Netflix Inc. (NASDAQ: NFLX) is slated

to report fourth quarter 2019 earnings results on Tuesday, January 21, after

the market closes. Analysts project earnings to increase to $0.52 per share from

$0.30 per share reported a year earlier. Revenue is expected to see a growth of

30% year-over-year to $5.45 billion.

The fourth quarter report will be an interesting one, in particular because it will give investors a sense of how the company’s subscriber numbers have been impacted by the launch of two important rivals Disney + and Apple TV +. Last quarter, Netflix missed the guidance for subscriber additions.

In addition, the streaming space is set to get more

competitive with the upcoming launches of more services such as HBO Max. In this

scenario, it will be worth noting what Netflix’s strategy for the upcoming

fiscal year will be in order to maintain its ground amid the rising

competition.

Although expansion opportunities appear to be bleak within

the US for the streaming giant, there seem to be ample opportunities to expand

its footprint in international markets. Netflix’s quarterly results are likely to

benefit from this opportunity. The company’s game plan of investing in original

content in order to reduce dependency on content from other studios might also

prove beneficial to results.

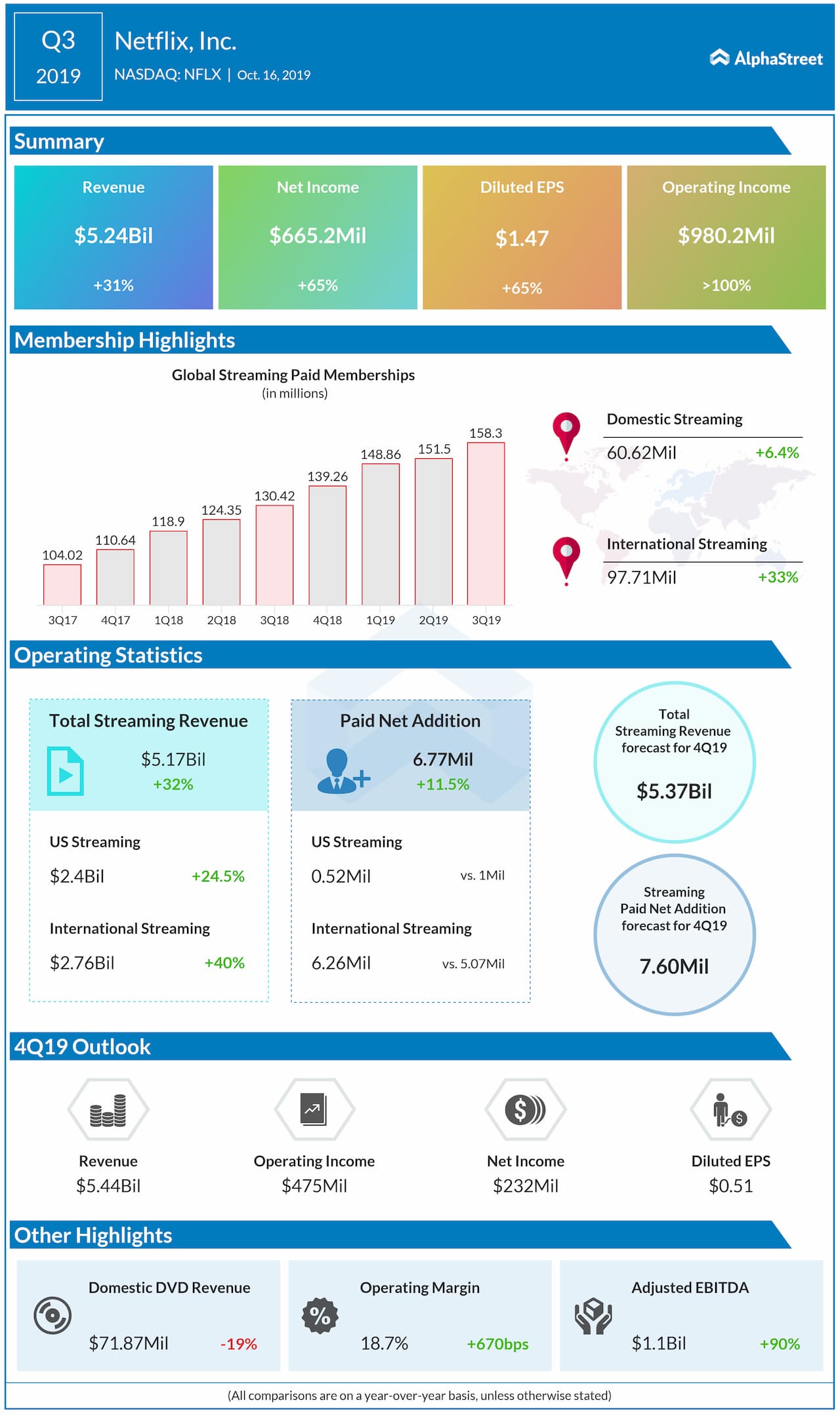

In the third quarter of 2019, Netflix topped earnings expectations while revenues matched estimates. Total revenues rose 31% to $5.25 billion while EPS totaled $1.47. Total paid net adds were 6.8 million.

Also read: Netflix Q3 2019 Earnings Conference Call Transcript

For the fourth

quarter of 2019, Netflix expects revenues to grow 30% to $5.4 billion. Net

income is expected to be $232 million, or $0.51 per share. Global paid net adds

are expected to be 7.6 million, with 0.6 million in the US and 7 million

internationally. Streaming ARPU is expected to grow 9%.

Starting from the fourth quarter, the company will report revenue and membership by region. The regional divisions will be Asia Pacific (APAC), Europe, Middle East & Africa (EMEA), Latin America (LATAM), and the US and Canada (UCAN).

Shares of Netflix have fallen 4% over the past 12 months. The majority of analysts have rated the stock as Buy and it has an average price target of $365.85.