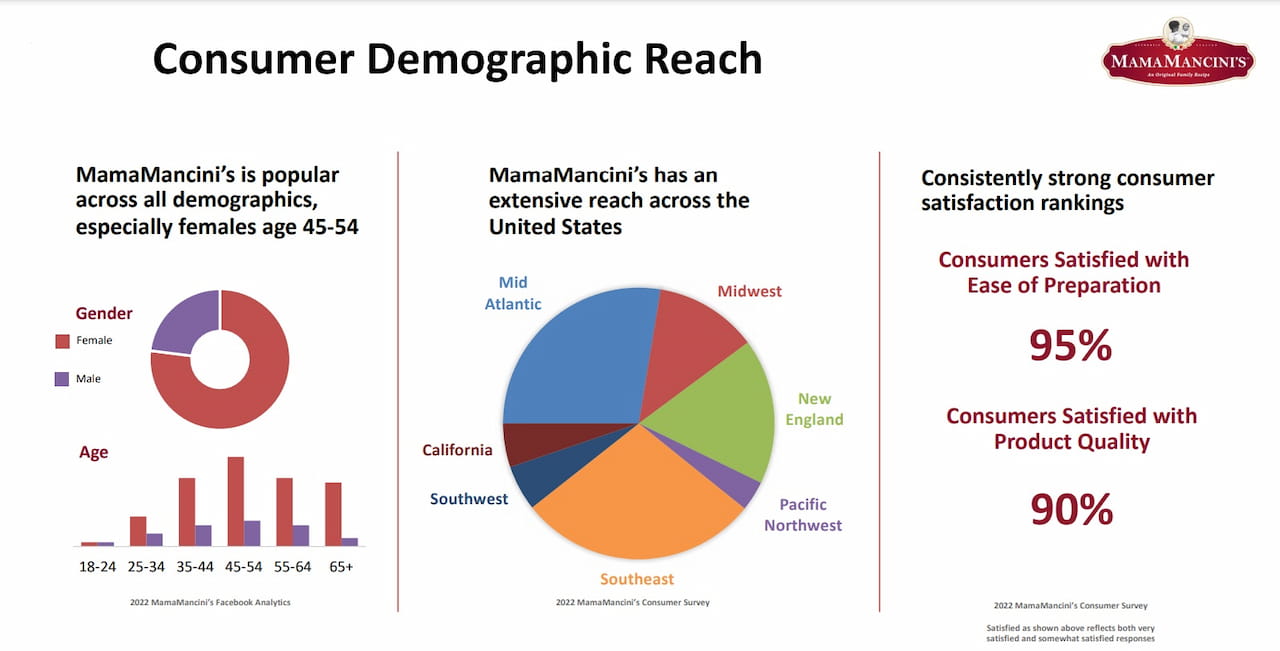

MamaMancini’s Holdings, Inc. (NASDAQ: MMMB) is a leading producer and distributor of specialty pre-prepared all-natural food products in North America. Currently, the company is on a drive to expand the business through various initiatives like strategic acquisitions. The products, including popular items like meatballs, sausages, and pasta bowls, are available in more than 45,000 tier-1 locations across the country.

In an exclusive interview with AlphaStreet, Adam Michaels, who joined the company as chief executive officer a few months ago, spoke about the factors influencing the business and the roadmap for meeting long-term goals.

Did the pandemic-induced shift in consumption habits help sales; if so, do you expect the tailwind to stay?

The pandemic was horrible and hurt so many families; We were there to help in any way we could. And we think our comfort products helped consumers get through the pandemic in a small way. On the sales front, firstly, consumers wanted a touchstone, they wanted to feel safe, and they wanted to feel nostalgia. Consumers gravitated to our products because it felt like home. They remember the meatballs their grandmother made when they were kids. Sausage & Peppers, our meatloaf, our grilled chicken meals, etc. These are all comfort foods, which accelerated over time. That helped us.

There was also more family mealtime. People were working from home, so they ate more meals at home, which helped us. Consumers continued to move to cleaner, fresher ingredients that they can pronounce. That helped us. Finally, as the pandemic moved on, people were still at home but were getting busier with everything going on. Our products are easy to prepare, so it gave back time to people that needed it.

While the amplitude of these feelings may normalize, I don’t think the direction will change. First, I think Americans in particular love nostalgia and coming back to their childhood. Two, they want high-quality, clean, fresh foods. Shoppers are moving to the perimeter of the store, and the deli is one of the fastest-growing departments, with the prepared foods section being the largest and fastest-growing within the deli. And third, and this one will actually continue to accelerate, consumers will continue to be time constrained and the ability to warm up our prepared foods in just a few minutes is a lifesaver to many. All of these are tailwinds for our business going forward.

Another huge tailwind for us is how we can help our retailers. Store real estate is expensive and labor continues to be constrained. The fact that we can deliver restaurant-quality meals (sorry, Dan Mancini always likes to say “grandma quality”!) at grocery store prices for our retailers and consumers means that we are providing an immense level of flexibility for our retail partners. Consumers are stopping into the grocery store on the way home from work and picking up a couple of prepared meals for dinner for them or their family, thus driving incremental trips for the retailer. This is HUGE and incredibly valuable to retailers.

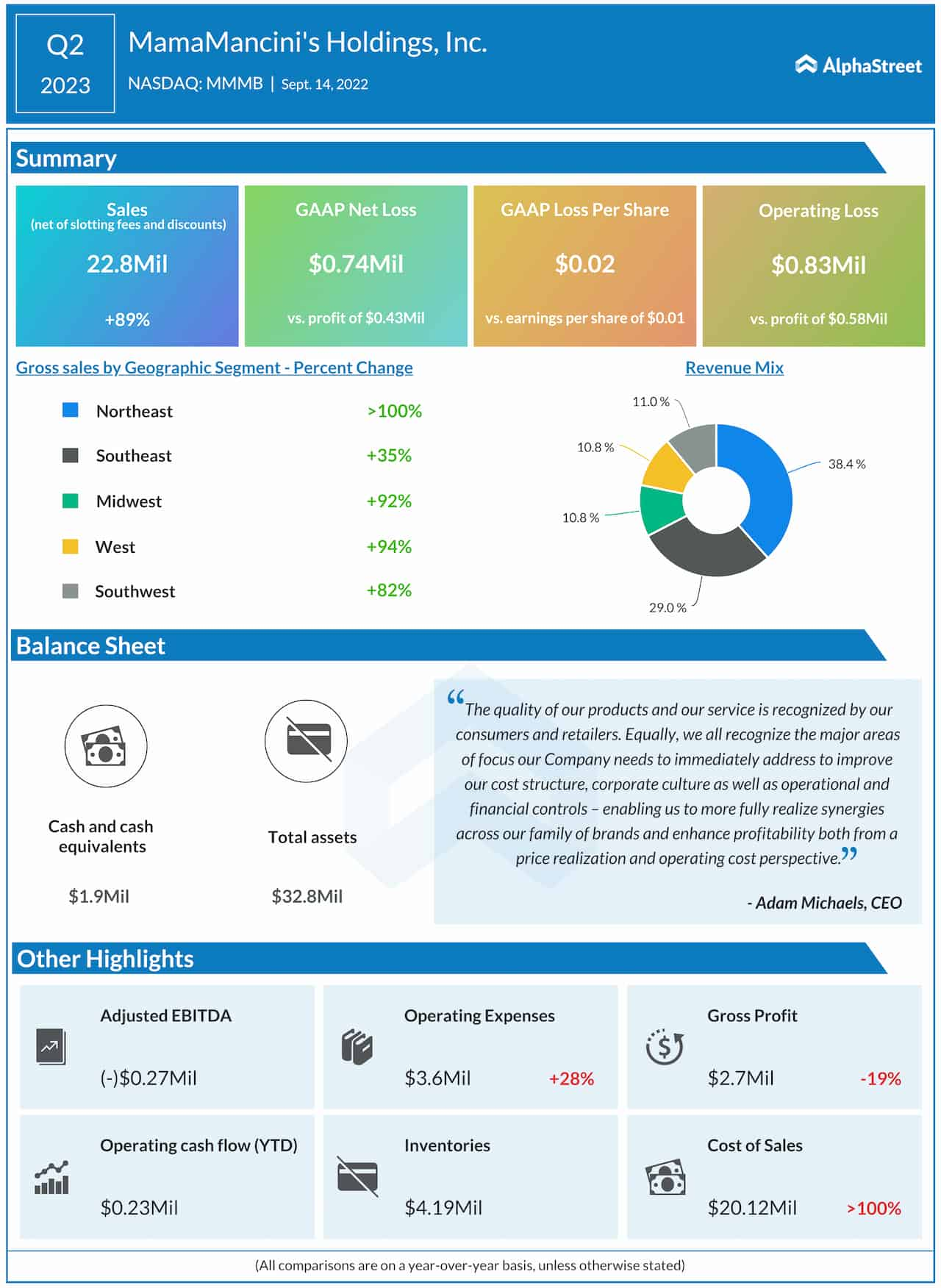

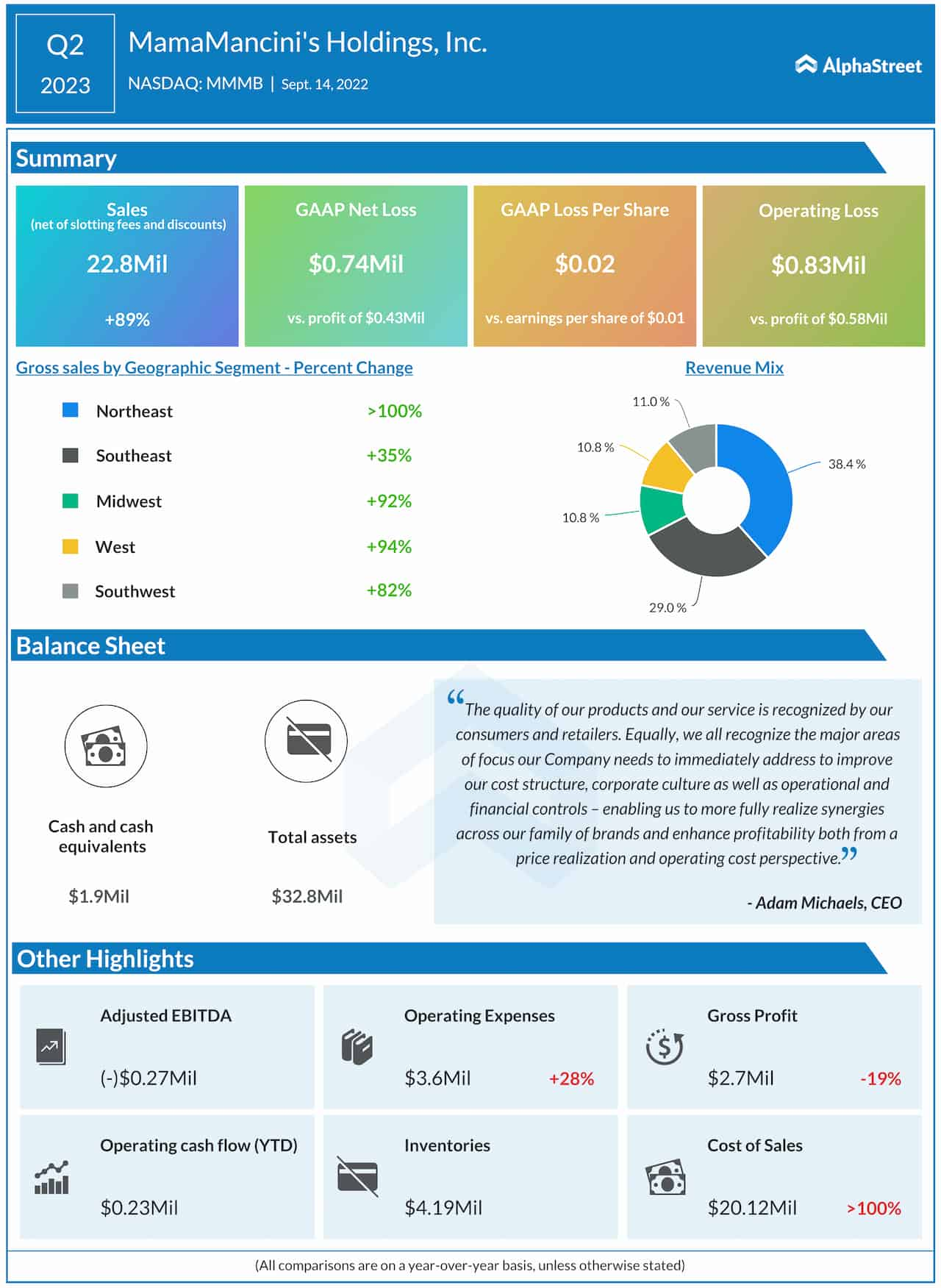

So, yes, we did see an increase in sales during the pandemic, from about $33M for the full year 2019 to nearly $25M last quarter alone inclusive of our recent acquisitions. And we expect the macro trends underpinning that growth to continue.

Can you provide insights into the performance of the food-service division since the 2020-launch?

Our traditional idea of food service faced significant restrictions over the last few years due to the pandemic and after a thorough evaluation, our food-service focus has shifted from university cafeterias (and comparable) to grocery store deli prepared foods sections (i.e. deli hot bars), an area where we have seen the most success and opportunity for growth through cross-selling. The way consumers dine is quickly changing and in my view, this is going to be the highest growth and most profitable food service opportunity for us.

For example, we started in Publix with our two retail pack SKUs in the fresh meat department. We then expanded to become the exclusive meatball provider for their top-selling meatball sub in the Deli department. After that, we expanded further into the hot bar and prepared foods section, to where we now have at least eight items in every store, including grab-n-go meatballs & sauce as well as half a dozen pasta bowl kits! That means we are shipping more products to the same distribution centers, reducing freight, and creating more in-store MamaMancini’s points of interaction for the consumer. As grocery stores continue to invest in their deli-prepared food sections, and as consumers continue to drive significant demand to that segment, we will continue to see success.

After a series of acquisitions, do you have more deals in the pipeline?

We truly believe that we can be a billion-dollar, one-stop-shop deli solutions provider for our retailers and ultimately our end consumers. That means that we want to have solutions for most, if not every, part of the Deli prepared foods section with our retailer partners.

We had a strong protein base brand with MamaMancini’s. A great Italian heritage, high quality, great tasting product. We are already creating great meatballs, meatloaves, grilled chicken, sausage & peppers along with complete prepared meals, such as Chicken Parmesan, Spaghetti Bolognese, Penne Vodka, and more.

Last year, we bought a company called T&L Creative Salads, which makes premium tuna and egg salads, grains such as couscous and pasta salads, flavored cream cheeses, grilled vegetables, etc. – so as you can see, we are ‘filling the deli case’ for our retailers and customers. You also see that Olive Bars are becoming very popular in delis, so we bought a company last year called Olive Branch, which is riding the wave and growing fast, selling olives and feta and peppers, etc. So as I hope you see, we continue to grow strategically, leveraging our great relationships with our existing (and new!) customers and leveraging our vertical supply chain.

Now, there are other sub-categories within the Deli that are also growing. Pizza, for instance, is growing strong. I would hope you would agree that Dan Mancini and his grandmother probably made some great-tasting pizza when Dan was growing up. Actually, if you check out his Instagram account, he recently posted a fresh pizza he made! That is something our consumers continue to tell us that MamaMancini’s has a right to grow into.

Equally, there are parts of the deli, that we might not have the supply chain or product level expertise. Sushi, for instance, is another big, growing part of the deli. We don’t have that expertise today. That could be something, in the longer term, we could possibly acquire. We will always be on the lookout! That said, we have tons of runway for growth with our proteins, salads, and prepared meals with significant potential for synergy realization to drive notable cost-savings at the public company level.

To what extent did your Beyond Meat tie-up help in expanding the product line?

Great question. While we no longer utilize Beyond Meat specifically for the base protein in our plant-based meatballs, it continues to be a nice bolt-on product to drive incremental shoppers to our brand who would not purchase our meat-based products otherwise. Just last month, we won “Best Plant Based Meatball” on QVC – so the product is where it needs to be from a flavor perspective. That being said, it’s not a “game changer” given it’s a more focused market, but still attractive in that it is a highly incremental shopper as I noted.

What is your strategy for achieving sustainable profitability?

So glad you asked! As you know, I just took over as CEO of MamaMancini’s. This is actually week five for me! And improvement in our gross margin profile is the #1 focus for me and the team right now. I feel very good about our near-term game plan.

First off, our prices historically did not keep up with food price inflation. Full stop! So, quite literally even before I started, we put in place a new pricing process and built new capabilities for the team. It starts with weekly (if not daily!) tracking of our input costs. Commodities, as I am sure you all know, have been volatile, to say the least. We need to fully understand our costs before we can properly, and fairly, share pricing. We are doing that! So now, all new products are priced to achieve our required margin threshold. If they don’t meet our margin threshold, a sale does not take place.

Also, we are reviewing all existing products being sold to customers and repricing them to achieve our required margins. Those customer meetings have been going well because they clearly see our prices have not been keeping up with inflation. So, we have already successfully received acceptances of many of these new prices and are waiting to hear back from others.

Second, we have to drive a higher level of operational efficiency and effectiveness. I have been incredibly lucky in that over the past 20 years, I have had great mentors and teachers in the fundamentals of the business. I started my career in Operations and Supply Chain. I was taught early about KPIs and how “what gets measured, gets improved”. We are on our way to reimagining our operations to drive more efficiency in our two manufacturing facilities. The same can be said for our Procurement and our Logistics efforts.

Galaxy Next Generation’s main focus in FY23 is accelerating revenue growth: CEO Gary LeCroy

A third and final area for achieving sustainable profitability is through our recent acquisitions. In my last role at Mondelez, I had the great fortune to help lead our M&A and Venture efforts. We acquired five businesses and helped manage two other acquisitions. I know how to balance the freedom & entrepreneurship of our acquisitions while capturing the supply chain, administrative and sales synergies of a larger, integrated business. I am most excited about the customer sales synergies we are already capturing by selling in new T&L Creative Salads and Olive Branch products to our existing MamaMancini’s customers. But I am equally excited to drive operational and quality best practices across the three businesses and drive efficiencies with our shared back-office administrative functions.

In summary, the focus is on margins. Not just to be sustainable, but the more margin realization we can have, that means the more trade and marketing promotion we can do – and the more product & packaging innovation we can do – and the more investment we can make in our R&D and Operations. Margin realization will create the flywheel for sustainable (and profitable!) growth for years to come.