Match Group (NASDAQ: MTCH), the owner of Tinder, Match, PlentyOfFish, Meetic, OkCupid, OurTime, Pairs, and Hinge brands, is set to report its first quarter 2019 results on Tuesday, May 8, after the market closes. Despite growing competition from Facebook (FB) and Bumble, market watchers expect the growth in the average subscriber count to continue for Match Group and its leading brand Tinder. Match Group stock ended up 2.48% at $61.91 when market closed on Friday.

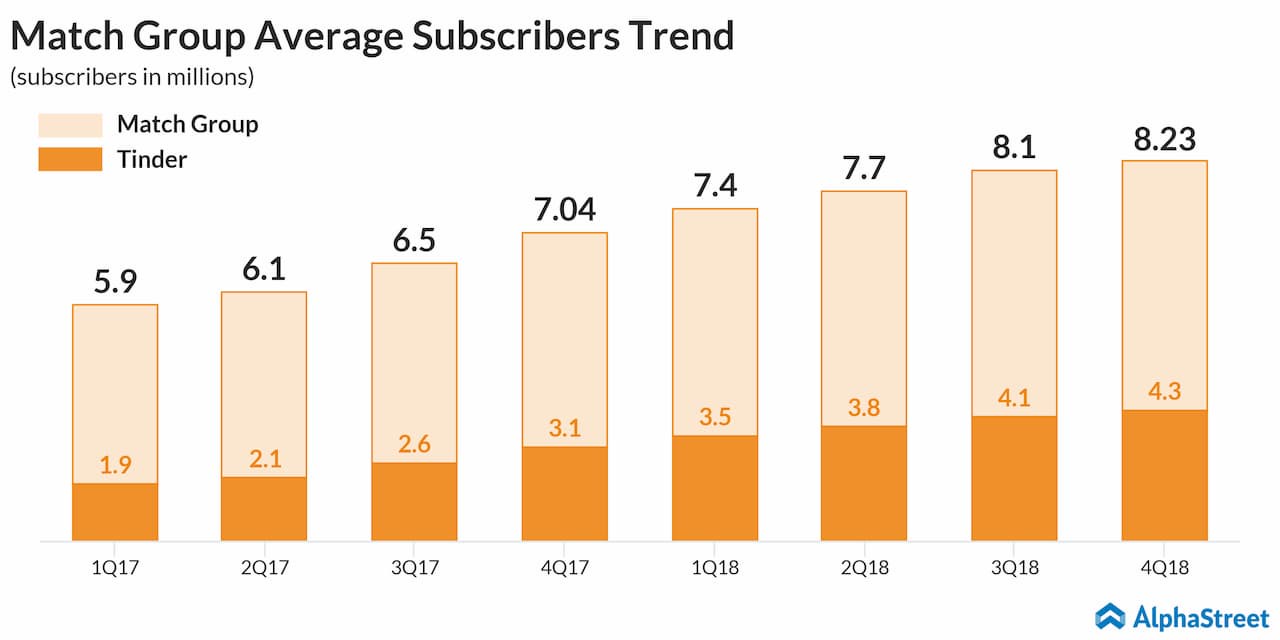

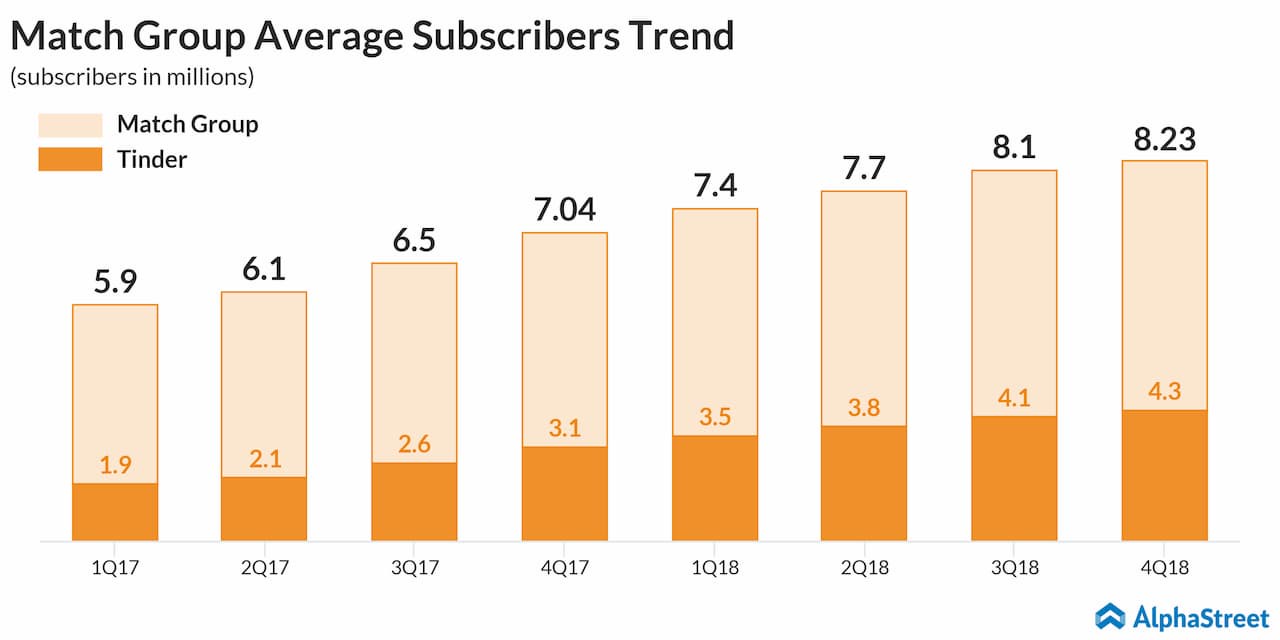

On average, the analysts expect Match Group to post earnings of $0.32 per share on revenue of $463.74 million for the first three months of 2019. This compares to earnings of $0.26 per share on revenue of $407.4 million in the first quarter of 2018. Tinder average subscribers were 3.5 million and Match Group had 7.4 million average subscribers in the year-ago quarter.

For the fourth quarter 2018, the online dating company posted GAAP EPS of $0.39 on revenue of $457 million. Revenue growth of 21% was driven by 17% average subscriber growth and 4% ARPU growth. Average subscribers grew to 8.2 million from 7.0 million in the fourth quarter of 2017. Tinder average subscriber base grew 1.2 million year-over-year to 4.3 million.

The Dallas, Texas-based company has got significant opportunity in North America and Europe as well as in other international regions also. In North America and Europe, more than half of singles have never tried dating products.

Match Group has got a massive opportunity in APAC, Africa, Middle East and LatAm regions with approximately 75% of global singles. It’s worth noting that two-thirds of singles in the above regions have never tried dating products.

On April 29, Match’s peer Momo (MOMO) got battered as Tantan, a similar app like Tinder, was banned by the Chinese government. Momo said in a statement that it will work with the authorities to restore the app. Momo stock has dropped 8% in the last one month.

For the year ended December 2018, Tinder’s revenue doubled year-over-year to $805 million. According to app intelligence firm Sensor Tower, Tinder beat Netflix (NFLX) in 1Q19 and became the world’s top grossing mobile app for the first time in more than two years. With 30 billion total matches and 2 billion views per day, Tinder app has been used in 190 countries worldwide. Investors expect Tinder to fuel the growth for its parent Match.

Match stock, which reached its 52-week high ($63.12) on April 24, had gained 45% since the beginning of 2019 and 79% in the last 52 weeks period.