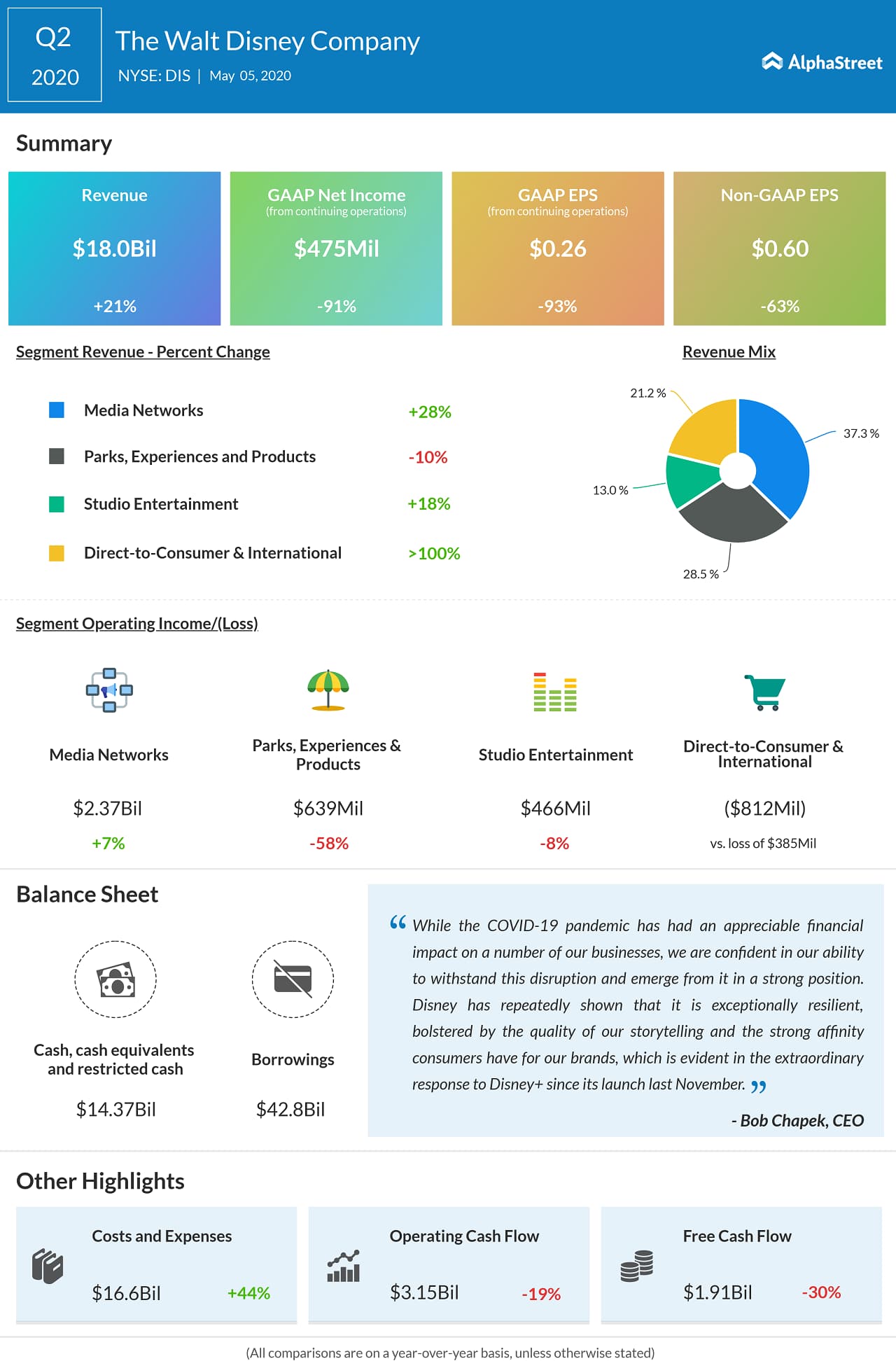

It was expected that the Walt Disney Company (NYSE: DIS) would take a significant hit from the coronavirus outbreak as its theme parks closed down, its cruise lines were suspended and its film and TV productions came to a halt. This rang true as the company reported a 93% drop in its profits for the second quarter of 2020.

However, despite the setbacks, all is not lost in the House

of Mouse. Even though the Parks segment suffered, the company saw some momentum

in the Disney + and ESPN divisions. The sentiment in general appears to be

bullish around Disney as the company is expected to bounce back strong once the

storm passes and business returns to normal.

Parks, Experiences

and Products

Disney is estimated to have taken a $1-billion hit on its operating

income from the Parks segment due to revenue loss from the closures. Revenues

fell 10% during the quarter in this division. The Shanghai and Hong Kong parks

were closed in January while Tokyo was closed since February and the US and

Paris parks since the middle of March.

On its quarterly conference call, the company said it is seeing signs of normalcy slowly return in China and it now plans to open Shanghai Disneyland on May 11. This will be done in a phased manner while adhering to safety protocols.

The capacity at the Shanghai Disney Resort tends to be 80,000 a day and the government wants to limit this to about 24,000 but the company plans to open far below this number in order to make sure there are no glitches in its new procedures.

There is still not much visibility on the reopening of the

remainder of the parks and resorts or on the resumption of cruises. Disney said

cruises will be the last business to restart but it added that it had data which

indicated that the demand for cruises remains intact so the company remains

bullish on the business.

Disney +

At the end of the second quarter, Disney + had 33.5 million

paid subscribers. The company successfully launched Disney + in Western Europe

and in India in late March. Disney plans to roll out its streaming service in

Japan, Nordics, Belgium, Luxembourg, Portugal and Latin America this year.

As of May 4, Disney estimates it had around 54.5 million

Disney + subscribers. The content continues to get richer with movies like Frozen 2, Onward, The Lion King and Aladdin. The company plans to continue

investing in this business with new and exciting content to drive subscription

rates and retention. Although these investments will weigh on operating income

in the short-term, it can be assumed that in the long run, Disney + will

definitely bring in profits for the company.

ESPN

ESPN too had some bright spots in the quarter. Despite the

absence of live sports, the division managed to woo viewers with innovative and

compelling content such as the docuseries The

Last Dance and the NFL Draft. The

former has been rated the number one program in America among all key male

demographics while the latter managed to rake in a record 55 million plus

viewers over a three-day event.

Thanks to these two events, in April, ESPN’s prime time audience was up 11% year-over-year among adults aged 18-49. Disney believes that when sports returns, ESPN is well-positioned to benefit with several attractive offerings.

As mentioned earlier, despite the challenges Disney is facing currently due to the pandemic, there is optimism that once the situation normalizes, the company will see strong demand and growth in its operations.