Building Client Base

In an interview with AlphaStreet, MacPherson shed light on the venture highlighting his extensive experience in the field and the decade-long efforts to expand the client base. “So for the past 10 years, we’ve worked on developing the client base, and further being a technology. And in recent years, we’ve focused on taking our skill set in the field of chemisorption. And, being able to expand on that for other technologies for use in other environmental fields that we’ve been working on and bringing that information to the market over the last two years,” he said.

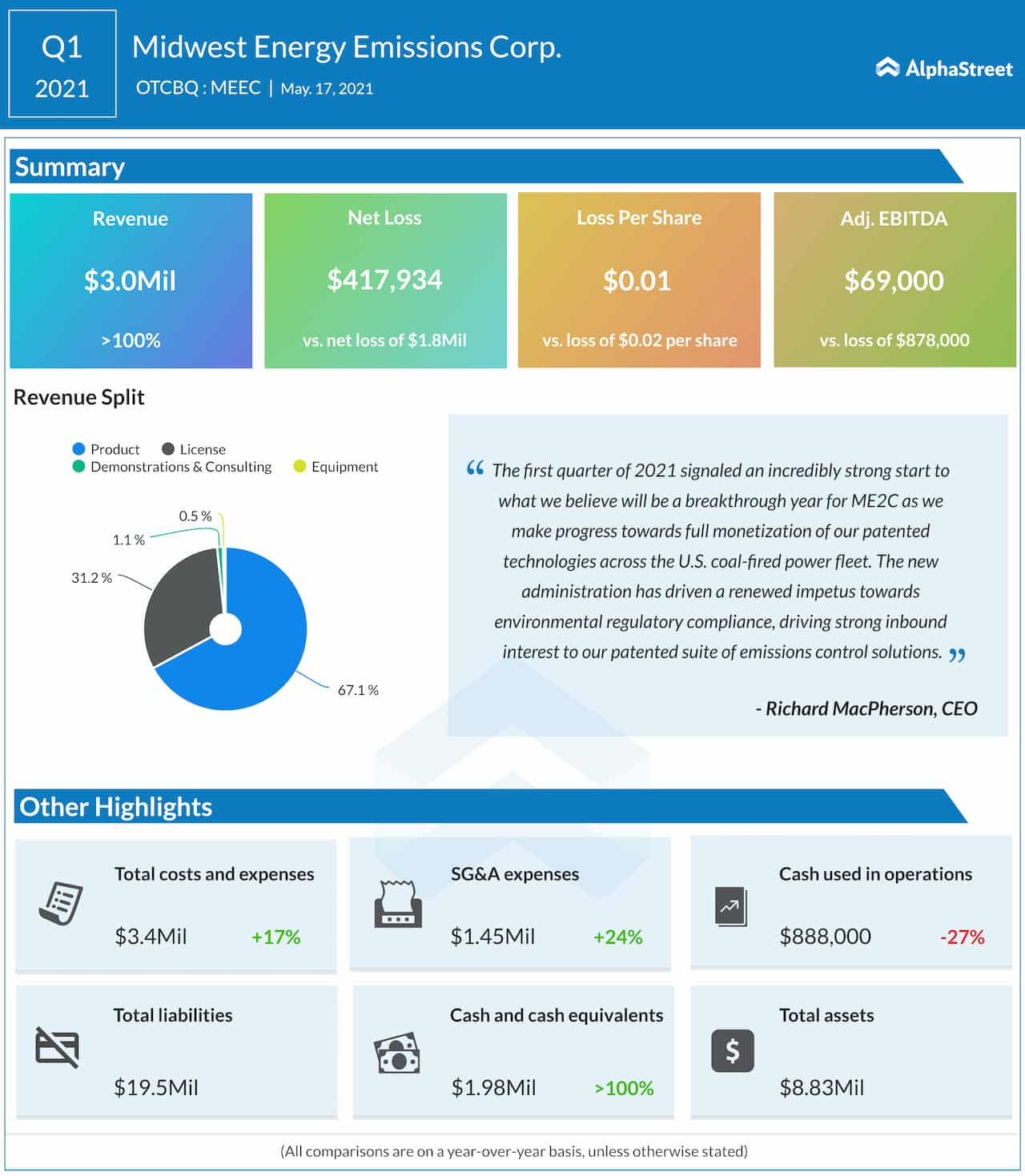

Stressing the need to have effective emission control systems in place, considering the stringent regulation in the U.S. that requires big power plants to remove as much as 90% of mercury emissions, MacPherson said ME2C’s processes would help utilities meet the norms in a cost-effective manner. According to him, a number of power plants in the U.S. would find it difficult to meet the emission criteria without the company’s processes.

Interestingly, the management is currently on a mission to protect the company’s intellectual property rights, fighting a patent-infringement case against enterprises that used its technology without valid contracts. The patented processes lost secrecy during demonstrations carried out as part of the client-building process and many accessed them through external sources, rather than licensing them.

Shapeways CEO: Software platform helps us achieve higher gross margins vs. industry

Protecting Patents

The company has settled with the first four energy utilities that infringed upon its patents and is currently continuing with the lawsuit involving refined coal entities. It is expected that other infringing coal-powered utilities not currently named in the existing lawsuit to enter into either license agreements or supply contracts to continue using the patented processes.

“We made significant changes to the patent portfolio, to make sure that we were able to move forward and make proper claims on behalf of our shareholders. And, after filing a significant lawsuit in that regard, in 2019, I’m pleased to say that the industry is now recognizing our position. We very much expect that licensing arrangements or supply contracts, which include license arrangement, will be expanding nicely from our original successes in that effort as we go forward this year,” said MacPherson.

Midwest provides supply-side customers licenses to operate its processes, under three-to-five-year renewable contracts.

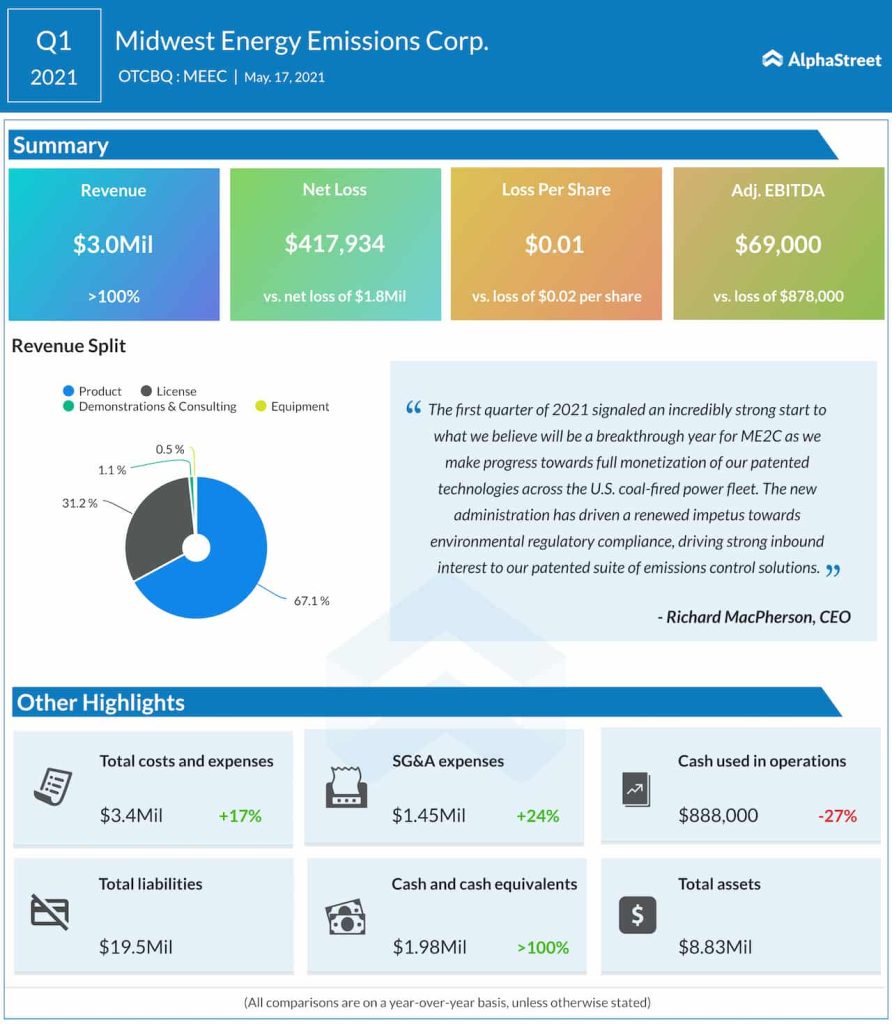

Towards Profitability

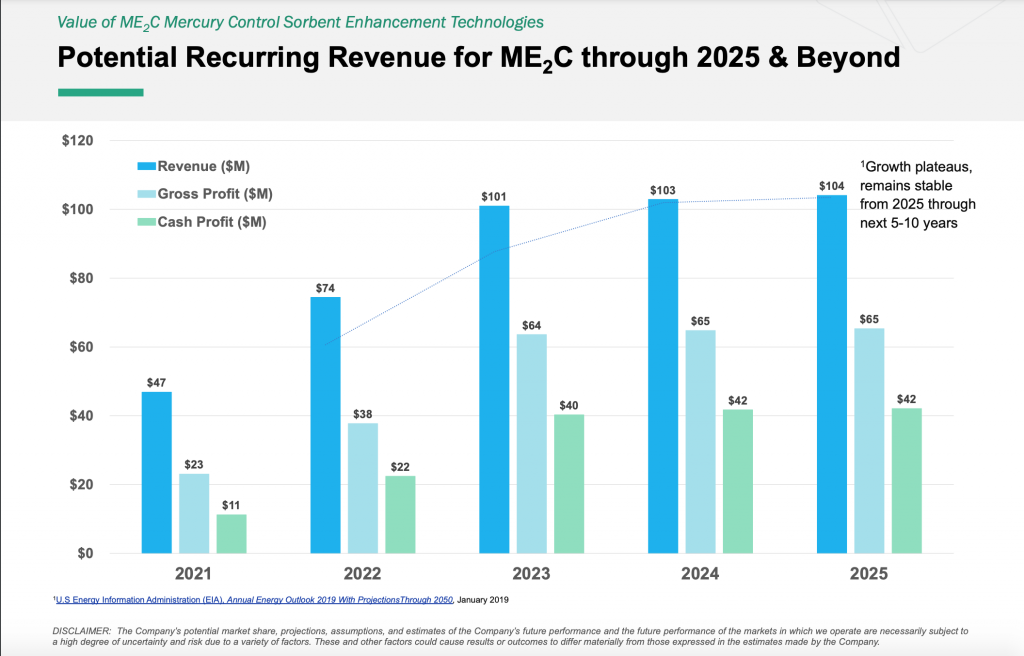

When it comes to capital deployment, MacPherson is bullish on the company’s cash balance, which is expected to grow steadily in the coming years, continuing the current trend. He expects to have a profitable year as the company reaches settlements with more entities involved in patent-related claims.

Having tasted success, the company is taking growth to the next level through initiatives like the recent development of methane emission control technology and wastewater/ash pond remediation through joint venture partnerships.

Banxa founder Domenic Carosa: Crypto industry seeing huge HNI interest

“I think the coal ash pond remediation, and rare earth element extraction as a value add is an enormous opportunity, which has very solid long-term real value potential. And as we develop those going into the fall, and commercialize them, they will reposition the company for tremendous value proposition longer term,” he added.

Responding to a question on ME2C’s plans to uplist the stock, MacPherson said he is hopeful of uplisting to one of the leading stock markets by in early fall, details of which will be published later.

_____