The company is depending on building its new stores that have grown to 593 in the second quarter on a sequential basis. Luckin continues to place its strategic focus on the development of pick-up stores. This is likely to increase costs. The company plans to lower the costs by reducing the wastage of the raw material, enhancing bargaining power, operating efficiency from technology and higher store throughput.

For the third quarter, the company will face an increase in costs and expenses and this could hurt the profitability. Analysts expect the coffee maker to report a loss of $0.37 per share on revenue of $211.46 million. For the quarter, Luckin Coffee expects net revenues from products to be in the range of RMB1.35 billion and RMB1.45 billion.

Read: Starbucks Q4 earnings review

ADVERTISEMENT

For the second quarter, Luckin posted a 698% jump in revenues from products helped by a significant increase in transacting customers, a higher average number of items purchased by its transacting customers, and an increase in effective selling prices. However, an increase in costs and expenses drove net loss wider than the last year.

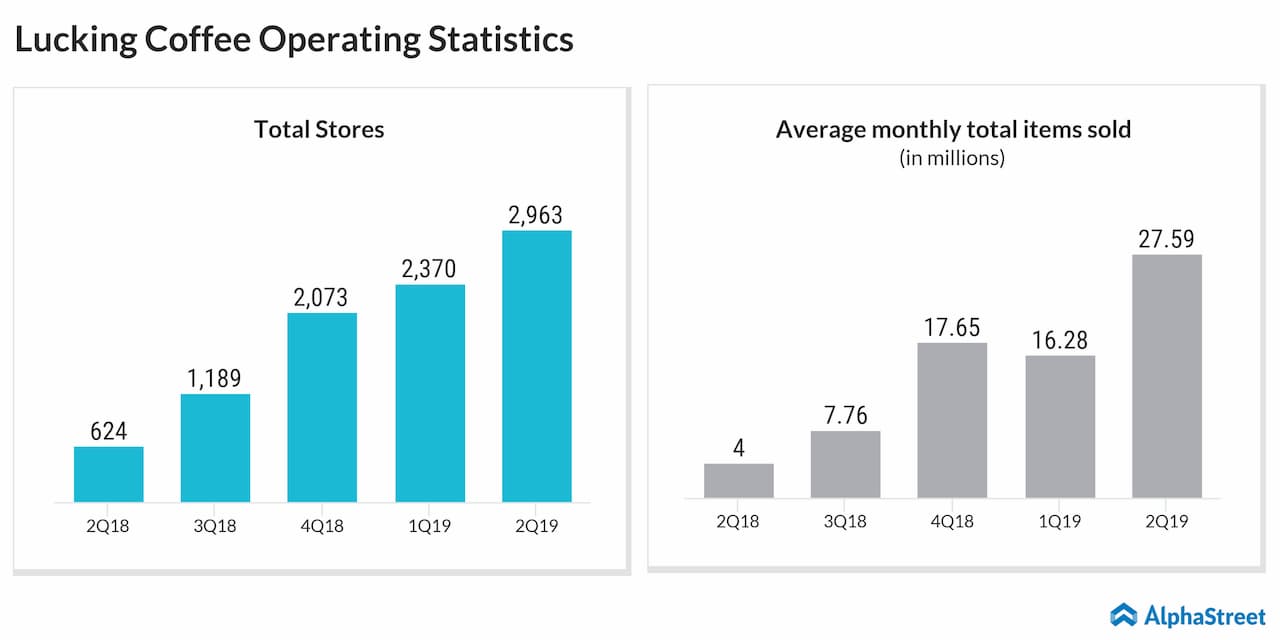

For the second quarter, the new transacting customer acquired was 5.9 million. Average monthly transacting customers soared by 411% to 6.2 million from 1.2 million a year ago, and average monthly total items sold jumped by 590% to 27.6 million. The total number of stores at the end of the quarter was 2,963 stores, representing an increase of 374.8% from 624 stores at the end of the prior-year quarter.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.