Net loss was $463.5 million, or $1.57 per share, compared to $249.2 million, or $11.58 per share, in the prior-year quarter. Adjusted net loss was $121.6 million, or $0.41 per share. Analysts had forecast a loss of $1.66 per share.

Logan Green, Co-founder and Chief Executive Officer said, “Our continued focus on consumer transportation is yielding meaningful improvements in monetization and strong operating leverage. As a result of the continued strength of our execution, we are updating our outlook for 2019. Importantly, we now expect to be profitable on an adjusted EBITDA basis in the fourth quarter of 2021.”

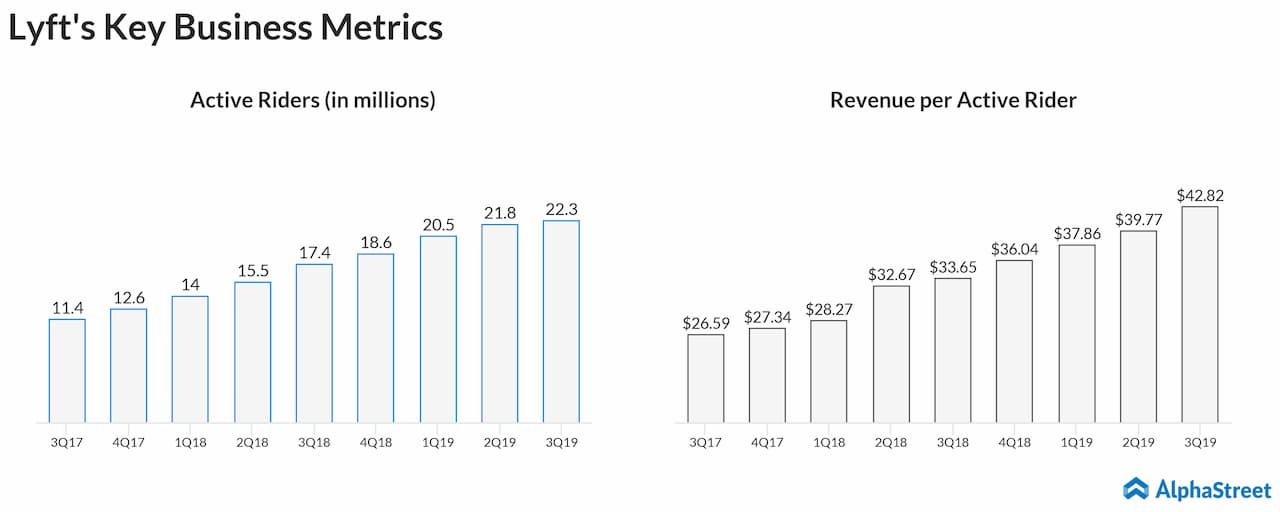

During the quarter, the company reported a 28% increase in active riders to 22.3 million. Revenue per active rider increased 27% to $42.82.

Lyft reported contribution of $479.2 million, reflecting an increase of 82% year-over-year. Contribution margin increased to 50.1% from 45% last year.

For the fourth quarter of 2019, Lyft expects revenues to grow 46-47% to a range of $975-985 million.

For full-year 2019, the company raised its outlook and now expects revenues to grow around 66% to a range of between $3.57 billion and $3.58 billion. This compares to the previous guidance range of $3.47 billion to $3.50 billion, reflecting a growth of 61-62%.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.