Worldwide gross billings for Dolls were down 11% YoY, mainly due to declines in Barbie. Gross billings for Infant, Toddler, and Preschool were down 25%, due to declines in Fisher-Price, Preschool Entertainment, and Baby Gear & Power Wheels.

Gross billings for Vehicles were $626 million, up 8%, driven primarily by growth in Hot Wheels. Gross billings for Action Figures, Building Sets, Games, and Other were up 11%, primarily driven by growth in Action Figures, partly offset by a decline in Building Sets.

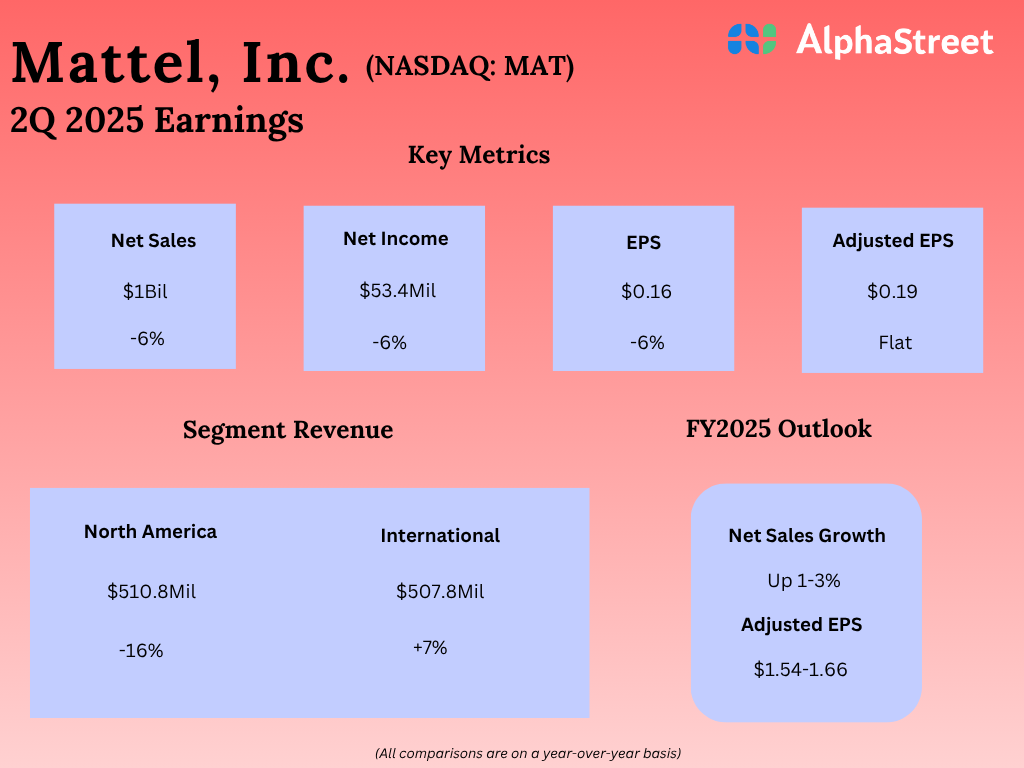

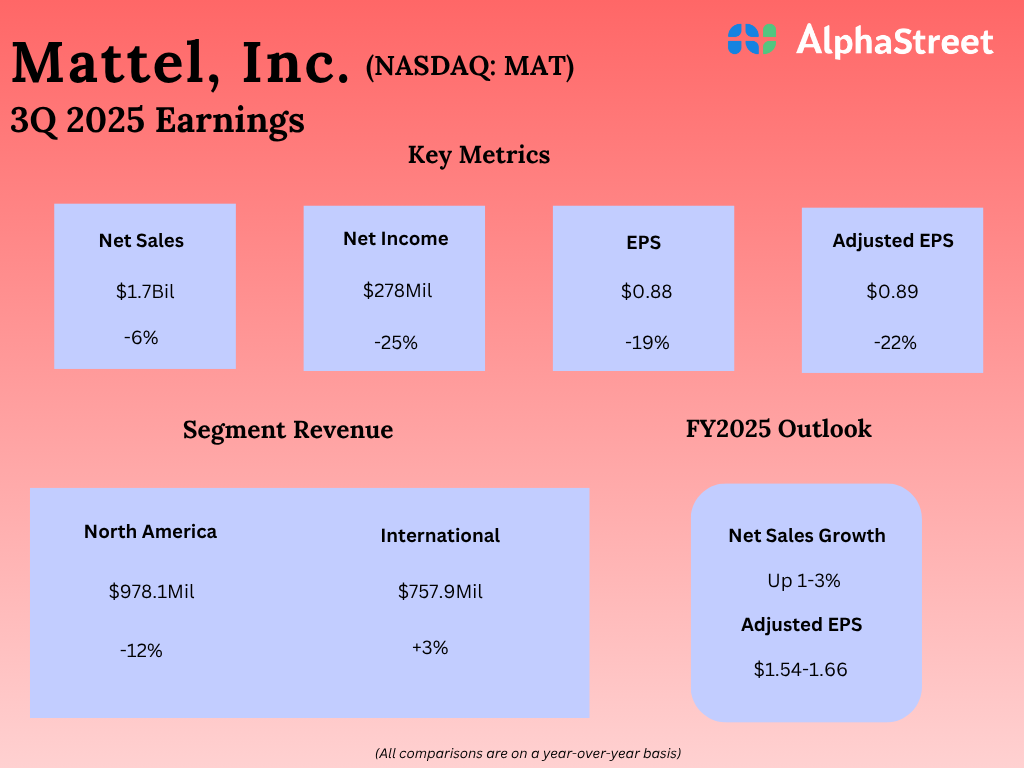

For the full year of 2025, the company expects net sales growth of 1-3% and adjusted EPS of $1.54-1.66.

Prior performance