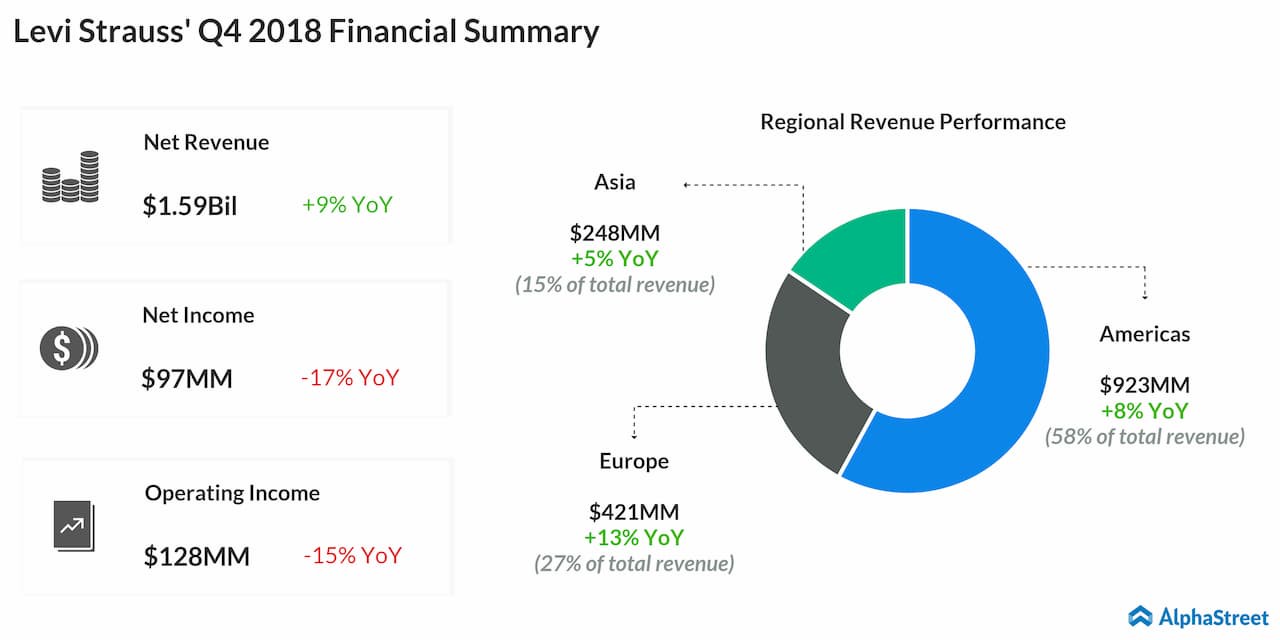

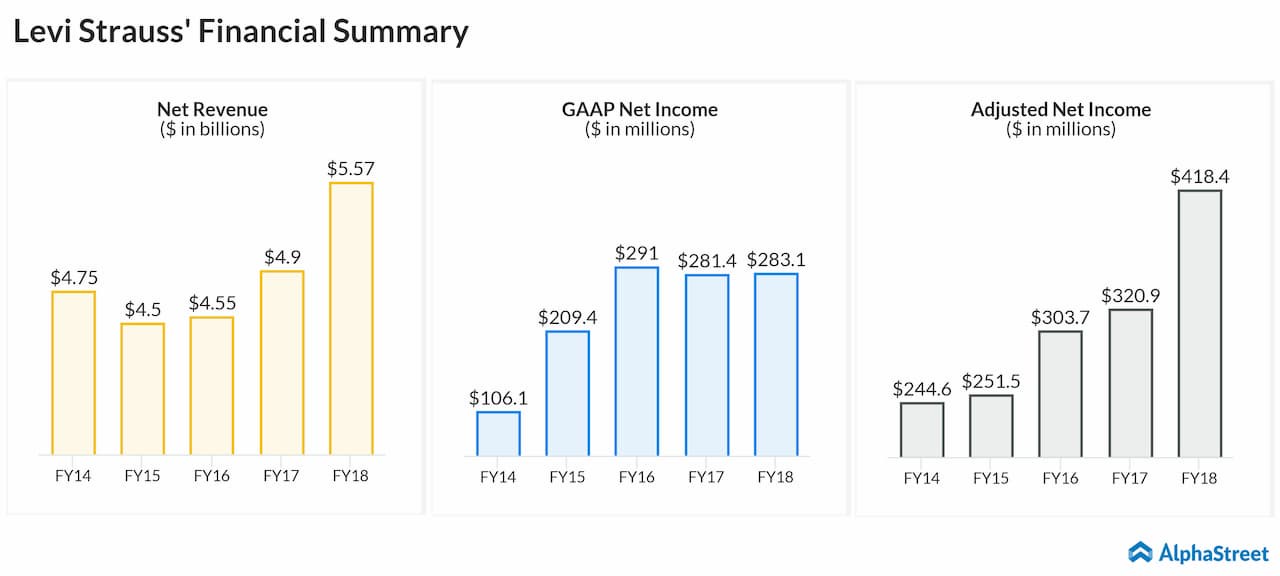

In fiscal 2018, the San Francisco-based firm’s revenue increased 14% year-over-year to $5.6 billion on a reported basis. Net income for the year was flat at $285 million.

When Levi Strauss reported its fourth quarter and full-year 2018 results in early February, CEO Chip Bergh had said: “It’s clear our strategies to diversify our product portfolio, expand our direct-to-consumer business, and deepen our connection with consumers worldwide have worked, resulting in both higher annual revenues and gross margins.”

When the company reports its first-quarter results on Tuesday, investors will be looking at year-over-year growth in revenue and net income. During the year-ago quarter (Q1 2018), Levi Strauss had reported a 22% increase in net revenue to $1.34 billion. Adjusted net income almost doubled to $117 million.

READ: LYFT AND SIX OTHER COMPANIES WENT PUBLIC IN MARCH. FULL LIST

Investors will be looking forward to the earnings conference call where the management is expected to give a blueprint of how it plans to use the IPO proceeds. At the time of the IPO filing, The company had said proceeds would be used for general corporate purposes, including working capital, operating expenses and capital expenditures.

It also indicated that it may use a portion of net proceeds for acquisitions or other strategic investments.