Mixed results

The slowdown in revenue growth remains a concern and the company has attributed this to various factors such as account sharing, competition, and sluggish economic growth. For the third quarter of 2022, revenue is expected to grow 4.7% YoY to $7.83 billion.

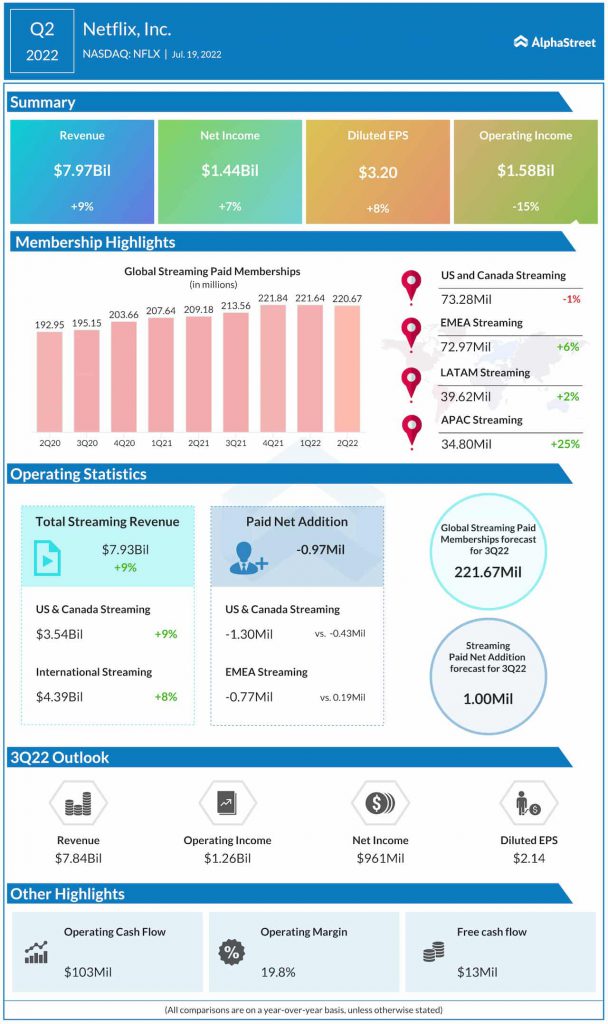

Earnings grew 8% year-over-year to $3.20 per share and surpassed estimates of $3 per share. For Q3, net income is expected to be $961 million, or $2.14 per share.

Subscriber growth

The subscriber numbers were the biggest highlight of the quarterly report. After losing 200,000 subscribers last quarter, Netflix guided for the loss of another 2 million this quarter which gave investors enough pain. So it came as a relief when the company reported a loss of only 970,000 subscribers in Q2.

The loss of less than 1 million subscribers versus the estimated 2 million along with the forecast of subscriber growth in the coming quarter has boosted optimism. For the third quarter of 2022, Netflix projects global streaming paid net additions of 1 million.

In Q2, global streaming paid memberships grew 5.5% YoY to 220.67 million. For Q3 2022, paid memberships are expected to increase 3.8% to 221.67 million.

Content

Netflix has most of its eggs in the original content basket and that basket looks a bit wobbly now. Although Stranger Things season four was a huge hit, generating 1.3 billion hours viewed and reigniting interest in earlier seasons, it may not be enough to keep the show going. Netflix faces tough competition from rivals like Disney (NYSE: DIS) and HBO Max who have libraries of massively popular content that can reel viewers back in again and again. Disney’s movie franchises are a good example of this.

Netflix needs to produce extremely engaging content to attract and retain viewers. The company’s investments in producing local content to cater to viewers in international markets as well as its decision to acquire the animation studio Animal Logic to create animated movies are steps in the right direction.

Ads/Gaming/Paid sharing

Netflix has other plans as well to improve monetization and drive revenue growth. The company has partnered with Microsoft (NASDAQ: MSFT) to develop a low-priced ad-supported offering that is expected to launch in early 2023. It is also working on tackling the issue of password-sharing through a paid sharing offering which it is looking to roll out in 2023. Netflix is also expanding its capabilities in gaming. The company currently has 24 games in its portfolio and it is building a pipeline of new games that are expected to launch over the coming years. These efforts are expected to help the company drive growth in the future.

Click here to access the full transcripts of the latest earnings conference calls