Quarterly performance

Home improvement trends

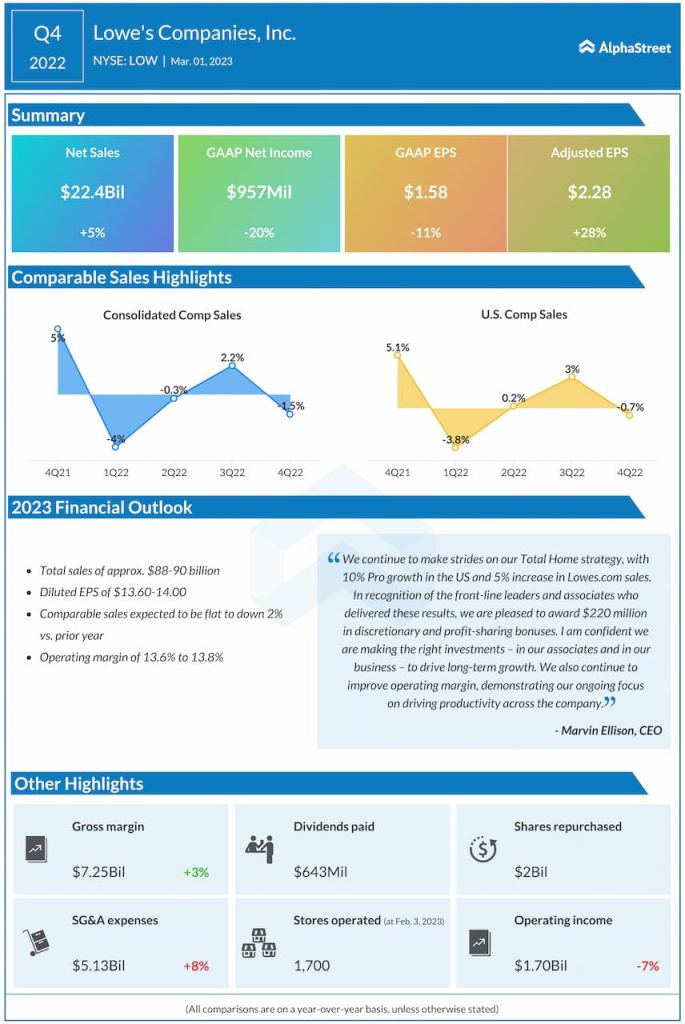

In Q4, comparable sales for the US home improvement business fell 0.7% but Lowe’s saw strong sales within the Pro customer category. On its quarterly conference call, the company said the majority of its Pro customers appear to have healthy backlogs. Within Pro, the company saw strength across categories like rough plumbing, paint and millwork. Lowe’s also saw solid DIY demand in core home improvement categories during the quarter.

Despite the macroeconomic uncertainty, Lowe’s remains optimistic on the core drivers of its business – disposable personal income, home price appreciation, and the age of housing stock. On its call, Lowe’s stated that consumer savings are still roughly $1.5 trillion higher than pre-pandemic. In addition, the housing stock continues to age with 50% of US homes over 41 years old.

The company believes that these factors, along with strong millennial household formation, the remote work model, and an increasing preference among baby boomers to age in place will prove to be beneficial for its business. Lowe’s continues to see more consumers opting to upgrade their existing homes to meet their changing needs. All these factors give it confidence in the medium and long-term outlook for the home improvement industry.

Outlook

Although its long-term outlook for the home improvement market remains strong, Lowe’s expects residential investment to remain pressured in 2023. The company is forecasting a slight decline in the home improvement market due to inflation, higher interest rates and a more cautious consumer.

For FY2023, Lowe’s expects total sales of approx. $88-90 billion while comparable sales are expected to be flat to down 2% compared to last year. EPS is expected to range between $13.60-14.00.

Click here to read the full transcript of Lowe’s Q4 2022 earnings conference call