Chinese dating app Momo Inc. (NASDAQ: MOMO) is slated to report second-quarter financial results on Tuesday, August 27, before the market hours. Wall Street expects higher revenues and earnings during the quarter, driven by continued growth in user base. (check the actual results – Momo reports better-than-expected Q2 earnings)

For the second quarter, Momo’s management had projected net revenues in the range of RMB 4 billion to RMB 4.1 billion, which it hinted was a conservative one.

The guidance was announced at a time when its sister dating app Tantan was removed from Chinese app stores, pending an investigation into pornographic content in the platform. However, in July, Tantan was back in app stores and quickly became a top-grosser.

Tantan’s return should boost Momo’s overall revenues, which could possibly come in the top end of the projection range.

READ: Major IPOs expected in late-2019 or 2020

ADVERTISEMENT

Wall Street analysts are expecting revenues of $574.29

million for the second quarter, while EPS is forecast to increase by 10 cents

to $0.72. Momo has surpassed earnings

expectations in all four trailing quarters.

In the first quarter, Momo Inc reported a 65% decline

in earnings, weighed down by expenses related to Tantan acquisition.

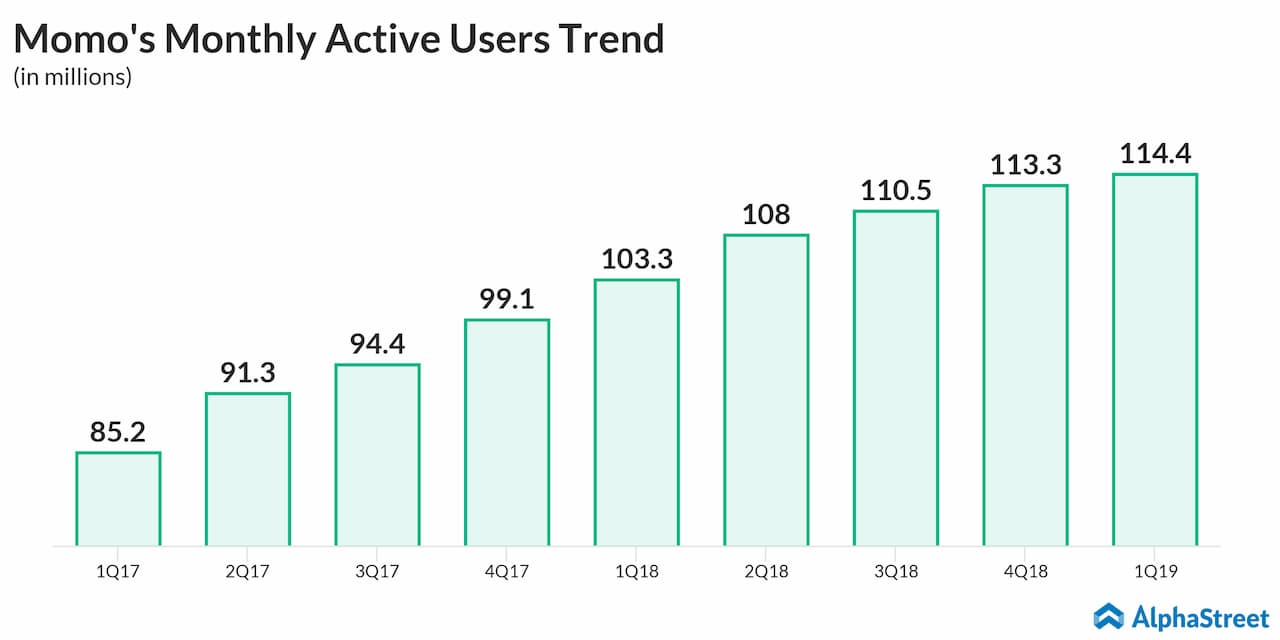

Net revenue, meanwhile, jumped by 35% to $554.7 million as monthly

active users on Momo applications grew to 114.4 million from 103.3 million in

the previous year period.

Notably, Momo is one of the Chinese stocks that has been relatively resistant to the trade war and Chinese economic weakness. The stock has gained 35% since the beginning of this year and is still trading at a discount of 34%.