Over the years, Shopify Inc. (NYSE: SHOP) has steadily expanded its footprint in the online retail market through constant innovation, like the recent launch of a mobile POS device for in-person sales. The e-commerce infrastructure company is betting on its B2B platform and international expansion to drive long-term growth.

After experiencing a significant selloff during the COVID era, Shopify’s stock is yet to recover fully, although it has regained some momentum in the past year. In the early days of the pandemic, SHOP spiked and hit all-time highs as the businesses thrived on the online shopping boom, before retreating to the pre-crisis levels later. The stock has gained an impressive 21% in the past six months.

Shopify is scheduled to unveil its first-quarter numbers on Wednesday, May 8, at 7:00 a.m. ET. The consensus earnings estimate by Wall Street analysts is $0.17 per share, on an adjusted basis, which is sharply higher than the $0.01/share the company earned a year earlier. Revenue is expected to have grown about 29% to $1.84 billion in the March quarter. The management calls for revenue growth in a low-twenties percentage rate on a year-over-year basis for Q1.

Road Ahead

While the company’s positive cash flows show it is headed for a strong 2024, the continuing pressure on profitability remains a concern. The Shopify platform is used by millions of small businesses to bring their products to customers, and it is estimated that the company accounts for about 10% of all e-commerce transactions in the U.S.

“We launched our suite of AI-powered tools known as Shopify Magic, an AI shopping assistant on our Shop App, and further embedded AI tools within Shopify to increase productivity and streamline administrative tasks that have saved our merchants and our team thousands of hours of work, enabling us to ship faster and make great decisions quicker. What we have known from day one at Shopify is that when our merchants are more successful, Shopify is more successful. Revenue hit $7.1 billion, up 26% year over year with Q4 surpassing $2 billion in a single quarter for the first time ever,” Shopify’s president Harley Finkelstein said at the Q4 earnings call.

Strong 2023

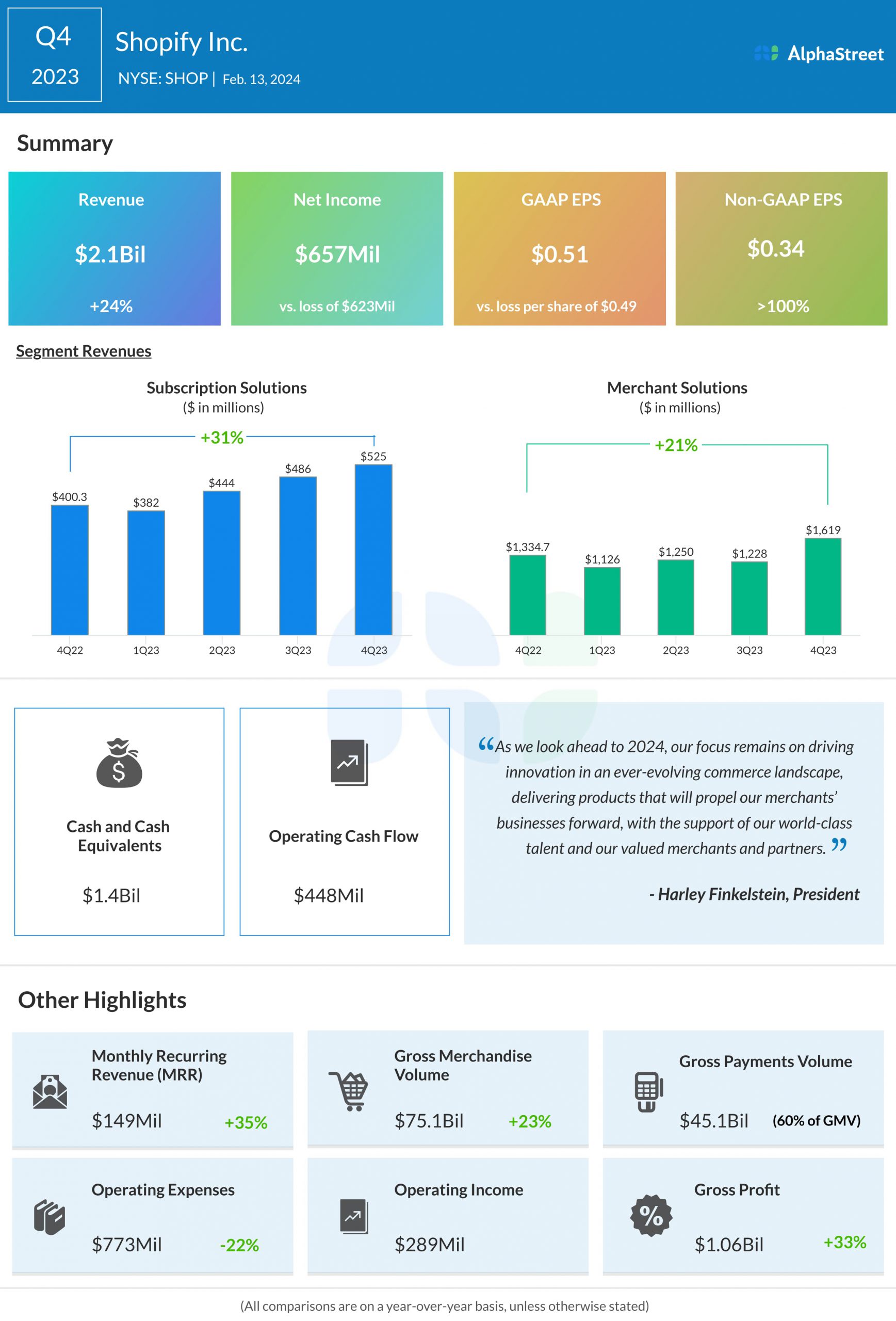

In the final three months of fiscal 2023, Shopify’s revenue increased 24% to $2.1 billion and exceeded analysts’ forecast, marking the sixth beat in a row. At $75.1 billion, gross merchandise volume was up 23% in Q4. Fourth-quarter net income was $657 million or $0.51 per share, an improvement from the year-ago period when the company incurred a loss of $623 million or $0.49 per share. On an adjusted basis, net income was $0.34 per share. The bottom line beat estimates for the seventh consecutive quarter.

This week, shares of Shopify stayed close to where they were at the beginning of the year. The stock traded higher during Wednesday’s session, after opening slightly above $70.