Sales decline

Profitability

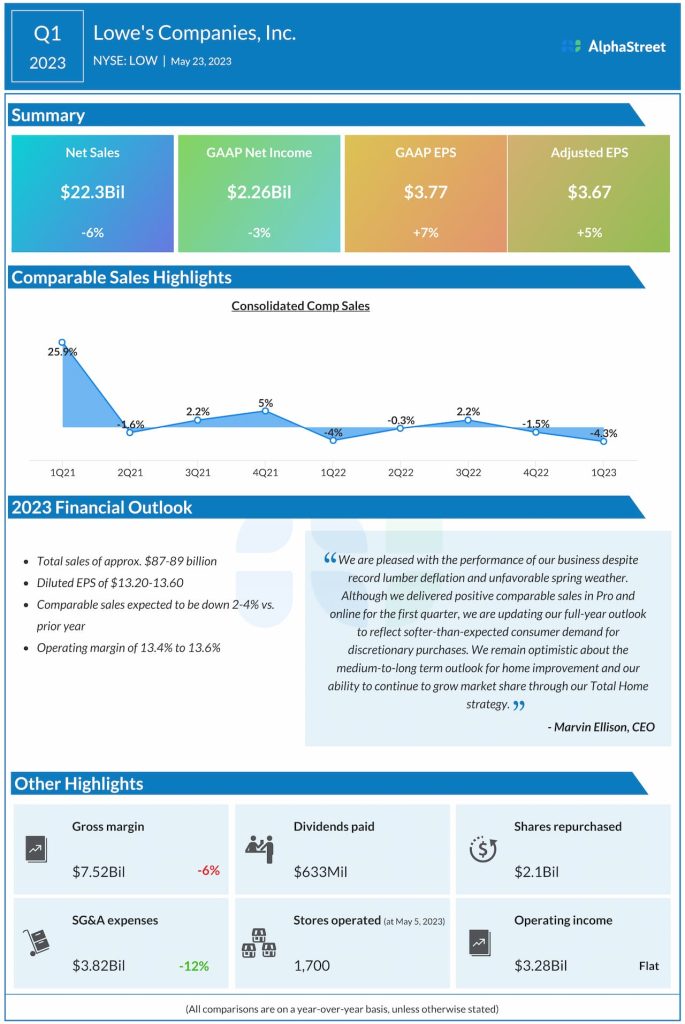

On a GAAP basis, Lowe’s net income fell 3% YoY to $2.26 billion but EPS increased 7% to $3.77. Adjusted EPS rose 5% to $3.67, exceeding expectations.

Category performance

As mentioned on its quarterly conference call, in Q1, Lowe’s saw positive comparable sales in the Pro segment with gains across several categories. However, sales in the do-it-yourself (DIY) segment, which makes up 75% of the company’s business, were hurt by lower-than-expected discretionary demand and a delayed spring.

As many of its seasonal categories are heavily concentrated in DIY, a late start to spring has a meaningful impact on this segment. Although Lowe’s anticipates a rebound in spring projects as the weather improves, it still expects discretionary consumer spending to remain low over the near term.

The delayed start to spring and the lower-than-expected DIY discretionary sales negatively impacted comp transactions which were down 4% in Q1. Lower sales in seasonal categories pressured sales by around $400 million in the quarter.

Guidance cut

Due to home improvement spending turning out lower than expected, Lowe’s now expects its relevant market, which reflects its 75% DIY, 25% Pro mix, to be down mid-single digits in 2023. Even though DIY discretionary demand was lower than expected, the company saw strength in the Pro segment. It expects Pro to outpace DIY for the year, helped by healthy backlogs and strong demand for Pro services.

Lowe’s lowered its sales outlook for the full year of 2023 to a range of $87-89 billion from the previous range of $88-90 billion. Comparable sales are now expected to be down 2-4% versus the earlier estimate of flat to down 2%. Adjusted EPS is now expected to range from $13.20-13.60 compared to the prior outlook of $13.60-14.00.