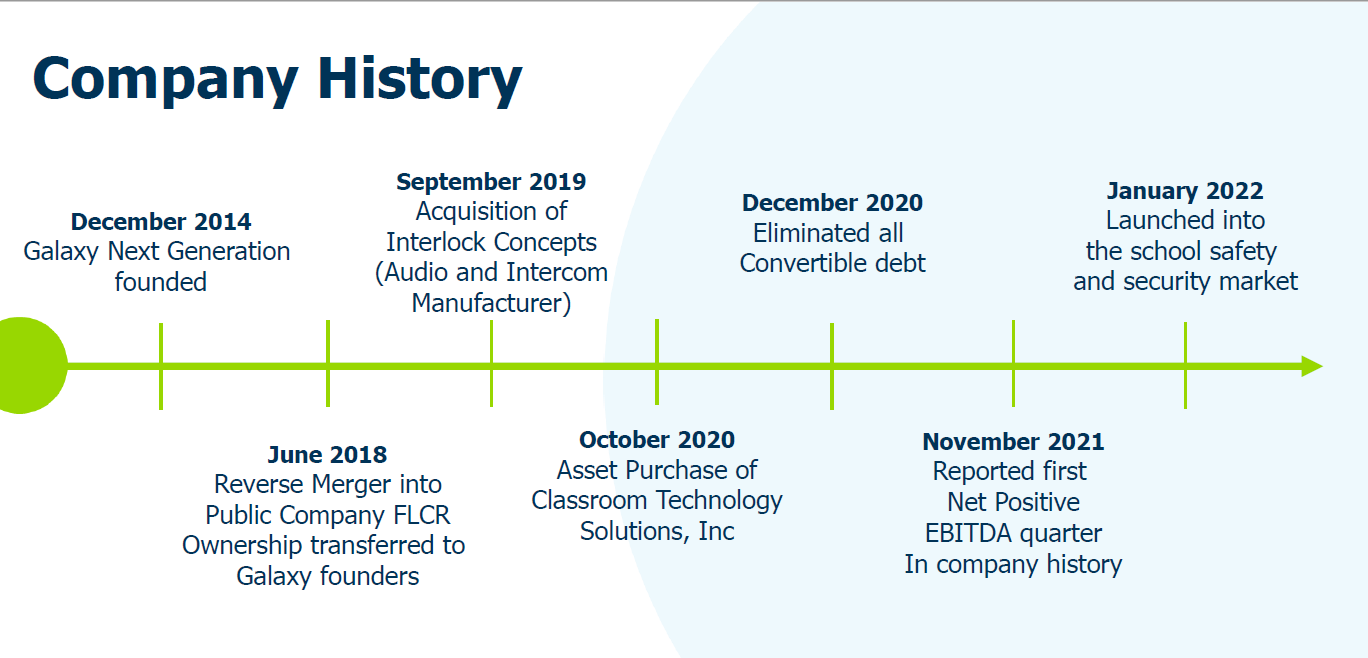

Galaxy Next Generation, Inc. (OTCQB: GAXY) is a leading provider of interactive learning technology solutions. The company’s hardware and software products are used for enhancing learning in classrooms and improving communication, safety, and security on campus. In an email interview with AlphaStreet, Galaxy’s CEO Gary LeCroy spoke about the company’s financial performance and future plans.

What differentiates Galaxy from other interactive learning services?

We believe our biggest differentiator is the way our full product offering integrates into one seamless system that supports student achievement while creating a safer learning environment. Our product offering ranges from interactive touch panels to classroom audio solutions, as well as full intercom and paging systems, and emergency communication tools.

All G2 products can be integrated into the whole G2 ecosystem. For example, our G2 Link Classroom audio system can be a stand-alone ‘voice lift’ system in the classroom, or used as the endpoint for G2 Communicator and act as the two-way communication in the classroom for our intercom solution. Following the same example, the teacher’s microphone can also be used as an emergency call button to initiate the need for a lockdown alert via G2 Secure.

This scalability and flexibility enable our education customers to adopt our products within their financial means and allow them to add products and scale out the full G2 ecosystem over time. Our open-source approach to product development has kept us able to quickly adapt to other technologies within the school environment as well so that we can truly integrate seamlessly into any classroom. This prevents distractions and allows the teacher to focus on fostering achievement amongst their students while giving them peace of mind in a safer learning environment.

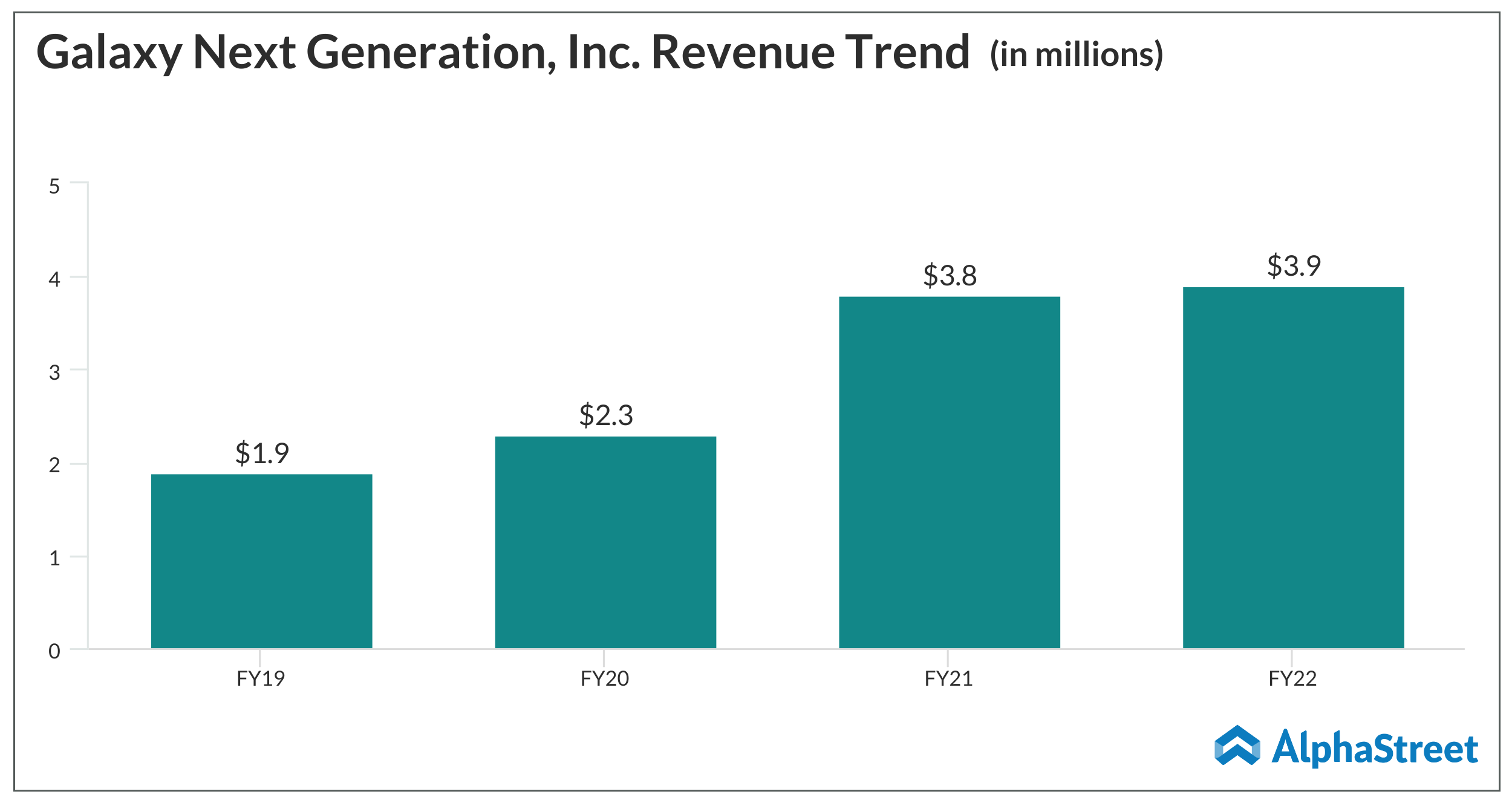

What is the primary factor behind the impressive FY22 results, and do you expect the trend to continue?

We have seen a successful start to our 2023 fiscal year and believe that this trend will continue. Fiscal 2022 was a transitional year for Galaxy, as our cash flow increased and our focus on servicing past debt obligations, including the elimination of high-interest convertible debt, enabled us to narrow our net operating loss from $24 million to just $6 million.

Trxade will focus more on core biz, and connect with POS systems: CEO Suren Ajjarapu

Our biggest focus moving into fiscal 2023 is accelerating our revenue growth to assist in mitigating the remaining operational overhang. With the launch of two new products in January of this year, we have seen an increase in interest from new and existing customers. We believe a combination of increased sales staff and efforts, coupled with the new product launches, positions our organization to achieve continued success and meet our top-line revenue goals.

While the outlook points to accelerated growth this year, how soon the company is expected to become consistently profitable?

We believe that achieving profitability on a consistent basis is within reach in the relatively near future. When we look internally at some of our non-GAAP adjusted EBITDA numbers, we see that quarterly revenue of just $1.5 million gets us to break even. We achieved a similar revenue number for several quarters over the last year, so coupled with some of the trends and focus mentioned above, achieving consistent quarterly revenues of $1.5 million to $2 million would allow us to reach profitability on a go-forward basis.

What is your strategy for long-term growth?

It’s really three-fold. First, we have and will continue to focus on building out our reseller channel. Just recently, we signed on with the second largest education reseller in the US to champion our products to their customers. More credible and well-known partners will help quickly turn Galaxy into a more well-known brand amongst schools nationwide, naturally increasing demand and revenue for us. Secondly, we will continue to execute on our robust product roadmap to ensure we stay ahead of market trends and bring new products and new features to market in a consistent manner. New products allow us to revisit our existing customer base and create reoccurring revenue opportunities.

Finally, we continue to focus our marketing and sales efforts towards our higher-margin products. By shifting our revenue mix away from the lower margin interactive flat panels toward our new products such as G2 Link, G2 Secure, and Communicator, we expect an increase in our profit margins from ~25-35% to ~65-85%. In summary, increased top-line revenue, coupled with increased profit margins, position us for long-term growth in terms of financial performance and market share within the industry.

What kind of effect did the pandemic have on Galaxy, and where is the business headed post-COVID?

Like many businesses, we did see some interruptions from COVID’s impact on the economy. We are still experiencing delays in our product supply chain due to component shortages and freight issues, but we have started to see indications of some normalcy coming back.

Having said that, we have remained agile and positioned Galaxy for continued growth through the post-COVID environment. For example, the stimulus packages that were awarded to schools through 2020 and 2021 have provided them with years of increased budgets for us to pursue. Schools will likely have increased funding through the 2024-2025 school year and we have definitely seen increased spending across the industry. Additionally, COVID uncovered many shortfalls in educational technology landscapes within classrooms as it was very difficult for some to pivot quickly to an online or hybrid learning environment.

Having multiple recurring revenue streams is a winning strategy for LiveToBeHappy: CEO Kevin Cox

Our products are exactly what schools need to make sure they are equipped with the resources needed for all learning – whether in class, at home, or in combination. We have been and will continue to market directly to these new funding resources when working with potential new customers. While we continue to navigate some of the lingering effects on our logistics, Galaxy has emerged as a stronger company in the post-COVID world. We are focused on executing our operating strategy to generate value for all our stakeholders, including our employees, customers, shareholders, and ultimately the students and educators that stand to benefit from our product suite.