L Brands Inc. (NYSE: LB) announced its decision to separate its Victoria’s Secret business into a private entity in a deal with Sycamore Partners on Thursday. This move has been welcomed by most experts and the stock is currently trading in green territory.

This appears to be a step in the right direction but it remains uncertain whether the road ahead will turn out to be smooth or rocky. For now, however, the pros appear to outweigh the cons.

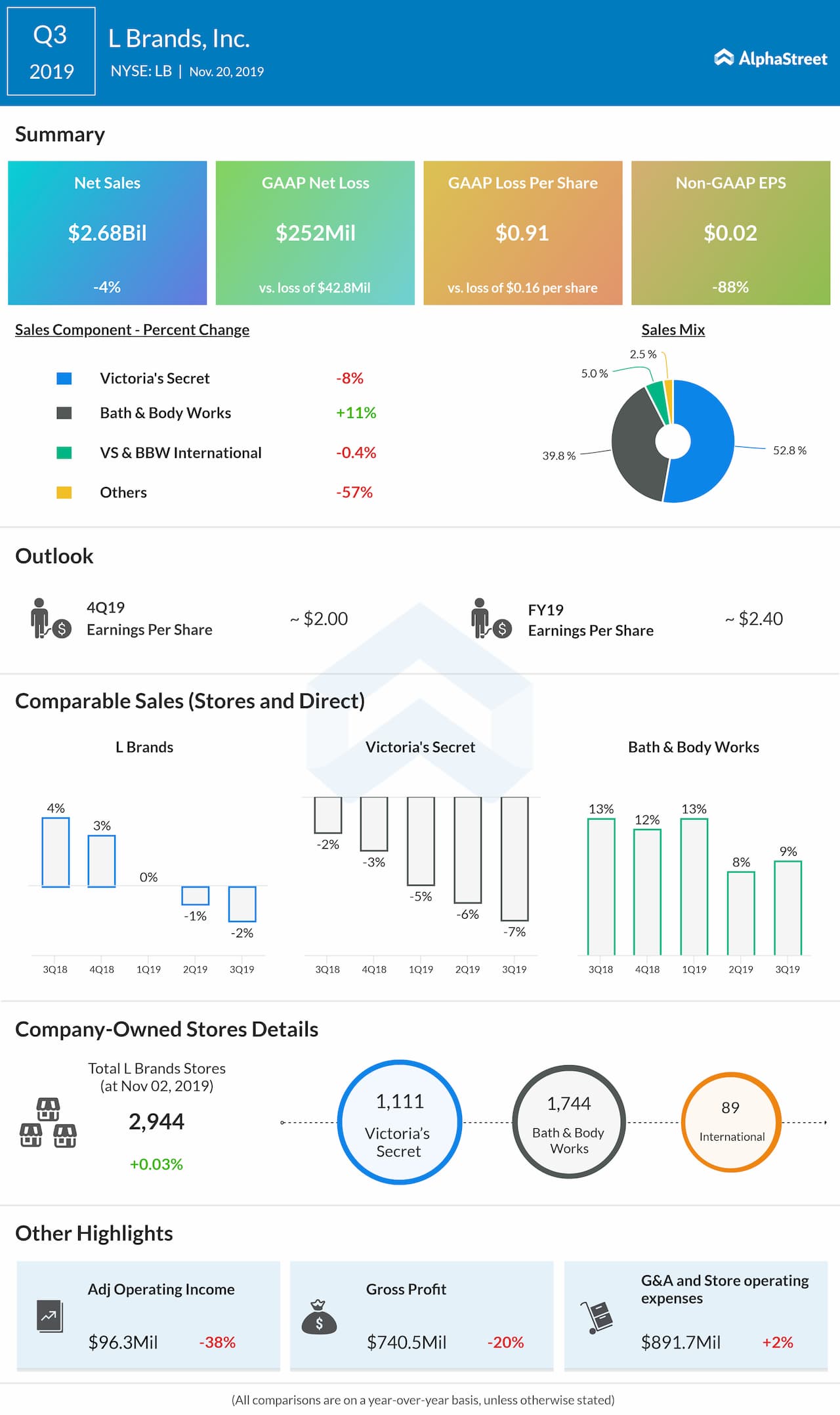

For long enough, the Victoria’s Secret division has

underperformed and dragged down L Brands’ results. The company’s overall revenues

have declined over the past quarters and its losses have widened. Comparable

store sales have also decreased.

This weakness was evident when L Brands reported its holiday

sales last month. Revenues fell 2% for the period while comp sales were down

3%. L Brands also lowered its fourth quarter 2019 EPS guidance to $1.85 from $2.00.

Meanwhile, Bath & Body Works has continued to post strong revenue and comps keeping the business afloat. The separation of Victoria’s Secret will allow L Brands to focus on Bath & Body Works and pave the way for further growth.

Under the new management, there will be changes in strategy and

direction for Bath & Body Works and Victoria’s Secret and this bodes well

for both businesses. L Brands will also be able to reduce its debt load with

the proceeds of this transaction which is another advantage.

However, L Brands, like several other retailers, continues

to face tough competition from ecommerce companies, and some analysts believe

the company might end up closing more stores going forward.

Despite the uncertainty, it seems L Brands does have a good

opportunity to turn around its business and maximize shareholder value. The

majority of analysts have rated the stock as Hold and it has an average price

target of $27.37, which represents a 15% upside from the current level.

L Brands will report fourth quarter 2019 earnings results on Wednesday, February 26. Analysts have estimated earnings of $1.83 per share on revenue of $4.6 billion.