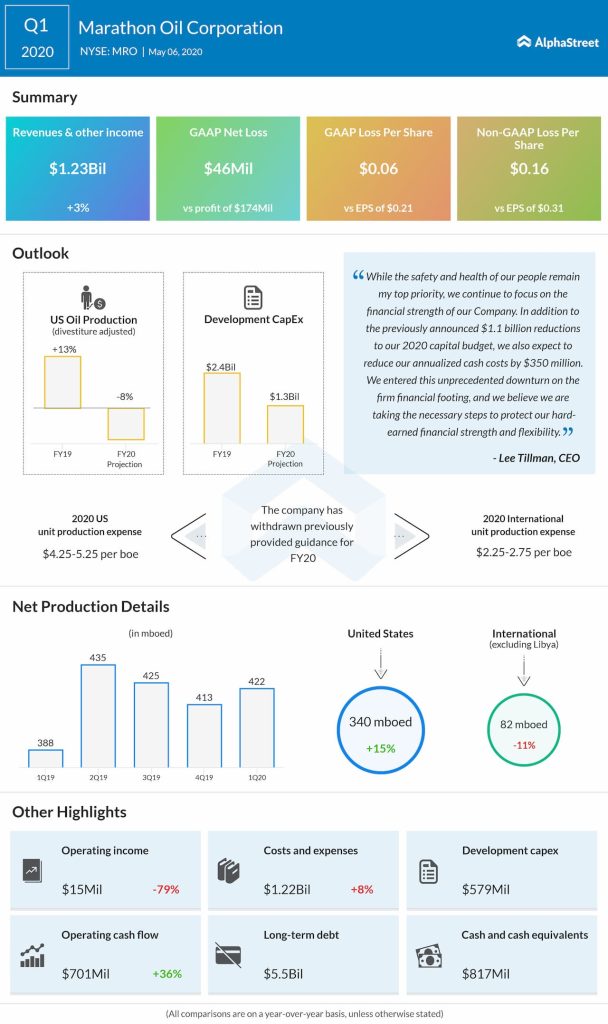

At the revised capital spending budget of $1.3 billion or less, for full-year 2020, the company now expects its underlying US crude oil production to decline by about 8% on a divestiture-adjusted basis, with a similar percentage decline expected for boe production. Underlying International oil production is expected to decline by about 7% on a divestiture-adjusted basis, with a similar percentage decline expected for boe production.

Marathon Oil now expects that Q2 US crude oil and boe production to be down sequentially due to curtailments along with natural decline from reduced activity. Consistent with a focus to continually reduce its cost structure, Marathon Oil expects to capture annualized cash cost reductions of about $350 million relative to its initial 2020 budget.