The burger giant McDonald’s Corp. (MCD) reported better-than-expected first-quarter results, helped by an increase in sales-driven franchised margin dollars and the benefit from a lower effective tax rate. Shares of the fast food titan rose 4.23% in the premarket session.

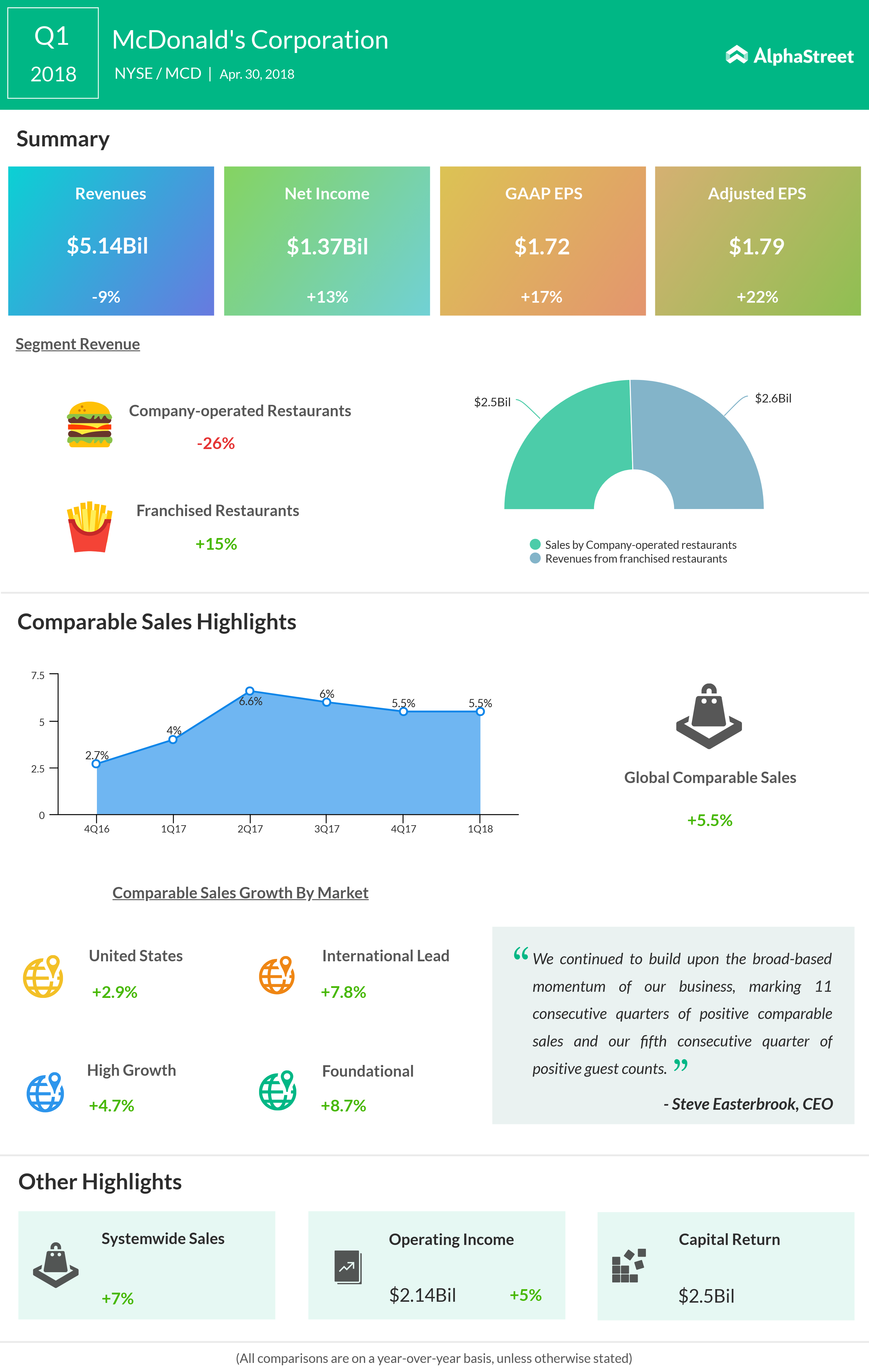

Despite revenue declining by 9% to $5.14 billion, the global foodservice retailer’s earnings rose by 13% to $1.38 billion, and EPS grew by 17% to $1.72. Excluding additional income tax expense associated with adjustments to the provisional amounts under the tax act, EPS increased 22% to $1.79. Foreign currency translation had a positive impact of $0.07 on diluted EPS.

Revenue was hurt by the impact of the company’s strategic re-franchising initiative. The decline largely reflects the sale of company-owned restaurants to franchisees. Systemwide sales increased 7% in constant currencies. Global comparable sales increased 5.5%, and global comparable guest counts rose 0.8%.

In the U.S., comparable sales rose 2.9% driven by growth in average check resulting from menu price increases and product mix shifts. Operating income increased 5% helped by higher franchised margin dollars and higher gains on sales of restaurant businesses.

Comparable sales for the International Lead segment grew 7.8% driven by positive results across all markets, primarily driven by the U.K. and Germany. In the High Growth segment, comparable sales rose 4.7%, led by strong performance in China and Italy and positive results across most of the segment. In the Foundational markets, comparable sales increased 8.7%, reflecting positive sales performance across all geographic regions.

Since 2015, McDonald’s chief Steve Easterbrook had a turnaround plan that included restructuring business segments, lowering expenses and re-franchising a large number of its corporate-owned stores. During fourth-quarter, the company intends to invest about $2.4 billion of capital, mostly on existing locations in the US.