Sales

The company saw net sales and comparable sales decline across its Macy’s and Bloomingdale’s nameplates in Q3. The Bluemercury nameplate alone recorded a 2.5% growth in both net and comparable sales. The beauty category was the top performer across all nameplates during the quarter. Looking to the holiday season, Macy’s believes its customer across nameplate is likely to be under pressure and remain cautious in spending on discretionary categories.

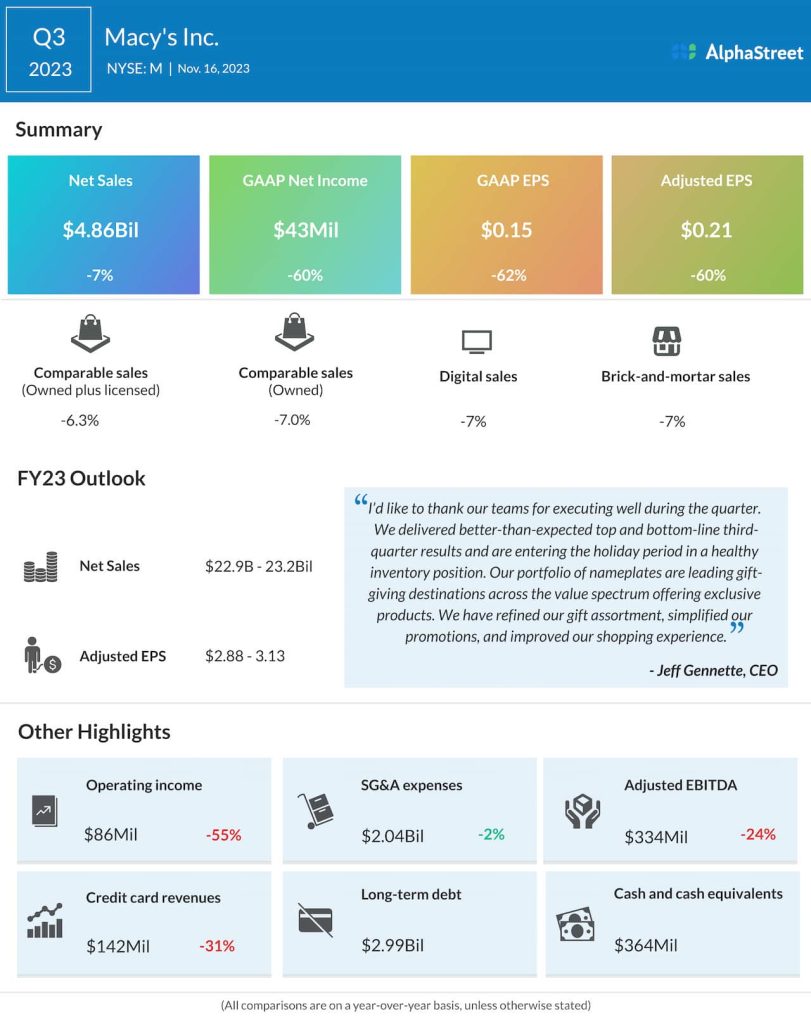

For the fourth quarter of 2023, net sales are expected to range between $7.95-8.25 billion. Macy’s updated its sales guidance for the full year of 2023 to a range of $22.9-23.2 billion from the previous range of $22.8-23.2 billion.

Profits and margins

Macy’s delivered adjusted EPS of $0.21 in Q3 2023, which was down 60% year-over-year. For Q4 2023, the company expects adjusted EPS of $1.85-2.10. For FY2023, it now expects adjusted EPS to be $2.88-3.13 versus the prior outlook of $2.70-3.20.

Gross margin rose to 40.3% in Q3 2023 from 38.7% in the year-ago period. Merchandise margins improved 110 basis points due to lower markdowns and improved freight expense. Macy’s expects the gross margin rate for Q4 2023 to be at least 220 basis points better than the prior-year quarter, when the company had to undertake higher markdowns and promotions to deal with increased competition.