Overview of Q4 2025 Results

Segment Performance

Earnings Quality and Outlook

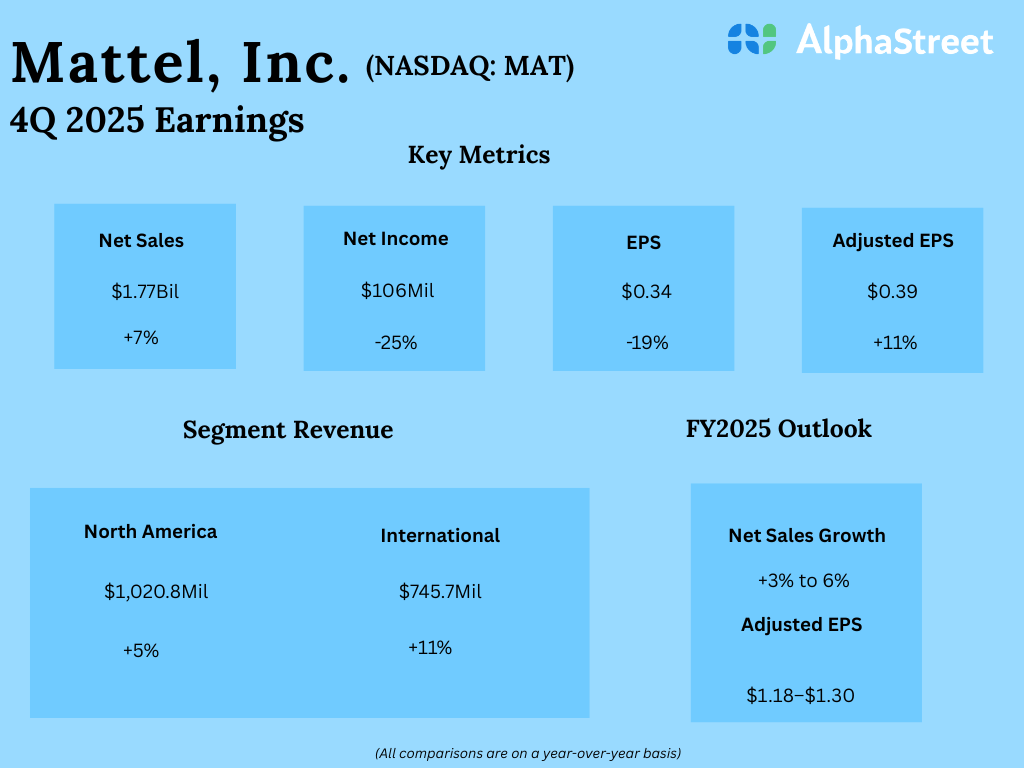

The divergence between revenue growth and declining net income underscores cost or margin pressures during the quarter. While reported EPS fell to $0.34, the increase in adjusted EPS to $0.39 indicates improved performance on an adjusted basis. For FY2025, management projects net sales growth of 3% to 6% and adjusted EPS in a range of $1.18–$1.30. Overall, the data portray a company achieving revenue expansion across regions but navigating earnings volatility. Sustained sales momentum, particularly internationally, may support future stability, though recent declines in net income and reported EPS highlight the importance of operational discipline.

This balanced performance profile reflects the complexity of the current operating environment. Top-line gains of 7% demonstrate underlying demand, yet the 25% decline in net income signals that profitability did not keep pace. The contrast between a 19% drop in reported EPS and an 11% rise in adjusted EPS further emphasizes the role of adjustments in shaping headline earnings trends. Investors reviewing these metrics are presented with a mixed but clearly defined financial picture entering FY2025. Overall financial health remains cautiously constructive. Yet vigilant.