The Walt Disney Company (NYSE: DIS) this week delivered one of the biggest earnings beats in recent times, triggering a stock rally. The entertainment behemoth also announced a slew of new projects, including an ESPN streaming platform and partnership with Epic Games.

Disney’s stock has been in a downward spiral after hitting an all-time high in early 2021, and the value nearly halved since then. It regained some momentum this year, especially ahead of the earnings, and rallied after the company reported strong first-quarter results this week.

Value for Shareholders

Recently, the company declared an additional dividend and announced a $3-billion stock buyback program for fiscal 2024. Now, DIS offers a dividend yield that is slightly above the S&P 500 average, which makes the stock an attractive bet for those looking for income investment.

“… I am pleased to share that the board declared that our next semi-annual dividend, to be paid in July, will be 50% higher versus the last dividend paid in January. The board has also authorized the company to begin repurchasing shares for the first time since fiscal 2018, and we plan to start by targeting $3 billion this fiscal year. As we continue to invest in our growth businesses and maintain our strong balance sheet, we also expect to prioritize dividend payments and share repurchases in the coming years,” said Disney’s CEO Bob Iger at the Q1 earnings call.

Strong Q1

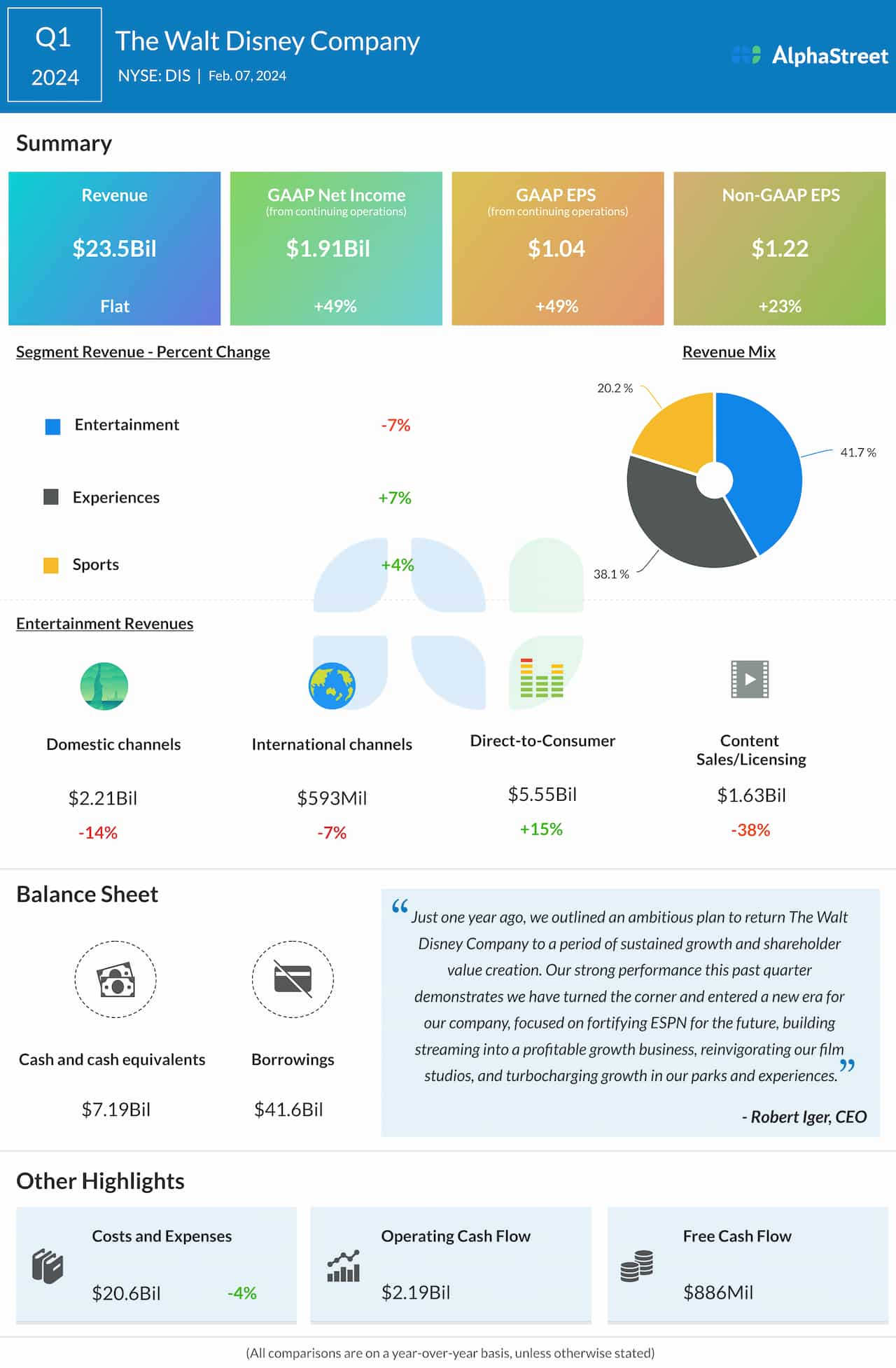

In the three months ended December 2024, earnings surpassed estimates for the third time in a row while revenues beat for the fifth consecutive quarter. Q1 earnings, excluding special items, climbed 23% annually to $1.22 per share, while revenues remained broadly unchanged at $23.5 billion.

In the core Entertainment division, double-digit growth in the direct-to-customer business was more than offset by weakness in the other platforms. Overall, margins benefited from a decrease in operating costs, thanks to the management’s cost-cutting efforts. Though Disney+ witnessed a drop in subscriber numbers, revenues increased due to higher fees.

Action-Packed

Currently, Disney’s key priorities include transitioning ESPN into the main digital sports platform; turning streaming into a profitable growth business; ramping up film studios, and accelerating growth for Parks and Experiences. In a major move, the company invested $1.5 billion in Epic Games, maker of the popular Fortnite franchise, to create new games, thereby opening a new revenue stream. The upcoming projects include the release of a sequel to the hit ‘Moana’ later this year, an exclusive version of Taylor Swift’s concert film, and the launch of an ESPN streaming service.

After entering 2024 on a weak note, Disney’s shares gained strength and traded above their 52-week average fo far. On Friday, DIS pared a part of the post-earnings gains and mostly traded lower.