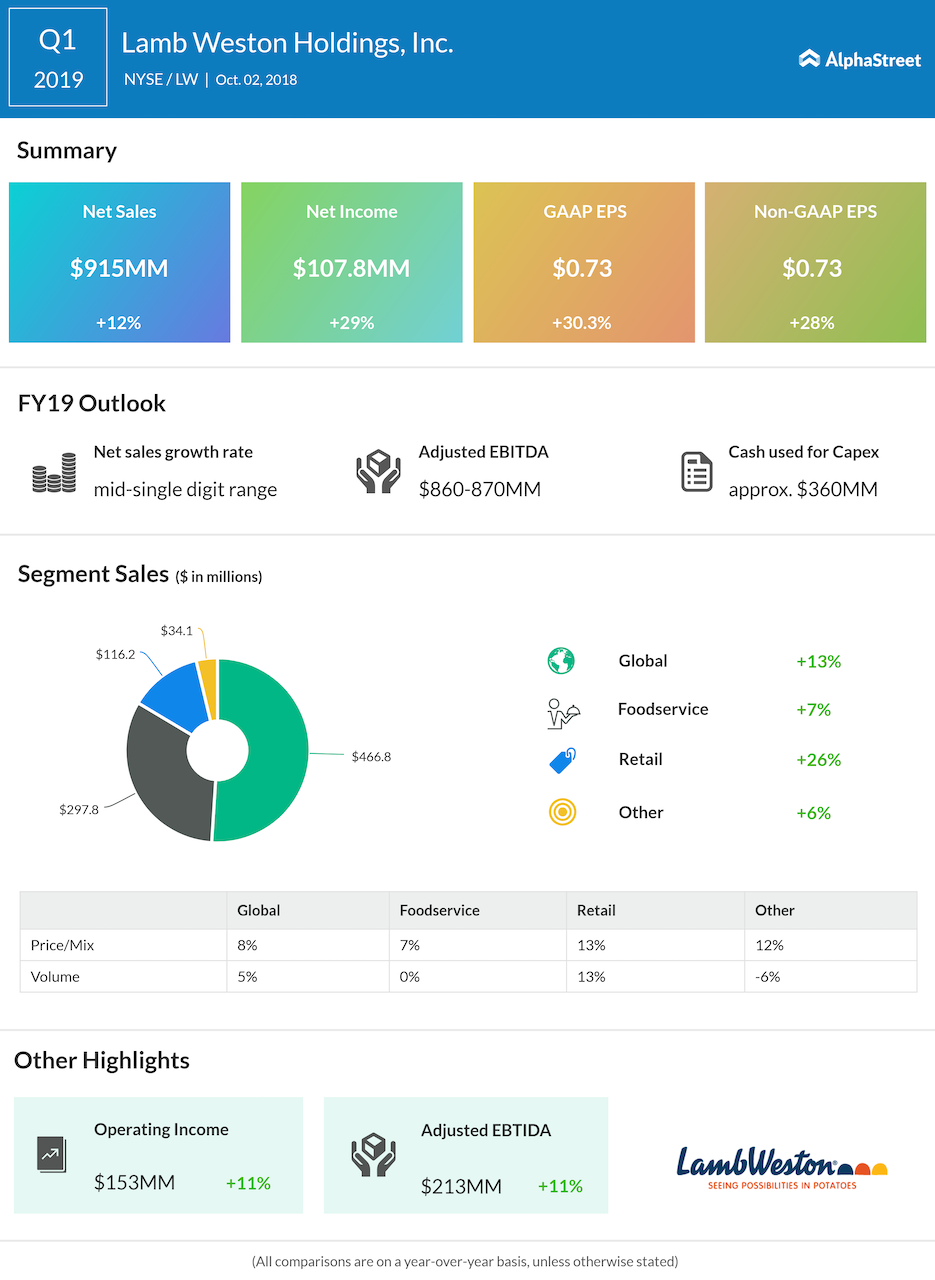

Lamb Weston Holdings Inc. (LW) topped market estimates on revenues and earnings for the first quarter of 2019. The stock was up over 4% in premarket hours. The company reported a 12% increase in net sales to $915 million compared to the same period last year. Volumes improved 4% driven by growth in the Global and Retail segments.

Net income attributable to Lamb Weston increased 29% to $107.8 million while diluted EPS grew 30% to $0.73 versus the prior-year period. Adjusted diluted EPS grew 28% to $0.73.

Lamb Weston posted revenue increases across all three of its segments. While the Global and Retail segments saw volume increases, the Foodservice segment saw a slight dip in volume as the sales growth of higher-margin Lamb Weston products largely offset the loss of some lower-margin product volumes.

Tom Werner, President and CEO said, “For the remainder of fiscal 2019, we continue to anticipate the operating environment in North America will remain generally favorable, with solid demand for frozen potato products and tight manufacturing capacity. However, we expect that our European joint venture, Lamb Weston/Meijer, will face challenges arising from a poor potato crop. Although it’s too early to determine the full impact of these challenges, we believe that Lamb Weston/Meijer’s pricing and cost reduction actions, along with opportunities in our North American and export businesses, enable us to remain on track to deliver on our fiscal 2019 targets.”

For fiscal-year 2019, Lamb Weston expects net sales to grow mid-single digits, with price/mix higher in the first half of 2019 versus the second half. Adjusted EBITDA, including unconsolidated JVs, is expected to come in between $860 million and $870 million. Capital expenditures are expected to total approximately $360 million, excluding acquisitions.

Last week, the company declared a quarterly dividend of $0.19 per common share, payable on November 30 to shareholders of record on November 2.