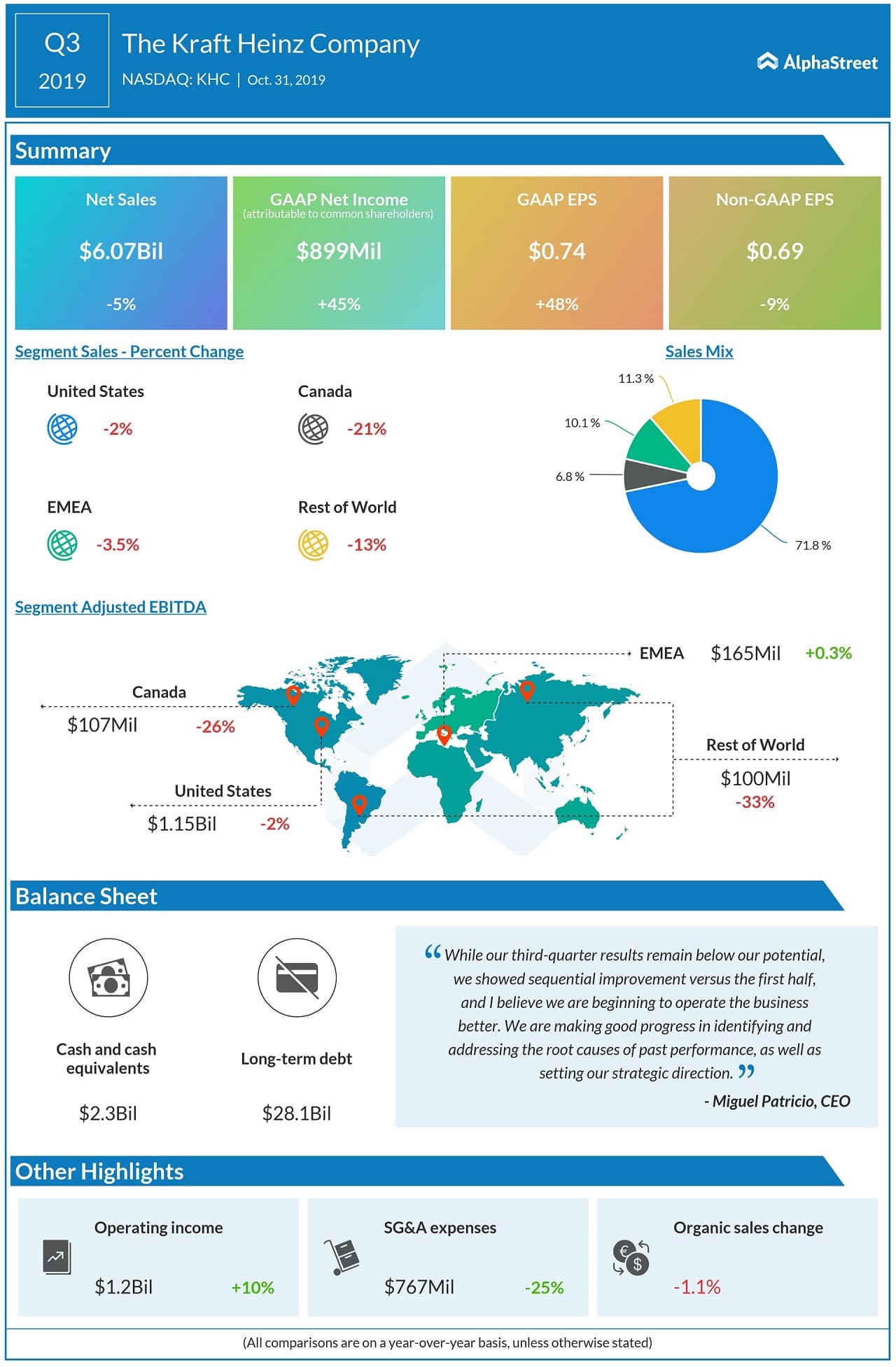

All four business segments witnessed weakness in the third quarter, resulting in a 5% fall in revenues to $6.1 billion. At $0.69, adjusted earnings were down 9%. While earnings topped the Street view, sales missed.

Kraft Heinz shares this week hovered near the all-time lows seen in mid-2019. The stock had an unimpressive start to the year and continues to underperform the market. In the past twelve months, it lost about 38%.