Morgan Stanley (NYSE: MS) is

scheduled to report fourth quarter 2019 earnings results on Thursday, January

16, before the market opens. Analysts expect earnings of $1.02 per share which

compares to EPS of $0.80 reported in the year-ago period. Revenue is expected

to grow 14% to $9.7 billion.

In general, the banking industry is expected to be affected by lower interest rates and Morgan Stanley is no exception. The company is likely to see strength in investment banking and sales and trading continue in the fourth quarter.

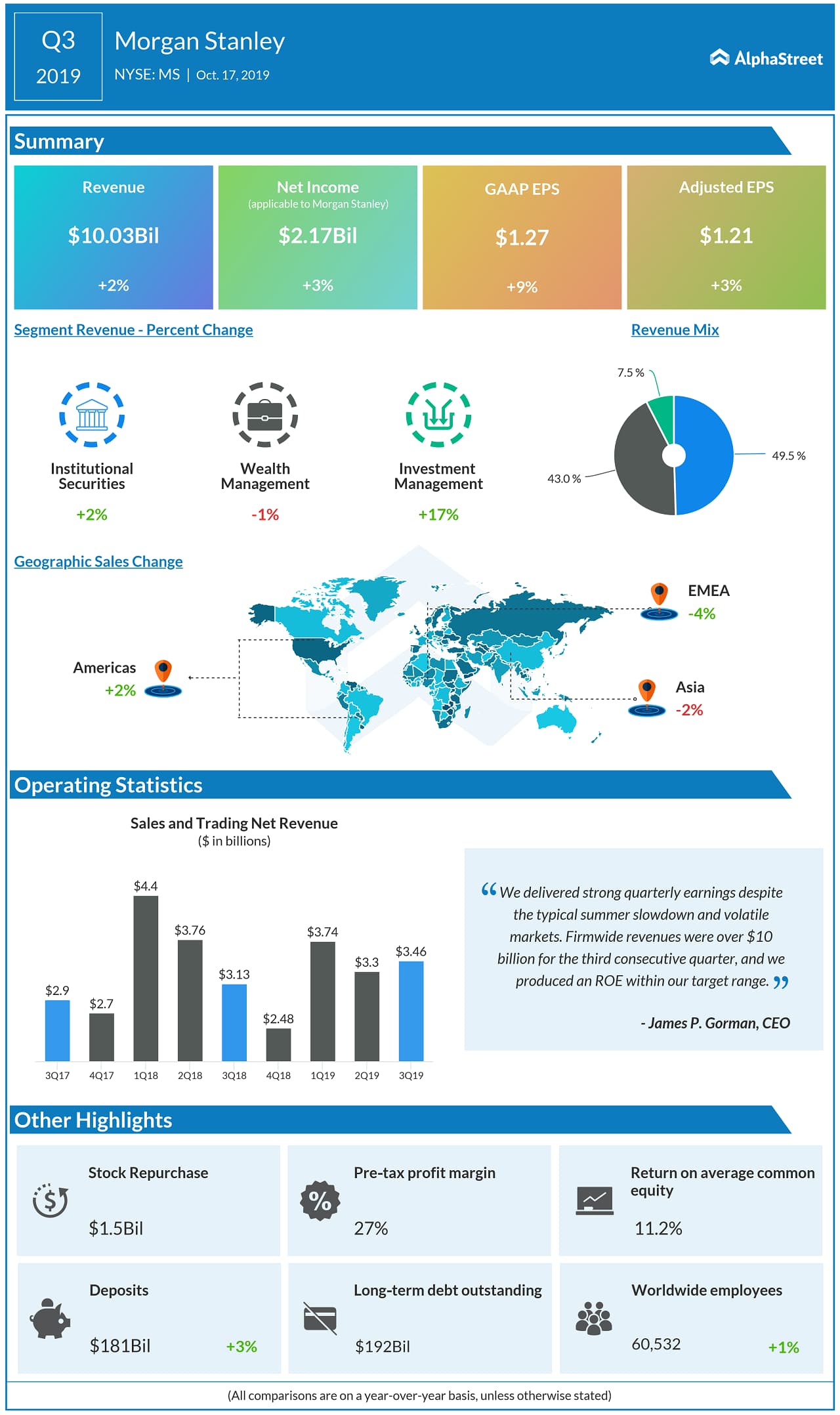

Last quarter, revenues in investment banking grew 5% and

sales and trading rose 10%. While wealth management revenues saw little change,

revenues in investment management jumped 17% helped by higher levels of assets

under management and gains on carried interest.

The company’s stable business model is expected to drive growth in results. After seeing weakness in previous quarters, Morgan Stanley achieved revenue growth last quarter driven by strong performance across its business segments. The company’s efforts in reducing costs will also prove beneficial in the to-be-reported quarter.

Also read: Morgan Stanley Q3 2019 Earnings Conference Call Transcript

In the third

quarter of 2019, Morgan Stanley beat revenue and earnings estimates.

Revenue increased 2% to $10 billion while adjusted EPS increased 3% to $1.21.

Shares of Morgan Stanley have gained 25% over the past 12

months and 4% over the past one month. The stock has an average price target of

$57.29.

This week will see several banks report their earnings including JPMorgan (NYSE: JPM), Citigroup (NYSE: C), Wells Fargo (NYSE: WFC) and Goldman Sachs (NYSE: GS).