After becoming a private company in 1985, the first blue jeans maker Levi Strauss returned to the public market today. On Wednesday evening Levi Strauss & Co. (LS&Co.) announced the pricing of the IPO of about 36.7 million of its Class A common stock at a price to the public of $17 per share, raising $623 million and making it a $6.6 billion valued company.

Shares of Levi Strauss, which started trading under the trading symbol “LEVI”, opened at $22.22 on NYSE today, up more than 30% from its IPO price of $17 a share.

Levi Strauss said in the IPO filing that it would use the net proceeds from this offering for general corporate purposes, including working capital, operating expenses and capital expenditures. The company also indicated that it may use a portion of net proceeds for acquisitions or other strategic investments.

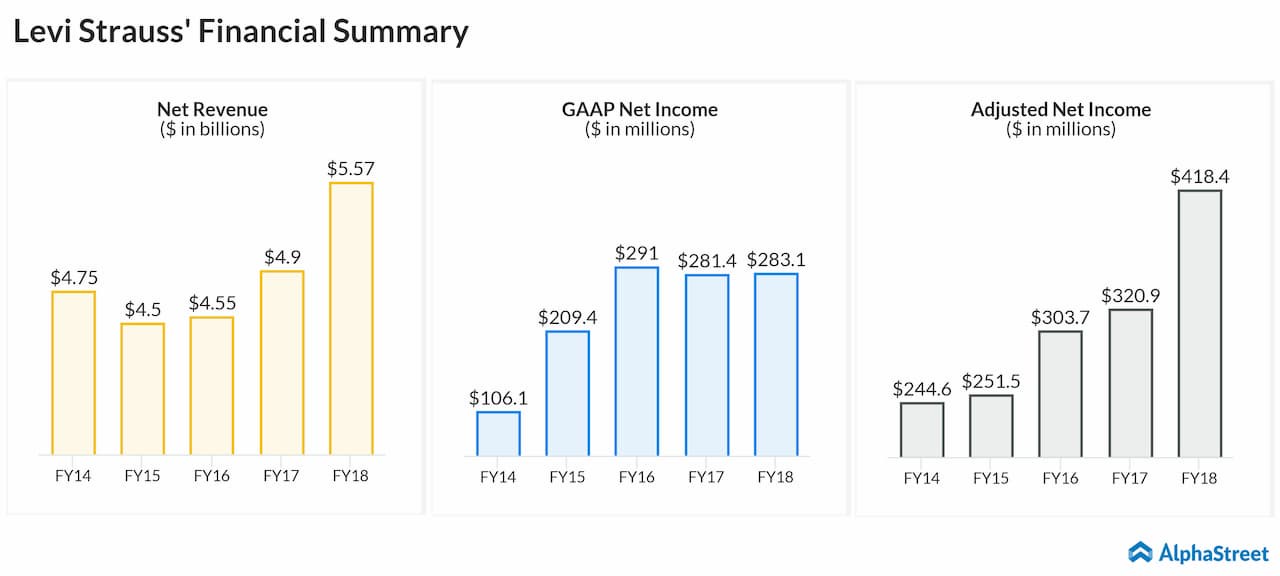

The San Francisco-based firm’s revenue grew 14% year-over-year to $5.6 billion on a reported basis in the fiscal year 2018, which ended on November 25, 2018. Net income was flat at $285 million.

When Levi Strauss reported its fourth quarter and full-year 2018 results in early February, CEO Chip Bergh commented, ““It’s clear our strategies to diversify our product portfolio, expand our direct-to-consumer business, and deepen our connection with consumers worldwide have worked, resulting in both higher annual revenues and gross margins.”

At November 25, 2018, cash and cash equivalents stood at $713 million and net debt was $339 million. Cash from operations was $420 million, a decrease of $106 million compared to fiscal 2017.

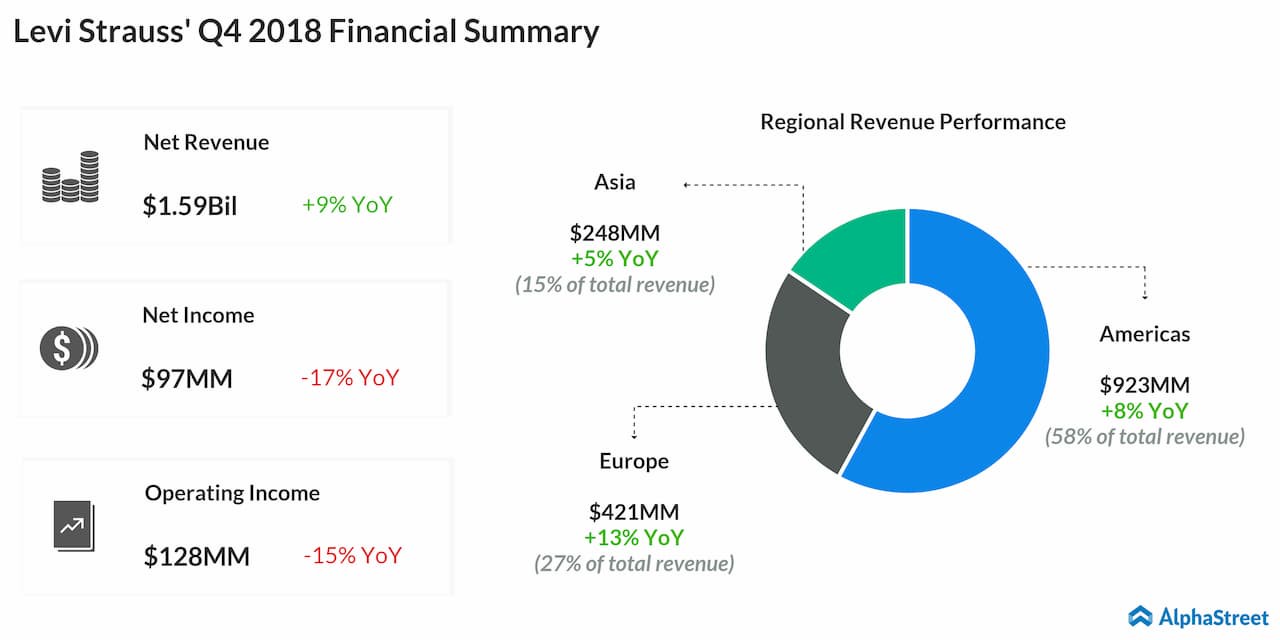

For the fourth quarter, revenue grew 9% on a reported basis to $1.59 billion and earnings declined 17% to $97 million or $0.25 per share. In January 2019, board of directors declared two cash dividends of $55 million each, the first to be paid in Q1 2019 to shareholders of record as on February 8, 2019 and the second to be paid in Q4 2019 to shareholders of record as of October 5, 2019.

On Wednesday, apparel retailer Guess? Inc (GES) reported mixed results for its fourth quarter in which the company missed earnings estimates and surpassed analysts’ revenue targets. Shares of Guess stumbled more than 10% in Thursday’s morning session.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions