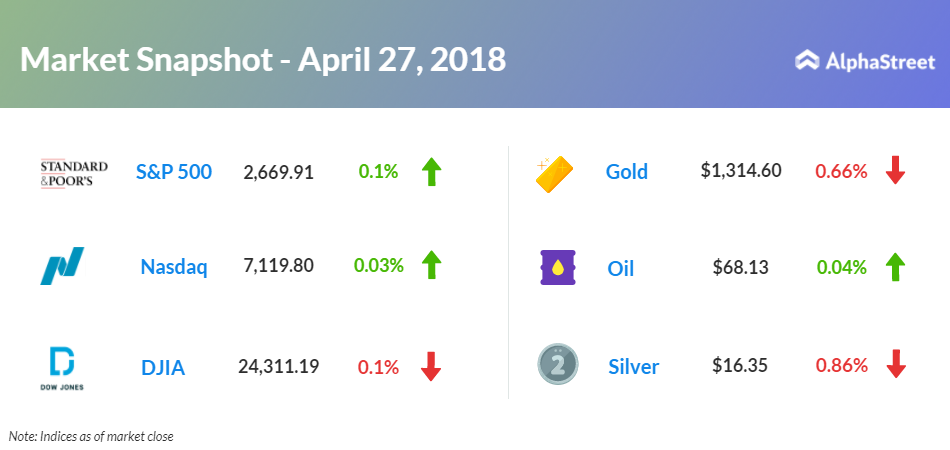

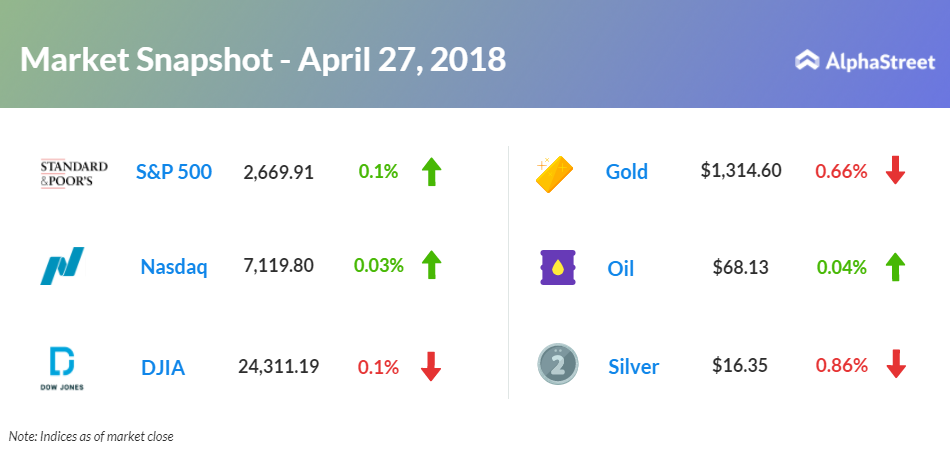

On April 27, US ended mixed, with Dow down 0.1% to 24,311.19. Nasdaq improved less than a tenth of a percent to 7,119.80, and the S&P 500 gained 0.1% to 2,669.91.

On the economic front, investors remained positive after the Commerce Department’s personal income report that rose in March. Personal income rose 0.3% in March, unchanged from the revised number in February.

Another Commerce Department report stated that personal spending rose 0.4% in March, after remaining unchanged in the previous month. An MNI Indicators report showed that Chicago-area business activity rose to 57.9 in April from 57.4 in March.

A National Association of Realtors report revealed that pending home sales moved up 0.4% to 107.6 in March from a downwardly revised 107.2 in February. PCE inflation, the Fed’s preferred inflation gauge, rose to 2% on year in March from a 1.7% pace in February, and Core PCE inflation climbed to 1.9%.

McDonald’s Corp. (MCD) stock grew 4.90% after better-than-expected first-quarter results.

On the earnings front, Allergan plc (AGN) stock fell 1.74% after guiding loss for the second-quarter. McDonald’s Corp. (MCD) stock grew 4.90% after better-than-expected first-quarter results. Loews Corp. (L) stock rose 1.41% after first-quarter earnings topped analysts’ expectations. Cooper Tire & Rubber (CTB) stock plunged 13.70% after disappointing first-quarter results. Diamond Offshore Drilling (DO) moved down 0.81% after a dip in first-quarter revenue. AK Steel Holding Corp. (AKS) stock fell 6.11% after a decline in first-quarter earnings.

Earnings to be published today after market include: Cognex Corp. (CGNX), Regency Centers Corp. (REG), NutriSystem Inc. (NTRI), Integrated Device Technology (IDTI), SBA Communications (SBAC), PerkinElmer (PKI), Akamai Technologies (AKAM), Neurocrine Biosciences (NBIX), Vornado Realty Trust (VNO), J&J Snack Foods (JJSF), Quaker Chemical (KWR), and Transocean (RIG).

Crude oil future is up 0.04% to $68.13. Gold is trading down 0.66% to $1,314.60, and silver is down 0.86% to $16.35. On the currency front, the US dollar is trading up 0.36% at 109.426 yen. Against the euro, the dollar is down 0.37% to $1.2079. Against the pound, the dollar is down 0.02% to $1.3772.