Housing Boom

The ongoing housing boom and the industry’s continuing resilience to the pandemic provide ample room for near-term business growth. Also, Lennar is a relatively cheap stock that is expected to gather further strength next year. Going by the current trend, it is unlikely to disappoint investors.

Read management/analysts’ comments on Lennar’s Q4 results

The demand for residential properties outweighed supply throughout this year – a trend that should continue in the coming months. Lennar’s sales performance has been stable for quite some time, which helped the company maintain industry-leading margins. Moreover, a strong balance sheet and healthy cash flows should help when it comes to meeting growth goals.

Challenges

But that doesn’t make Lennar immune to the supply chain challenges facing the business world, though things have improved recently. Delays in delivery and elevated lumber costs could be a dampener on the management’s growth plans. Inadequate raw material supplies and labor shortage might add to the backlogs.

In recent years, the Fontainebleau-based homebuilder constantly improved its profitability, and the bottom-line mostly topped the market’s expectations. The company started the new fiscal year on a positive note, after winding up the fourth quarter of 2021 with mixed financial performance.

From Lennar’s Q4 2021 earnings call transcript:

“While difficulties in the supply chain present challenges for Lennar and the industry, the housing market remains strong and supply of new and existing homes is very limited. We remain focused on an orderly targeted growth strategy with our sales pace tightly matched with our pace of production. We focus on gross margin by selling in step with production, while controlling costs and reducing our SG&A, and therefore, driving our net margin. As we look to 2022, we see continued strength in the market and double-digit growth for Lennar.”

Mixed Q4

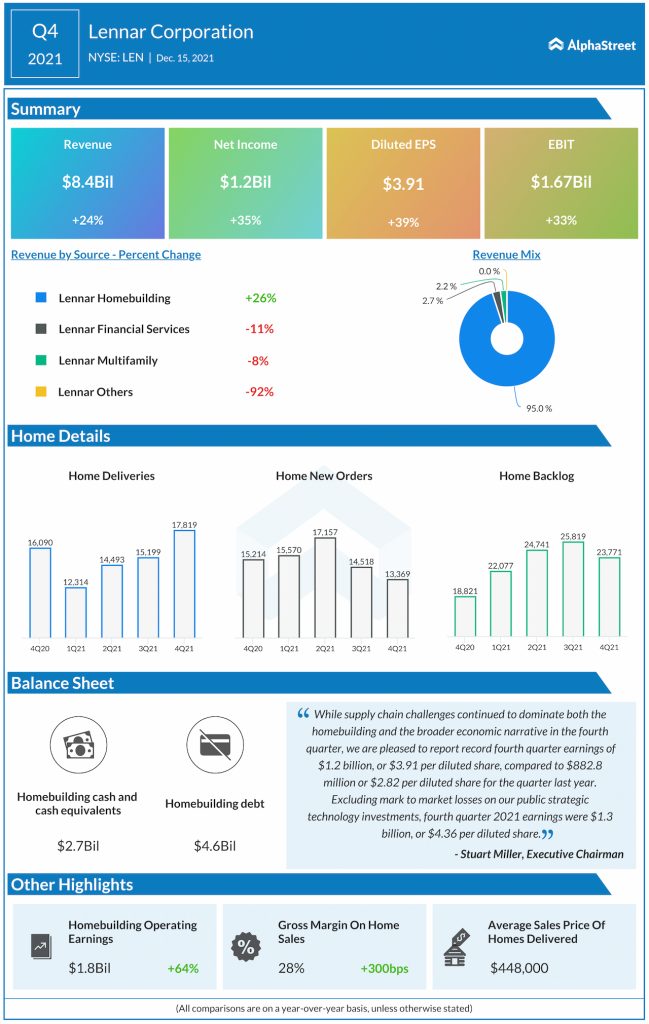

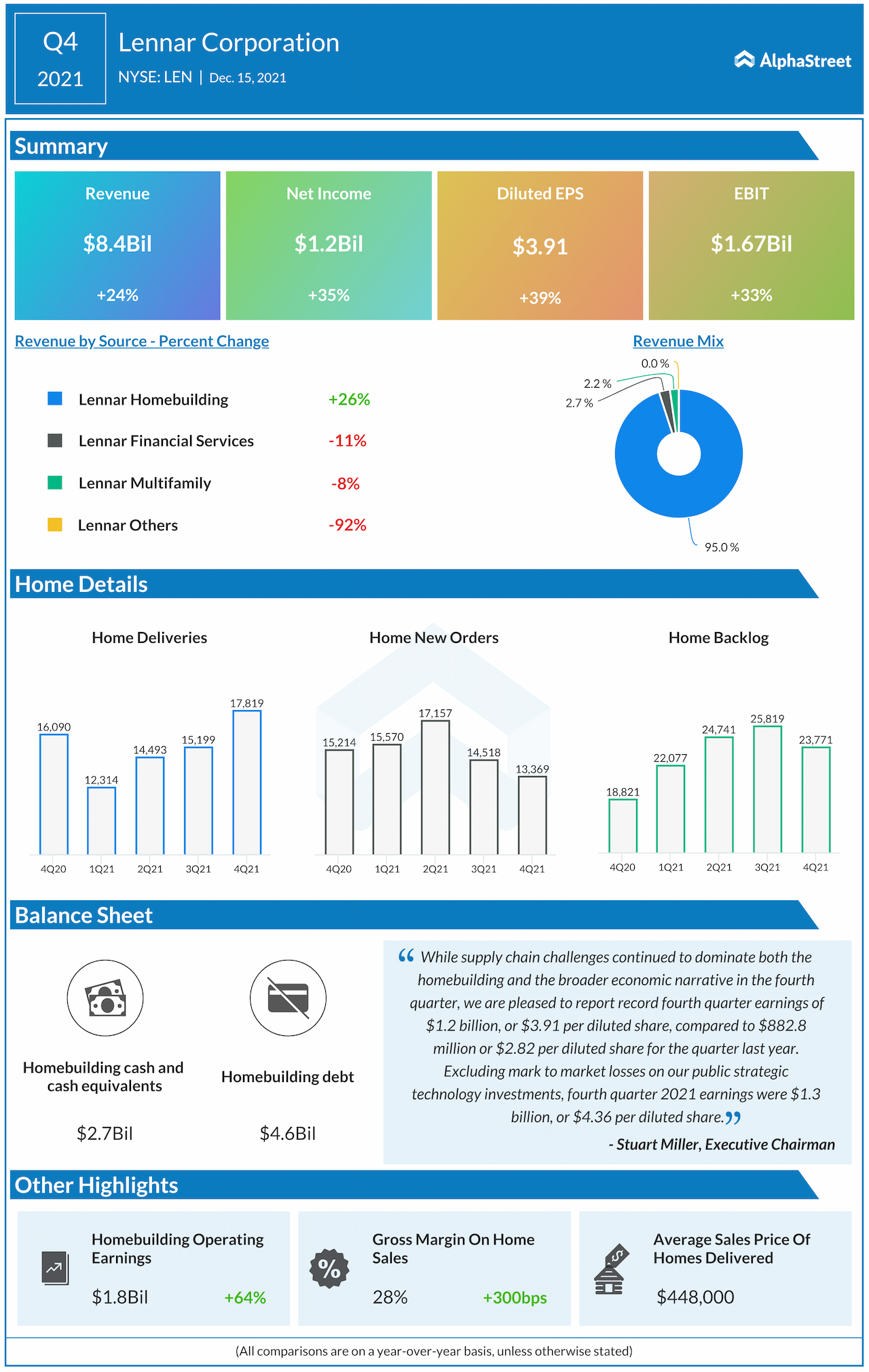

Revenues and earnings increased in double digits to $8.4 billion and $3.91 per share respectively in the fourth quarter. A 26% growth in the core Lennar Homebuilding segment, which accounts for around 95% of total revenues, more than offset weakness in the other divisions. The top-line, however, came in below estimates.

Should you invest in Home Depot ahead of third-quarter earnings

Ahead of the earnings announcement, Lennar’s stock made steady gains and set a new record early this month, before withdrawing to the pre-peak levels later. As 2021 comes to a close, LEN is trading up 53% from the level seen at the beginning of the year.