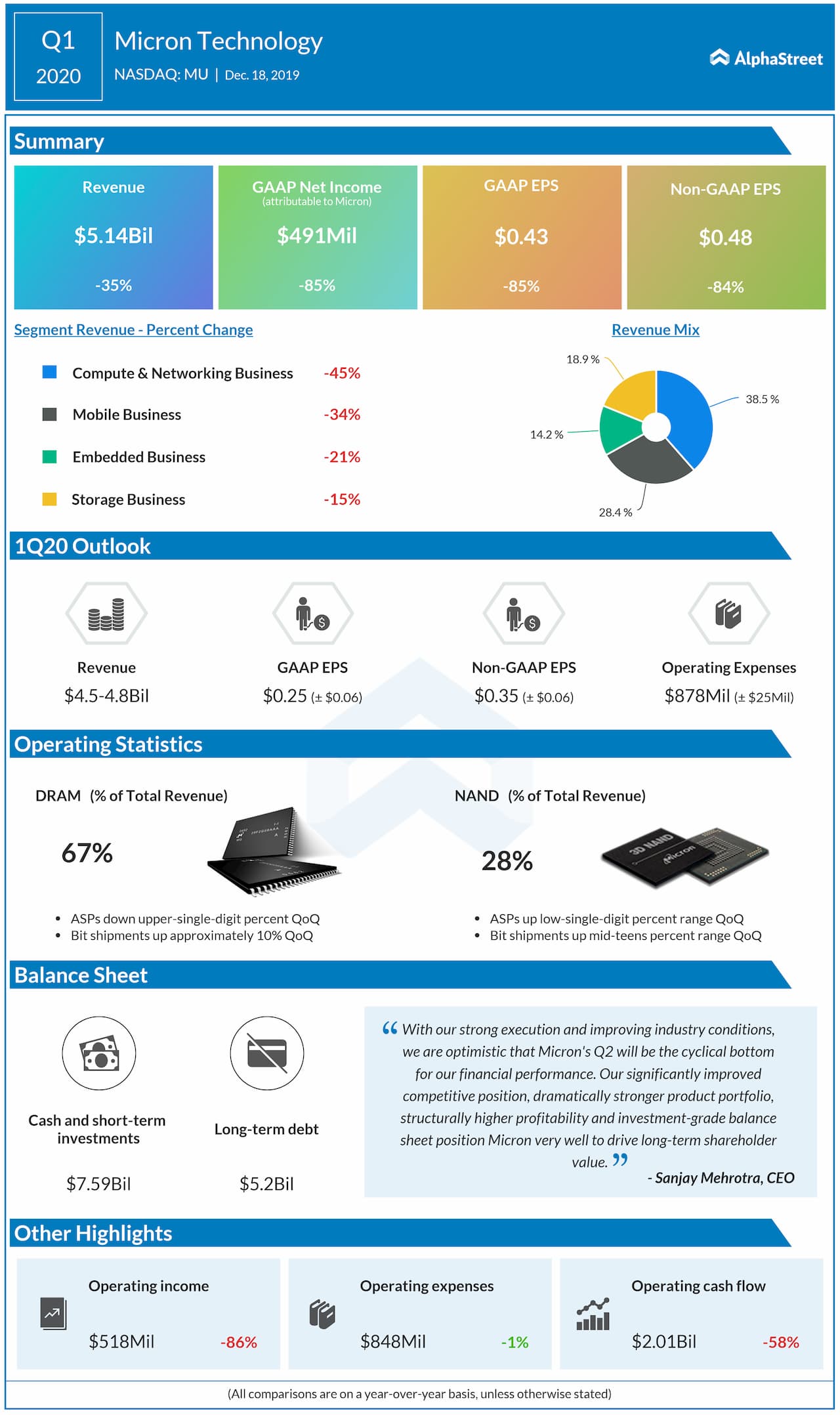

Revenue fell by 35% year-over-year to $5.14 billion. The top-line beat consensus estimates of $5.01 billion. The demand for microprocessors globally was impacted by near-term macroeconomic and trade-related uncertainties.

Looking ahead into the second quarter, the company expects revenue in the range of $4.5-4.8 billion and adjusted earnings in the range of $0.29-0.41 per share. The consensus estimates EPS of $0.41 per share on revenue of $4.78 billion. Unadjusted earnings are anticipated to be in the range of $0.19-0.31 per share.

For the second quarter, operating expenses are predicted to be in the range of $853-903 million on a GAAP basis and $800-850 million on a non-GAAP basis. Gross margin is projected to be in the range of 24.5-27.5% on a GAAP basis and 25.5-28.5%.

The company remained confident in driving long-term shareholder value helped by its significantly improved competitive position, dramatically stronger product portfolio, structurally higher profitability, and investment-grade balance sheet position.

The company had long-term debt of $5.19 billion as of November 28, 2019, while the cash and cash equivalents stood at $6.97 billion. The company has enough cash to meet debt obligations. However, the market experts remained concerned that if the demand weakness and macroeconomic uncertainties continue, the debt could rise.

Micron is struggling to achieve revenue growth and this could lessen the ratio at which it pays down the debt. The investors believed that the company taking on new debt financing could mean an expansion project is underway as part of its long-term growth strategy.

In the Huawei Technology update, the company said that although Micron is now able to qualify new products with Huawei’s mobile and server businesses, it would take some time before the qualifications are completed and contribute to revenue. Hence, Micron does not expect these licenses to have a material impact on revenue in the next couple of quarters.