Driving the bottom-line growth, net revenues of the tech firm jumped 50% annually to RMB3.84 billion ($559.1 million). Contributing to the increase, live video service revenue moved up 36% amid solid growth in quarterly paying users and average revenues per user. Value-added service revenue nearly tripled, while mobile marketing revenue dropped 15% hurt by lower demand from advertising and marketing customers.

Live video service revenue moved up 36% amid solid growth in quarterly paying users and average revenues per user

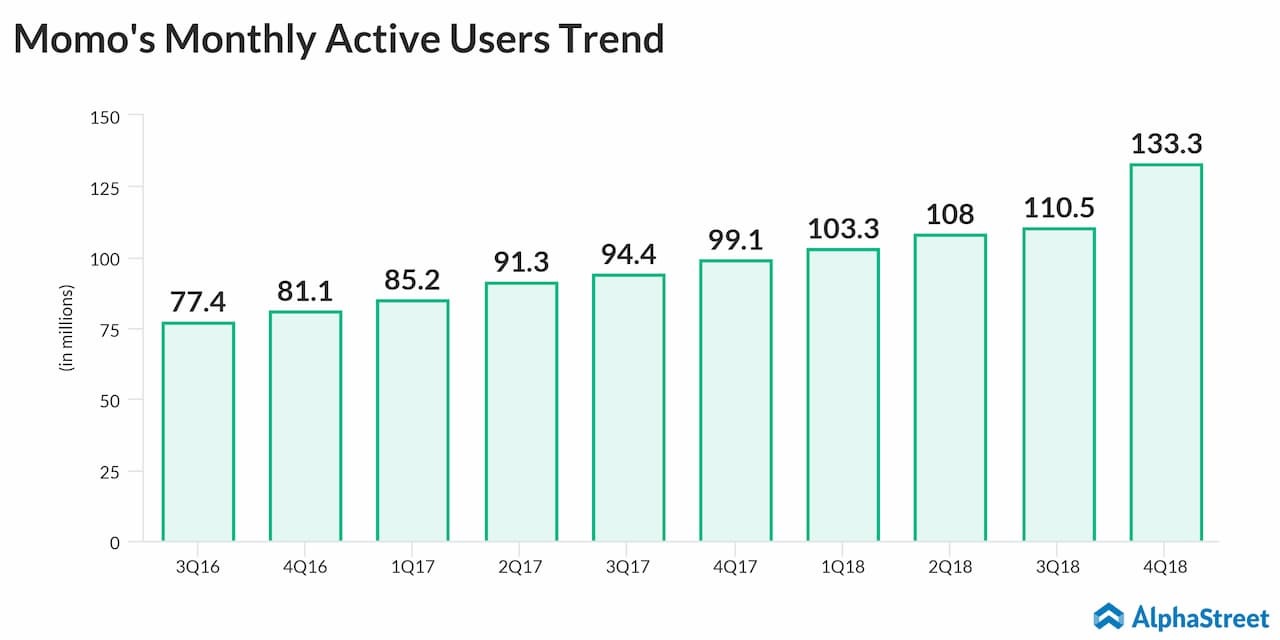

The company had 113.3 million monthly active users as of December 2018, up 14.3% compared to the corresponding period of 2017. The number of paying users for the live video and value-added services jumped 67% year-over-year to 13 million.

Momo’s CEO Yan Tang said, “I am pleased with the progress we made in 2018 in product innovation, monetization, financial performance and the strengthening of the Company’s position as a leading player in China’s open social space. We look forward to delivering more results to our shareholders in 2019.”

Also read: Facebook shares jump 7% on strong Q4 earnings

During the quarter, Momo declared a special cash dividend of $0.62 per ADS, which will be paid on April 30, 2019, to shareholders of record on April 5, 2019. Encouraged by the robust December-quarter numbers, the management currently predicts a 28-32% growth in first-quarter revenues to the range of RMB3.55 billion to RMB3.65 billion.

Momo’s stock climbed more than 10% in the pre-market trading Tuesday following the quarterly report, after closing the previous session slightly lower. The shares gained 31% so far this year and declined 12.5% in the past twelve months.