Facebook (NASDAQ: FB) is going through an eventful phase as usual with the ad boycott, the Congressional hearing and also the momentum it is seeing during the pandemic. The social media giant reported strong results yet again for the second quarter of 2020 with growth in the top and bottom line numbers as well as user metrics.

COVID-19 effect

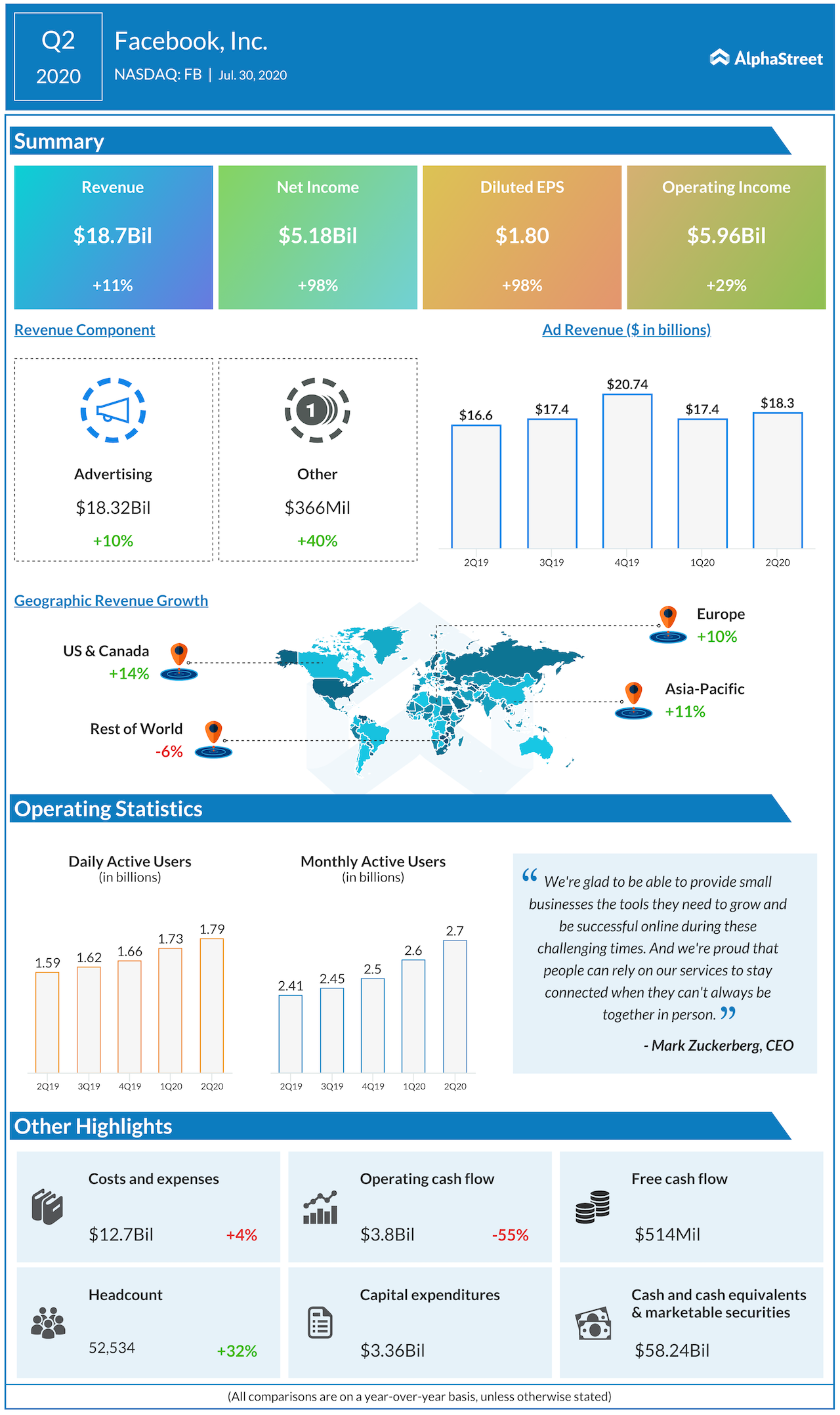

Facebook has seen higher levels of engagement and activity amid the coronavirus pandemic as people stayed at home and spent more time online. Facebook’s daily active users (DAUs) increased 12% year-over-year and 2% sequentially to 1.79 billion. Monthly active users (MAUs) grew 12% year-over-year and 3% sequentially to 2.70 billion.

People have used Facebook to stay in touch with their dear ones and to keep their businesses running. Amid the closures of physical stores, several businesses recognized the need to shift their operations online to keep going and have used Facebook for these efforts. Facebook currently has over 3.1 billion users and over 180 million businesses using its services.

Hate and misinformation

Hate speech and fake news have always plagued Facebook. On its quarterly conference call, the company said this toxic content forms only a small part of the total content on its platform and that it was taking several measures to combat it.

“We do not profit from misinformation or hate, and we do not want this content on our platforms. People come to our services to connect with people they care about. That is why people are using our services at record levels now, and enabling more of those meaningful social interactions is how we succeed. And we have a plan to further reduce the amount of harmful content.” – Mark Zuckerberg, CEO

ADVERTISEMENT

Facebook is using artificial intelligence tools to eliminate hate speech on its site and is submitting to audits by various agencies to provide transparency on various aspects of its operations such as elimination of harmful content, monetization of content and brand safety controls.

Advertising business and boycotts

Facebook came under the spotlight for the boycott of its advertising business by several large names. Despite this snub, the company’s advertising business grew 10% year-over-year to $18.3 billion.

As mentioned earlier, several small and medium businesses moved their operations online amid the health crisis and used Facebook to provide services to existing customers and reach out to new ones. The company had over 9 million active advertisers on its platform at the end of the quarter as many businesses shifted online.

Facebook stated that the biggest part of its business was focused on serving small businesses and while it valued every single customer, its business was not entirely dependent on few large advertisers.

Facebook acknowledged that cracking down on targeted ads would impact its revenues but added that it would lower growth and expansion opportunities for small businesses even more. The company believes a balanced approach is necessary whereby user data is kept safe through regulation while at the same time the benefits of personalized advertising are allowed.

Congressional hearing

On Wednesday, Facebook appeared before Congress along with its FAANG peers – Apple (NASDAQ: AAPL), Alphabet (NASDAQ: GOOGL) and Amazon (NASDAQ: AMZN) – for an antitrust hearing.

Also read: Facebook (FB) Q2 earnings: A visual dashboard

Facebook faced questions on competition and its purchase of Instagram. CEO Mark Zuckerberg asserted the need to innovate to survive especially in the face of increasing competition from Chinese tech firms. On Instagram, Zuckerberg said his company always viewed Instagram as a competitor and a complement to its services.

Outlook

Looking into the third quarter of 2020, Facebook expects the levels of engagement to go down and its user growth to normalize as pandemic-induced restrictions ease across developed markets. DAUs and MAUs are expected to be flat or slightly down in most regions compared to the second quarter.

In the first three weeks of July, the company saw year-over-year ad revenue growth rate that was in line with the 10% growth rate seen in Q2. Facebook expects the full quarter growth rate to be similar to the July performance.

Click here to read the full transcript of Facebook Q2 2020 earnings conference call