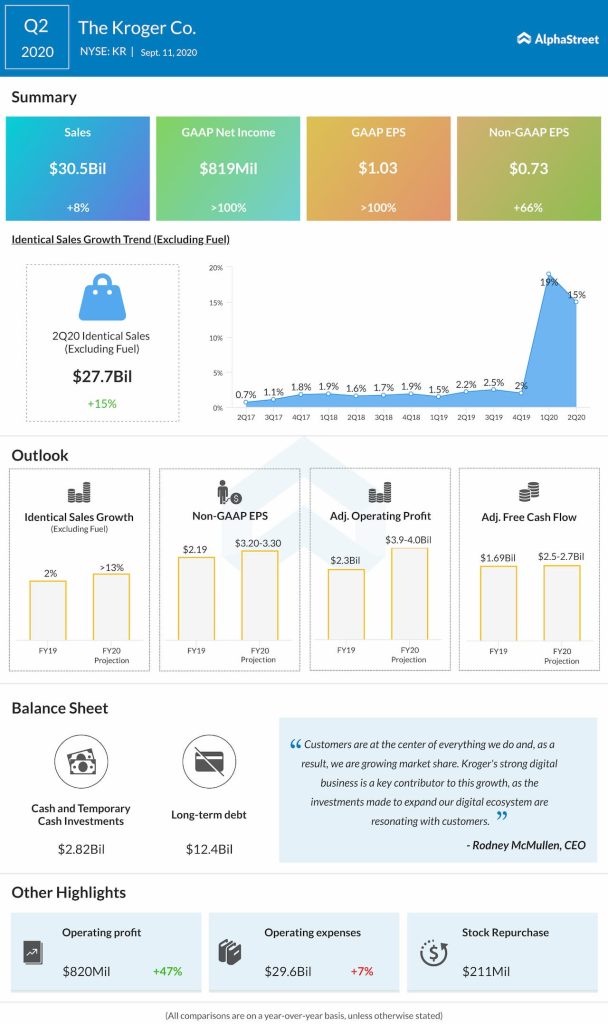

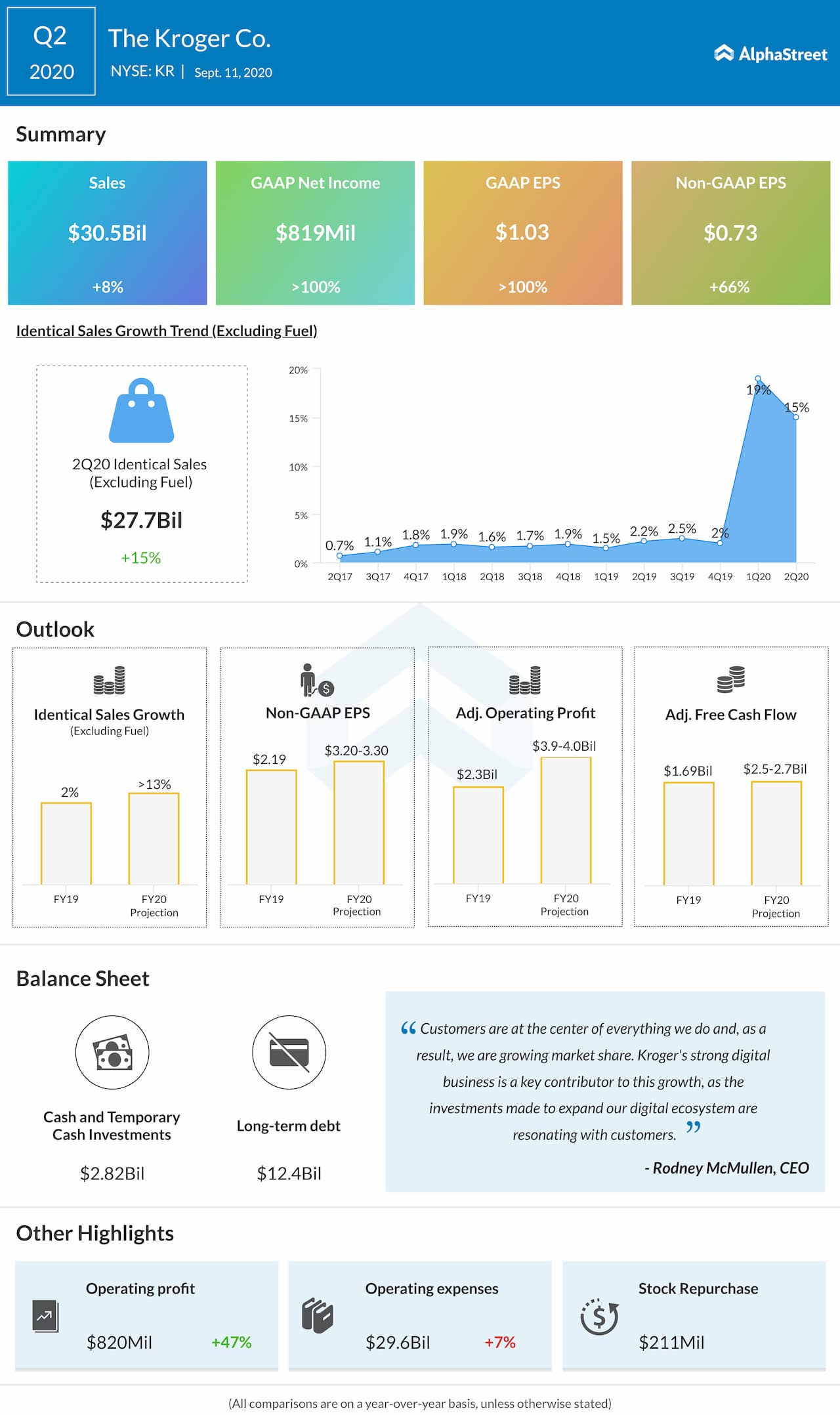

Q2 results

Updated outlook

As a result of the strong first half performance and the expectation of sustained trends in food-at-home consumption, the grocery retailer lifted its previously announced outlook for the fiscal year 2020. The company now expects non-GAAP EPS to be between $3.20 and $3.30 in FY20 compared to the prior estimate of $2.30 to $2.40. Identical sales (excluding fuel) growth is now projected to be greater than 13% versus the prior growth outlook of greater than 2.25%.

COVID-19 outcome

As a result of the pandemic, the slowness in returning to normalcy from the shutdown period resulted in fewer customer visits, but increased basket size for Kroger. The health crisis has resulted in people cooking more at home, which has now become their part of the new routine.

During Q2 earnings conference call, CEO Rodney McMullen stated:

“While the full economic impact of COVID-19 is yet understood, our data shows that during the periods of lower economic activity, we see a structural shift from food consumed away from home to food consumed at home. All of these factors combined lead us to believe there will be more meals eaten at home or prepared at home for the foreseeable future.”

Headwinds

In the second half of 2020, Kroger expects identical sales excluding fuel to continue at elevated levels, although tapering from the level experienced so far this year. The company expects fuel profitability to be a headwind for the remainder of 2020.

Also read: Walmart (WMT) bets big on grocery to navigate through pandemic

COVID-related cost investments in associate depreciation, cleaning, safety and supply chain amounted to $250 million in the second quarter. To reinforce safety in the stores, the company needs to spend more in the rest of the year. However, with the progress on its Restock Kroger savings initiatives in the second quarter, Kroger expects to balance these costs and estimates to achieve the previously announced $1 billion of savings in 2020.

At a time when other players are not investing on price, Kroger’s decision to waive the pickup fee as well as invest in promotions and price was questioned by an analyst in the conference call. Market watchers felt that these actions may not pay off for Kroger in the longer-term.