US futures are pointing to a lower open today after ending higher on Tuesday, on fresh trade war concerns. China announced brand-new tariffs on 106 American products including aircraft, beef, soybean, cars, defense, whiskey, chemicals, etc. This comes after President Donald Trump intending to impose about $50 billion of tariffs on Chinese products.

The S&P futures fell 1.41% to 2,576.50, Dow futures plunged 1.87% to 23,535, and Nasdaq dropped 1.65% to 6,362.75. Elsewhere, shares at Asian markets closed lower on Tuesday, and European stocks are trading lower.

On the European economic front, data from the Statistics Poland showed that Poland’s consumer price inflation slowed to 1.3% in March from 1.4% in February. Eurostat data revealed that euro-area jobless rate tumbled to 8.5% in February from 8.6% in January. Another Eurostat data showed that Eurozone inflation accelerated to 1.4% in March from 1.1% in February.

Istat data revealed that Italy’s unemployment rate fell to 10.9% in February from 11.1% in January. IHS Markit data showed that construction activity in the United Kingdom fell to 47 in March from 51.4 in February, due to unusually bad weather conditions. IHS Markit data revealed that Russia’s services purchasing managers’ index dropped to 53.7 in March from 56.5 in February.

On the Asian economic front, data from the ANZ bank and Roy Morgan Research showed that consumer confidence in Australia dropped 1.6% to 115.5 in the week ended April 1 from 117.4 last week. Caixin data revealed that China’s services PMI fell to 52.3 in March from 54.2 in February. The Australian Bureau of Statistics data showed that retail sales value in Australia increased 0.6% on month in February after rising 0.1% in January. Nikkei survey revealed that Japan’s services PMI tumbled to 50.9 in March from 51.7 in February. Another Nikkei data showed that Singapore’s private sector dropped to 53.7 in March from 55.3 in February.

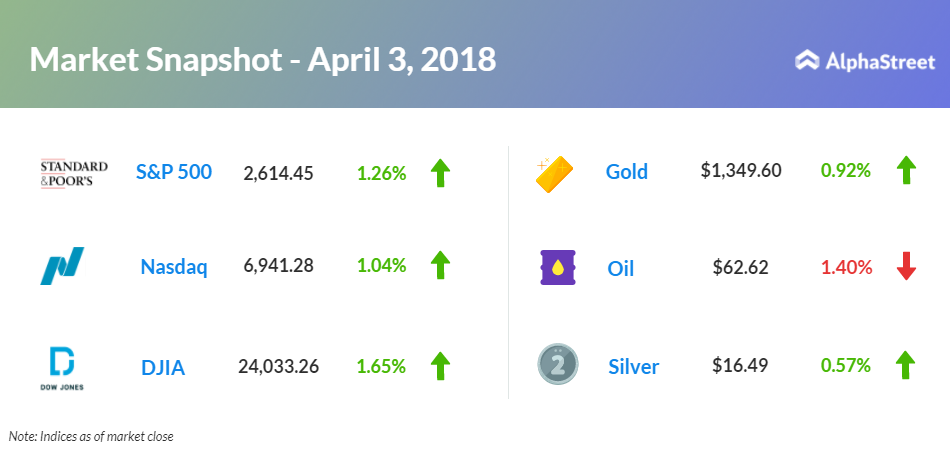

On April 3, US ended higher, with Dow up 1.65% to 24,033.36. Nasdaq rose 1.04% to 6,941.28, and S&P 500 advanced 1.26% to 2,614.45. Traders had taken advantage of the selloff on Tuesday due to potential trade war concerns. Technology stocks also contributed to the rebound in markets.

Meanwhile, key economic events scheduled for today include the Automatic Data Processing national employment report, U.S. services purchasing managers’ index, factory orders, the Institute for Supply Management’s non-manufacturing index, and Energy Information Administration’s petroleum status report. St. Louis Federal Reserve Bank President James Bullard and Cleveland Federal Reserve Bank President Loretta Mester will deliver speeches today.

On the corporate front, Endo International (ENDP) stock slid 3.32% in premarket after brokerage firm Mizuho downgraded the shares to neutral from buy. SS&C Technologies Holdings (SSNC) stock fell 3.98% in premarket after the pricing of 26.315 million common stock offering at $47.50 a share. Dave & Buster’s Entertainment (PLAY) stock tumbled 7.84% in premarket after fourth-quarter sales missed consensus. RMG Networks Holding (RMGN) stock dropped 11.72% in premarket after it agreed to be acquired by SCG Digital for $1.27 per share.

Dave & Buster’s Entertainment (PLAY) stock tumbled 7.84% in premarket after fourth-quarter sales missed consensus.

On the earnings front, the companies that will be reporting earnings include Lennar Corp. (LEN), CarMax (KMX), Acuity Brands (AYI), Resources Connection (RECN), and Ollie’s Bargain Outlet Holdings (OLLI).

Crude oil futures are down 1.40% to $62.62. Gold is trading up 0.92% to $1,349.60, and silver is up 0.57% to $16.49. On the currency front, the US dollar is trading down 0.37% at 106.233 yen. Against the euro, the dollar is up 0.04% to $1.2273. Against the pound, the dollar is down 0.28% to $1.402.