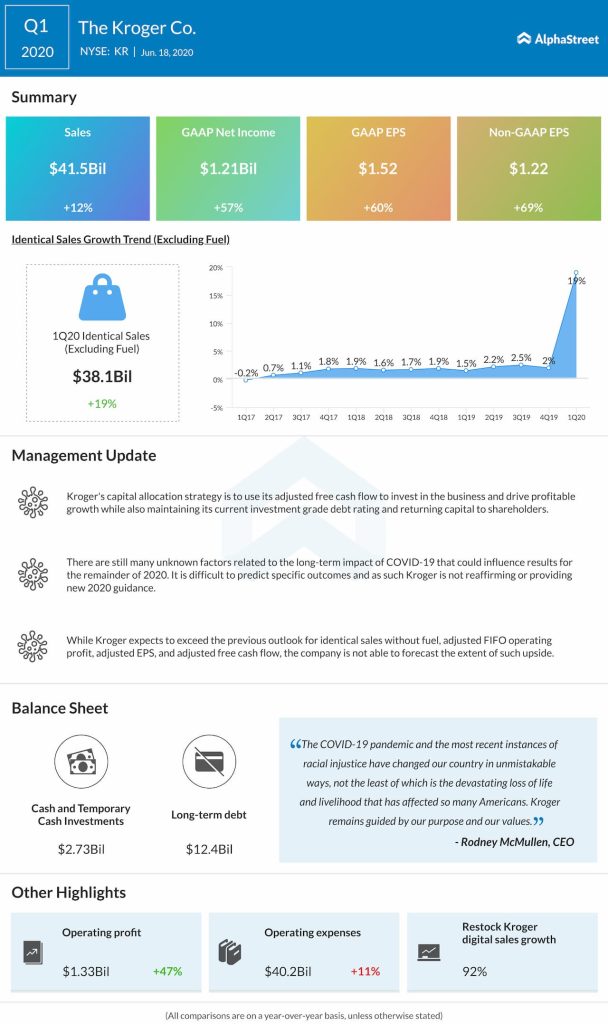

The COVID-19 pandemic has dramatically changed the outlook for food retail in 2020 and the company continues to monitor, evaluate, and adjust its plans to address the impact on its business. While Kroger expects to exceed the previous outlook for identical sales without fuel, adjusted FIFO operating profit, adjusted EPS, and adjusted free cash flow, the company is not able to forecast the extent of such upside.

Take a look at our Retail articles here