Preliminary Q3 results

The company saw sales growth at its Macy’s nameplate First 50 locations and its Bloomingdale’s and Bluemercury nameplates but this was offset by weakness in Macy’s other non-First 50 locations as well as its digital channel and cold weather categories. The retailer also said it was making progress on its Bold New Chapter strategy initiatives.

Results by nameplate

Sales for the Macy’s nameplate were down 3.1%, with comparable sales down 3% on an owned basis and down 2.2% on an owned-plus-licensed-plus-marketplace basis. Comparable sales for its go-forward business were down 2.6% on an owned basis and down 1.8% on an owned-plus-licensed-plus-marketplace basis.

Comparable sales for Macy’s First 50 locations were up 1.9% on both an owned and owned-plus-licensed basis, marking their third consecutive quarter of comp growth. This division benefited from strength in the fragrances, dresses, and men’s and women’s active apparel categories.

Net sales for Bloomingdale’s were up 1.4%, with comparable sales up 1% on an owned basis and up 3.2% on an owned-plus-licensed-plus-marketplace basis. The growth was driven by strength in contemporary apparel, beauty and digital. Net sales for Bluemercury were up 3.2% and comparable sales were up 3.3% on an owned basis, marking its fifteenth consecutive quarter of comp sales growth.

Macy’s stated that its November comparable sales were trending ahead of third quarter levels across nameplates.

Other metrics

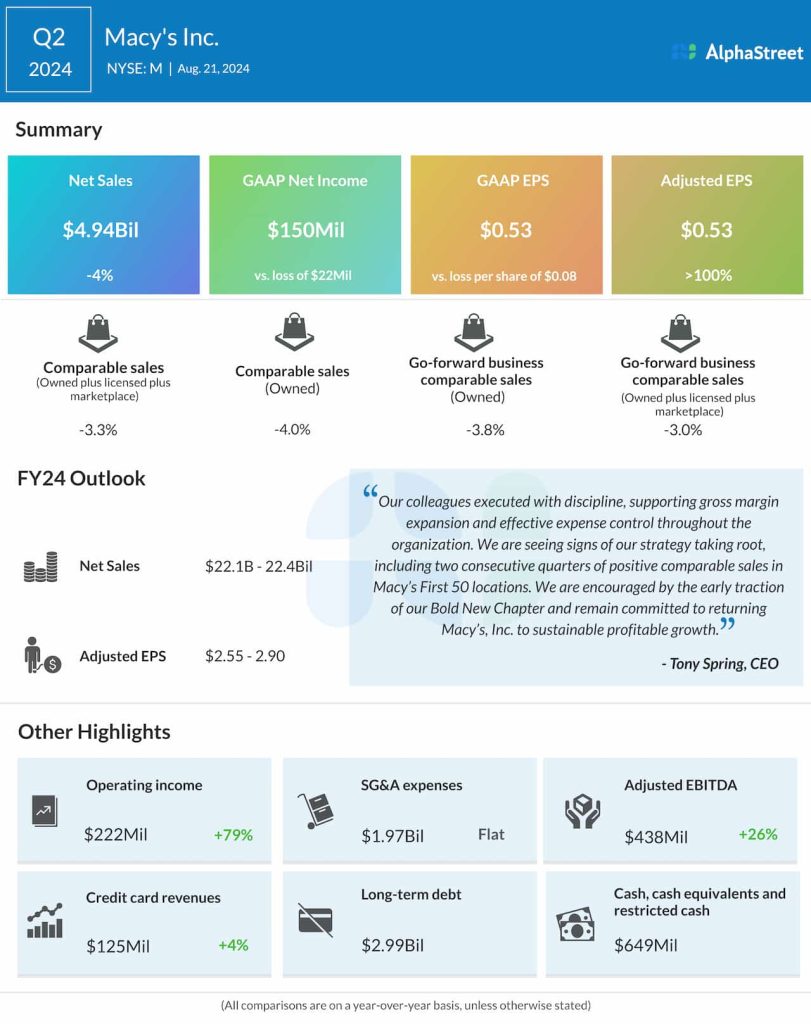

Macy’s Other revenue totaled $161 million, down 9.6% year-over-year. Credit card revenues fell 15.5% to $120 million. Macy’s Media Network revenue rose 13.9% to $41 million. Asset sale gains totaled $66 million. The company ended the third quarter with cash and cash equivalents of $315 million and total debt of $2.86 billion.