The company’s stock is currently trading close to its recent peak, after experiencing high volatility early this year. Despite the rally, the shares look rightly priced and they enjoy a bullish rating. Experts overwhelmingly recommend buying MDT, projecting double-digit growth for the year. Also, the company has raised its dividend regularly for more than four decades, maintaining its dividend-aristocrat status.

The Virus Effect

The top-line has been hit by the virus-induced slowdown, especially due to the deferment of elective surgeries as hospitals channelized their resources for COVID care. While the situation has improved since early last year, demand remains below the pre-COVID levels.

Once the market returns to normalcy, earnings and revenue would strongly bounce back, boosting shareholder returns. The extensive product portfolio and growing market share could come in handy for the execution of the new growth strategy. Though the focus remains on organic growth, the management also plans to pursue strategic acquisitions.

Earnings Dip

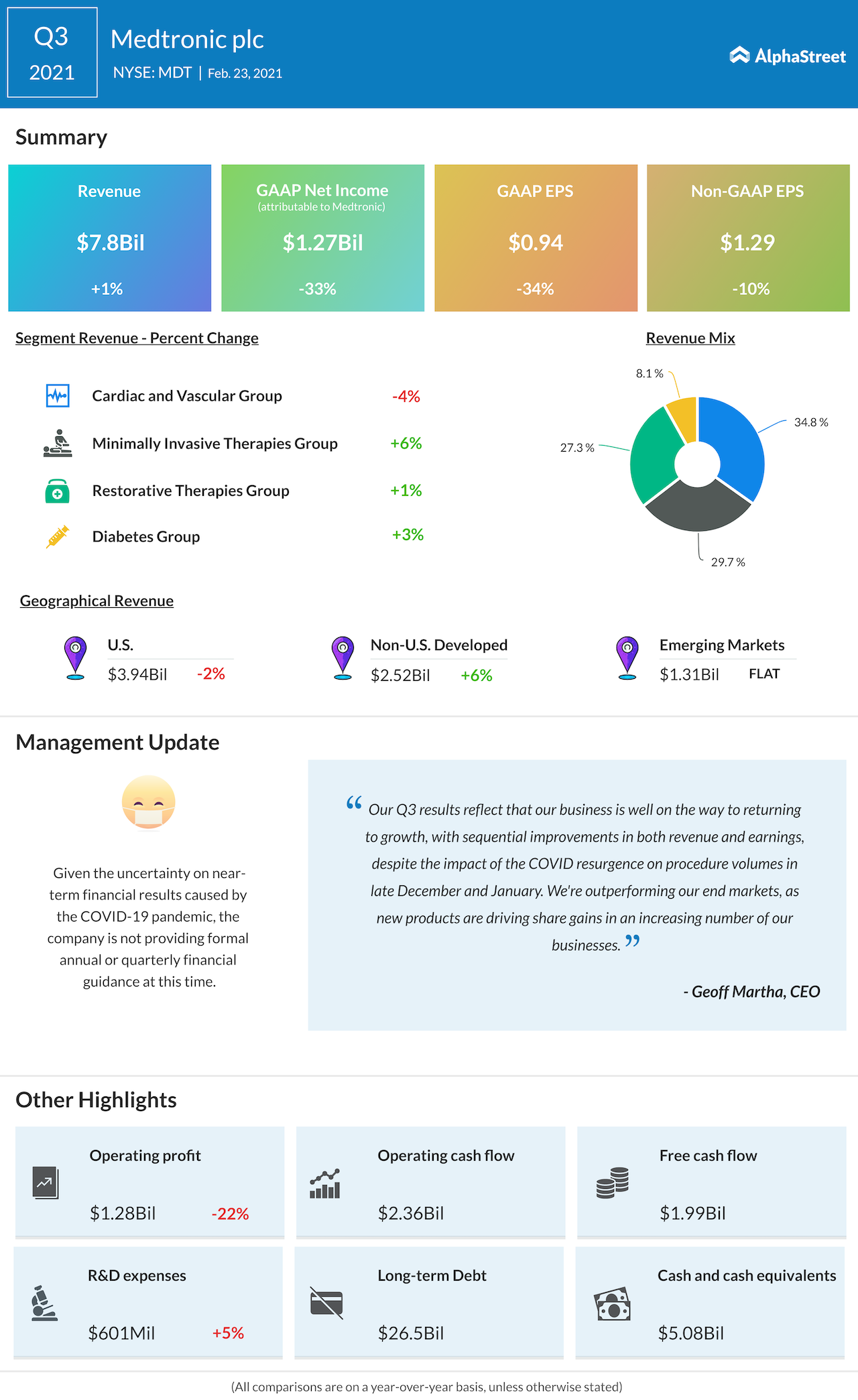

In the third quarter of 2021, earnings dropped 10% annually to $1.29 per share, mainly reflecting continued weakness in the Cardiac and Vascular Group, the main operating segment. That was offset by growth in the other divisions, resulting in a 1% increase in total revenues to $7.8 billion. Earnings came in above the market’s prediction as they did in the previous two quarters.

New Model

Currently, the company is busy preparing for long-term growth, leveraging the revised operating model that stresses decentralization. It will help streamline the product line and sales, thereby enhancing operational efficiency.

“We feel that the momentum we have is going to build over the coming quarters, driven, not just by the COVID recovery, but by the strong new product flow that we expect to bring to the market. And we’re supplementing this pipeline with an increasing cadence of tuck-in M&A. We’ve also implemented our new operating model, and we’re enhancing our culture, with a sharpened competitive focus. Through the actions we’ve taken over the past year, we’re emerging from this pandemic as a stronger Medtronic,” said Medtronic’s chief executive officer Geoffrey Martha during his interaction with analysts at the post-earnings conference call.

Read management/analysts’ comments on Medtronic’s Q3 earnings

Medtronic’s stock entered 2021 on a high note and reached a record high earlier this month. It has gained 18% in the past twelve months. The shares traded higher early Wednesday, after closing the last session higher.