Ballooning cloud

Innovation momentum at Microsoft has always been the key to high margins. Capex in the previous quarter was up by 12% year over year to meet the growing demand for cloud services. The investment seems to have paid off for the company, as Microsoft Cloud usage spiked up by 775% in large business centers, and it responded quickly to increased cloud traffic. Microsoft would have to focus on full-blown innovation continually, that’s disruptive to serve the changing market needs.

Microsoft announced its quarterly dividend of $0.51 per share, signaling positive future prospects despite the global pandemic. Supporting this signal are the words of the CEO, Satya Nadella:

“We have a great balance sheet, we are a very diverse business, we have a mix of annuity, non-annuity, that is also stronger than even the last time we even went into the financial crisis. I feel confident we’ll come out of this, frankly, pretty strong”.

ADVERTISEMENT

This statement is not unsubstantiated. Close to half of Microsoft’s balance sheet is cash & cash equivalents, highly liquid investments. Unearned revenue for the quarter ending March 2020, as of December 2019, was at $12.8 billion. Cash flow from operations, in the previous quarter, was at$10.7 billion, up by 20% year over year, and free cash flow of $7.1 billion, up by 37% year over year.

Cashing in on pandemic trends

The software business of Microsoft is growing, and it has been catering to the demand of its users in the work-from-home setup. Microsoft Teams had about 27 million meetings a month, even before companies shut operations. It is expected to shoot up manifold as many new companies are adopting Microsoft Teams amongst other group messaging apps, as Office 365 can be integrated smoothly with Teams.

Even when Microsoft sees the rising competition and low barriers to entry in the technology space, the pacifying fact is that it might take much longer for network effects to creep into the competitors’ products, and switching costs would continue to remain high for customers.

[irp posts=”53735″]

The investor perception of Microsoft stock is not very

different. It has seen a constant uptrend since the start of this fiscal year,

with a slight dip in March, priced at $173.7

as on April 14, 2020, and an average target of $188.8.

Supply chain disruption a concern

Microsoft’s revenue guidance for Q3, in the More Personal

Computing segment, was kept at $10.75 –

$11.15billion, which is a range wider than

usual to account for higher deviations reflecting the disrupted supply chains,

and uncertain public health situation.

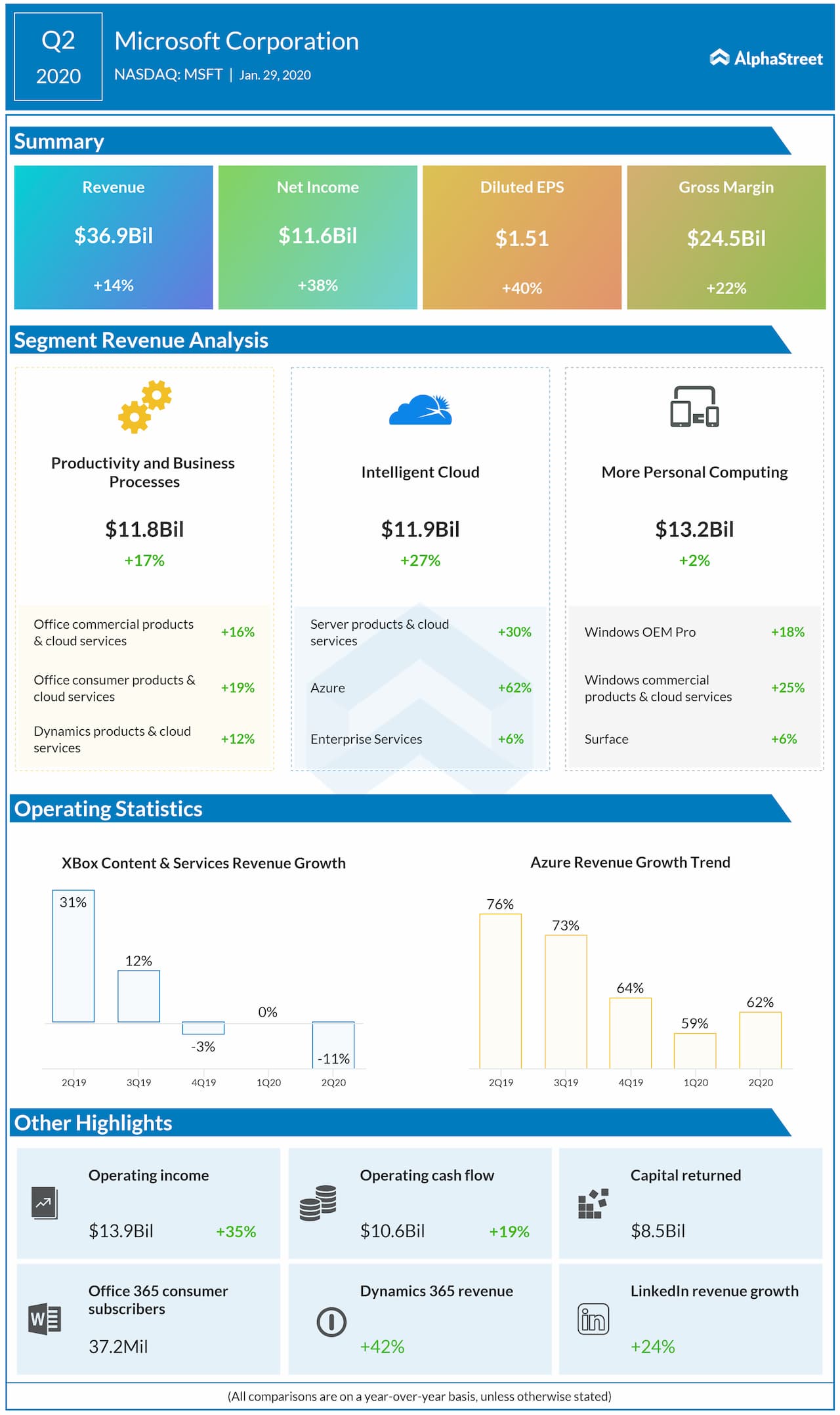

The share repurchase announcement in 2016, amounting to $40 billion, wasn’t over yet when the second announcement was made in September 2019. During the second quarter in 2020, Microsoft had returned $8.5 billion through dividends & share repurchase. Microsoft has declared its quarterly dividend as per the dividend history. Although it has the leverage to terminate the share repurchase program, such an announcement is unlikely given the stable liquidity position.

[irp posts=”53610″]

Considering that Microsoft has a global business, revenue

growth gets impacted, at least by a couple of points. As per the outlook given

by the CFO, Amy Hood, if the

current FX rates continue to remain, revenues are expected to decline in Q3.

Depending on the fiscal and monetary measures adopted by countries, exchange

rates could be unstable post the COVID 19 outbreak. So, it remains pretty

inconclusive on what FX impact would be on revenues, and might depend a lot on

how much currency risk exposure is hedged already.

A shopping season of big bargains

It is not surprising for big companies to acquire the small

players whose balance sheets shrink during periods of recession. Late last

month, Microsoft announced the acquisition of Affirmed Networks to deliver new

network solutions in the 5G space. If the synergies go unexploited, Microsoft

would have to impair goodwill, at least temporarily.

Overall, supported by its proactive investments over the

years, strong cash position, and software offerings that are seeing a rise in

demand, Microsoft may not feel the pinch all that hard, and emerge strong post the

COVID 19 recession.

Microsoft is slated to report Q3 2020 earnings results on Wednesday, April 29.

(Written by Manjula S)